Weekly Roundup, 13th March 2023

We begin today’s Weekly Roundup with commodities.

Commodities

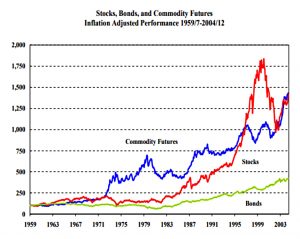

John Authers looked at commodity futures as an inflation hedge, using data from the Credit Suisse Global Investment Returns Yearbook 2023 (by Dimson, Marsh and Staunton).

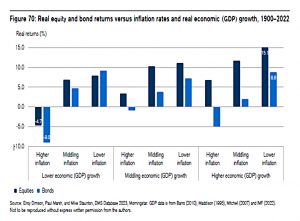

- The bad news is that stocks, long perceived to be an inflation hedge, aren’t.

If the past 123 years of data is any guide, inflation has negatively impacted both bonds and shares. Equities have been hurt less, but that’s not the same as providing a true hedge.

In 2022, both asset classes fell, and the 60/40 portfolio had possibly its worst year ever.

- The stock/bond correlation had been negative for 20 years, but it often isn’t.

Inflation is the key:

Returns on both have historically been much lower amid hiking cycles than easing ones. But both fare worse as inflation rises over time.

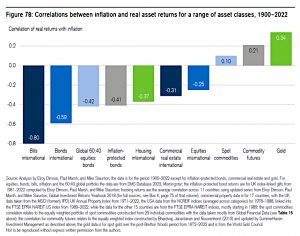

Commodity futures are better. They are:

Negatively correlated with bonds, lowly correlated with equities and also statistically a hedge against inflation itself.

Only commodities have returns that are positively correlated with inflation.

Energy futures perform well during energy-driven cost-push inflation; industrial metals during demand-pull inflation; and precious metals, especially gold, perform well when central bank credibility is questioned.

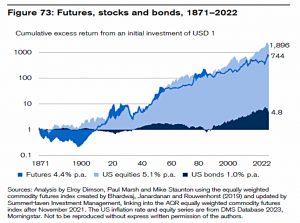

And commodities have decent long-term returns, though not nearly as good as stocks.

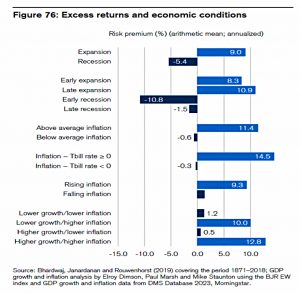

Their main weakness is that they lose money during recessions (and are not great during disinflation).

Anyone trying to time the market will have great difficulties. Conditions of rising inflation are best and early recession periods are worst, and as the latter tend to come immediately after the former.

But long-term buy-and-hold of a diversified commodity portfolio should do fine.

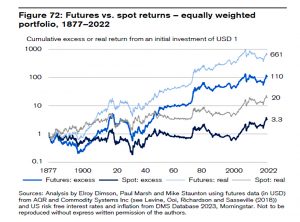

An equally-weighted portfolio of futures contracts gave an annualized excess return over Treasury bills of more than 3%.

John notes that the futures market is relatively small, and a spike in interest in commodities risks a bubble and a burst, as happened before the 2008 crisis.

John also refers to a 2004 paper called “Facts and Fantasies About Commodity Futures” by a pair of Yale academics.

- This described commodities as close to a “free lunch”:

A diversified investment in commodity futures has slightly lower risk than stocks — as measured by standard deviation. And because the distribution of commodity returns is positively skewed relative to equity returns, commodity futures have less downside risk.

After the paper was published, investors became interested in commodities:

Thanks in part to the launch of a number of exchange-traded funds tracking commodity indexes, the number of futures contracts outstanding nearly doubled between 2004 and 2007.

Which led to a bust, and a long period of negative returns.

The same Yale academics wrote a follow-up paper called ” Facts and Fantasies About Commodity Futures Ten Years Later” and decided that all was good:

The correlations among commodities, and commodities’ correlations with other assets “experienced a temporary increase during the financial crisis,” but that this was “in line with historical experience.”

All correlations head towards one in a crisis.

- But commodities did fail as a hedge at that time.

The Yale guys felt that the crisis was to blame for the poor returns, rather than the “financialization” (large inflows following the 2004 paper).

They have skin in the game on that one, but Dimson, Marsh and Staunton agree:

It would seem quite wrong to conclude that the risk premium from futures had disappeared simply because of the Global Financial Crisis drawdown in commodity futures that followed the publication of Gorton and Rouwenhorst’s research. This was a disinflationary and low inflation period, and these are challenging conditions for commodity futures.

John also explains why futures are preferred to spot commodities – returns:

An equally-weighted portfolio of spot commodities offered [an] annualized return of 2%. Futures perform better.

There are also the logistical and insurance costs holding physical commodities to consider.

The bottom line is that if you think inflation is here to stay, commodity futures can offer a good hedge.

Pensions dashboard

In the FT, Rafe Uddin reported that the pensions dashboard has been delayed again.

- The dashboard, which would offer secure access to state, workplace and personal pensions in one place, was announced in 2016 and was originally due to launch way back in 2019.

But there have been regular delays in collecting data from pension providers (which will come as no surprise to anyone who has had to deal with these firms).

- Deadlines were revised backwards (by several years) in 2020, and in November 2022, a new date of August 31st 2023 was set for provider compliance.

And now new pensions minister Laura Trott has announced a “reset”, which means a new chairman will be appointed to create a new delivery plan.

Trott said:

More time is needed to deliver this complex build, and for the pensions industry to help facilitate the successful connection of a wide range of different IT systems to the dashboards digital architecture.

The huge consumer benefits of pensions dashboards are yet to be realised, but it is vital that the foundation upon which the dashboards ecosystem is built is safe, secure, and works for both the pensions industry users connecting to it and the end users of the service. While there are issues to work through, we must not lose sight of these benefits.

Rocio Concha of Which? commented:

The average person is set to build up an average of 11 different pension pots in their lifetime. The government must commit resources to getting pensions dashboards back on track and set a clear timeline for implementation.

Steve Webb of LCP said:

The end goal of a website where people can see all of their pensions in one place would be of huge value to pension saver. It will help people to find pension pots they have lost track of, and will enable them to rationalise and make best use of the pots that they do have.

The government must ensure that any delay is kept to an absolute minimum. The lack of a firm new timetable will leave industry in limbo and this uncertainty must be resolved as soon as possible.

Many in the pensions industry fear that the dashboard will be quietly abandoned. Rachel Vahey, of AJ Bell, said:

The DWP has torn up the plans for pensions dashboards and has decided to start again. After years of work across the industry and multiple government bodies, this a staggering development and means dashboards are now at risk of being mothballed until the next Parliament, and may never become a reality at all.

For the industry this is frustrating, with countless hours of careful work put into developing dashboards. More importantly, this a huge let down for consumers.

Vanguard

Also in the FT, Chris Flood reported on Vanguard’s decision to close its UK financial advice function after less than two years of operation.

- The service, which launched in April 2021, offered advice (plus the underlying fund and platform fees) for an all-in cost of 0.79% on a minimum of £50K of assets (ie. a minimum fee of £395 pa) within a Vanguard ISA or SIPP.

The goal was to sign-up millions of investors, but there are “only” 485K customers on the Vanguard platform, and most of these have probably ignored the advice offered.

- So the service will close on May 31st. Clients will be refunded all of their advice fees and will have the choice to either switch to the non-advised platform or move to another adviser.

Vanguard said:

After careful consideration, we have concluded that our clients are looking for other, more adaptable forms of financial planning from Vanguard.

We have therefore taken the difficult decision to close the retirement planning service. We are committed to the development of further financial guidance and advice services, to give investors the best chance of investment success.

Although Vanguard’s similar service in the US is a success, the failure is not a great shock, as 0.79% is still too expensive, and Vanguard only offers its own funds. Holly MacKay of Boring Money agrees:

The £50,000 investment minimum was quite a steep barrier for an online service which was only able to hold Vanguard funds.

This is where the battleground will be for the next wave of online investors. People want someone they trust to tell them they are not doing anything daft. But Vanguard’s withdrawal reminds us that working out how to do this well, at scale and profitably, will not be an easy job for anyone.

HL has announced plans for a similar “low-cost” advice service, but only 10K of their 1.7M clients currently take advice from them.

- It’s hard not to feel that these offers are designed to prevent clients from migrating to other firms as they approach retirement (the time when most people take advice, whereas the average of the Vanguard customers was 38).

There’s also the influence of the regulator to consider.

- The FCA is concerned that many savers are sitting on too much cash for the lack of affordable advice and has announced plans to allow “simplified advice” on “mainstream products”.

About 4.2mn UK consumers hold more than £10,000 in cash and are open to investing some of this money.

I’m not convinced that low-cost advice will ever be available.

- The kind of help that (a minority of) investors want involves detailed planning, which takes time and is therefore expensive.

Crypto

The Economist reported that scrutiny of the major crypto institutions is increasing.

- A variety of agencies is involved – the Securities and Exchange Commission (SEC), the CFTC (which oversees commodities) and various state bodies.

On February 9th the SEC reached a settlement with Kraken; the company agreed to pay a $30m fine and stop offering its staking-as-a-service business. On February 13th the New York State Department of Financial Services ordered Paxos to stop issuing a stablecoin it had created for Binance.

There is also an ongoing probe into whether tokens listed on Coinbase are securities. There have been sanctions against Tornado Cash, which pools ETH deposits, making them hard to trace.

The Economist says that recent actions reveal both the priorities and the methods of the authorities:

One priority is snuffing out instruments that may be used for financial crime. The authorities have responded to potential wrongdoing by shutting down interactions with American firms. Regulators’ second priority is consumer protection.

One interesting point is that the US is relying on existing regulations, unlike Europe (and Singapore) which has come up with new rules.

Quick Links

I have four for you this week, the first three from Alpha Architect:

- Alpha Architect wondered Can We Improve Momentum Factor Investing via Salience Theory?

- And asked Are Short Covering Trades Informative?

- And questioned Can the Value Spread Expand Forever?

- The Economist said New York’s stockmarkets are thrashing Hong Kong and London

Until next time.