Weekly Roundup, 11th September 2018

We begin today’s Weekly Roundup in the FT, where John Authers was remembering the 2008 financial crisis.

Contents

Ten years gone

It’s the tenth anniversary of the Lehman’s collapse this week, so there was a lot in the press about it.

- John was in midtown Manhattan at the time, and witnessed first hand a stealthy bank run initiated by Wall Street insiders.

They were queueing at lunchtime to split their cash across enough accounts to take them under the federally insured limit of $100K.

- John didn’t tell the story at the time, as the FT worried that it might push the system over the edge.

I was working (in London) at a large US investment bank ten years ago.

- What I most remember was the feeling that even the guys at the bank didn’t know what would happen next.

- That was probably the only time I felt like that during a quarter of a century in the City.

But the message that our cash was at risk didn’t filter down to my pay grade, and I wasn’t queuing up to move it in my lunch break.

Elsewhere in the paper, Gillian Tett looked at whether we have learned the lessons of ten years ago.

- Why were the warning signs missed and where might the nest crisis come from?

Gillian had previously worked in Japan, and was warned about a possible rash by a former colleague who has watched the same thing happen there a decade earlier.

- She finds it ironic that finance depends on trust, but that too much trust leads to the bubbles that precede crises.

As we all know by now, the central cause of the 2008 crisis was the repackaging and selling on (securitisation) of dodgy loans.

- The people who authorised the bad loans would not be penalised when they went bad

- And the obligations between financial institutions became too complex to calculate, leading to a loss of trust and hence to a freeze in inter-bank lending – a credit crunch.

Today, the banks are stronger, but there is even more debt around than in 2007.

- Today it’s corporate and sovereign debt, rather than dodgy mortgages.

China looks risky, but its government has more freedom to act than the western democracies.

John Lanchester had a somewhat similar essay in the Sunday Times, which is also worth reading.

And The Economist also had a couple of articles on the topic (1 and 2)

- The first is too globalist / federalist in its proposals for my taste.

The second is better, but focuses on changes in the US banking system.

Central banks

John Redwood’s column in the FT appears to have gone monthly.

- This time he was writing about central banks.

John doesn’t believe that central banks are independent, even in democracies.

- This is important because the post-2009 bull marked has relied upon the expansionary monetary policies of the main central banks.

He expects that pressure from Trump will force the Fed to go easy on rate rises, which would be good for shares.

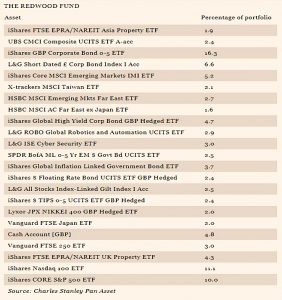

His FT fund is up 5% for the year, which look pretty good to me.

- John could have been writing a few weeks ago, but this morning I am barely positive for the year, and the FTSE All-Share index is down more than 4%.

Don’t run out of money

Jason Butler gave the sensible advice that you should try to run out of life before you run out of money.

- He quotes the old joke that one should want the cheque to the undertaker to bounce.

Of course, that’s easier said than done since none of us know when we will die.

Jason has some useful tips:

- Be clear about the cost of your retirement lifestyle.

- Use an SWR closer to 3% than 4%.

- Use a V-shaped or U-shaped equity glide path.

- This means reducing your exposure to stocks as you approach retirement (to say 30% equities), and then ramping up again past 70% stocks over the first 10 years of retirement.

Of course Jason can’t resist suggesting that you might need an IFA to help you.

- But as usual, I think that you should go down the DIY route.

Italian bonds

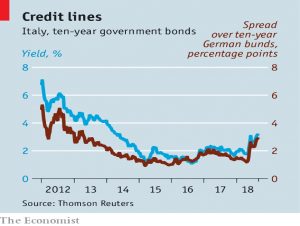

Buttonwood looked at why Italian government bonds are so unstable.

- Apparently, once yields are above 3%, bonds stop looking like safe assets and start look like speculative instruments.

The next stop is often 6% yields.

UK labour market

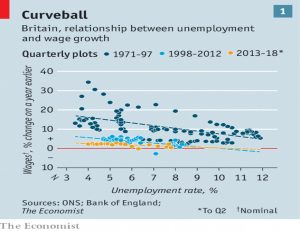

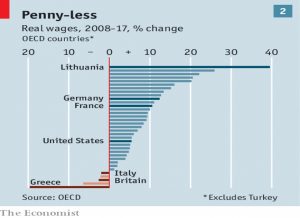

The Economist also looked at the UK labour market.

- Why is low unemployment not leading to faster wage growth, as the Phillips curve decrees?

Having one of the mostly lightly regulated labour markets in Europe helps.

But Economists used to believe that 6.5% was the lowest level of employment that wouldn’t lead to wage inflation.

- We’re now down at 4%, and so the “natural” level of unemployment has been adjusted down to match.

Productivity (production per man hour) is a big reason.

- Wage increases depend on productivity increases, and the UK hasn’t had these since the 2008 financial crisis.

- Low investment is one problem, and the rise in low-productivity service jobs such as hospitality is another.

And workers have diminished bargaining power.

- Union membership has been declining since the 1960s.

- And public sector wages (traditionally higher than those in the private sector) were capped until recently.

- With public-sector jobs less attractive, private sector bosses can be more stingy.

- Welfare has also been cut, giving workers an incentive to hang on to their job.

And 8% of existing workers would like to work more hours, suggesting that the labour market is not really as tight as it looks.

There’s no reason to expect significant wage growth in the near future.

Mirrlees

The Economist also reported the death of James Mirrlees – the Nobel prize-winning economist – at the age of 82.

Mirrlees worked on optimal tax rates under asymmetric information.

- The government doesn’t know how the most productive workers will respond to higher taxes.

It turns out that the data suggests that a flat tax of 20% would be optimal (though later economists think that the highest earners can tolerate another, higher band of tax).

He also showed how to deal with the moral hazard in insurance (that those with insurance are more likely to take out risks since they will not pay for the consequences).

- And he came up with a new way of analysing costs and benefits.

End of the bull

In the Spectator, Martin Vander Weyer argued that the bull run in stocks must soon end, and so it might be time to get back into gold.

Over in MoneyWeek, Merryn felt that the bull market could go on for a bit longer, but that it might be time to start moving into value stocks and Japan.

Wonga

In the same article as above, Martin wondered whether Wonga was all bad.

He’s not saying that 5000% pa was a fair interest rate, but before Wonga:

Markets for short-term, high-interest loans were shady and shark-infested. The new breed of lenders conducted their business in daylight, making their terms explicit even if they were exploitative.

It wasn’t the Wongas of this world that lied about lending rates, but the borrowers who too often lied about their incomes and existing debts to secure loans for holidays and luxuries they could not afford.

I see what he’s getting at.

- It reminds me of the way that the use of CDOs back in to 2008 has obscured the fact that the underlying problem was bad loans made by bad lenders to bad borrowers.

There are no easy solutions in the subprime sector.

Help to Buy

In a second article, Merryn argued that Help to Buy should be scrapped.

- All it does is push up the prices of horrible new houses and inflate the profits of housebuilders (and the pay packets of their executives).

New Zealand property

Also in MoneyWeek, Alex Rankine looked at New Zealand’s ban on foreigners buying property.

- Unless you are from Australia or Singapore.

- Or the house is a new build.

Local home ownership is down from 74% to 63%.

- But only 3.3% of houses sold in the last quarter went to foreigners.

The problem is that the corresponding figure for central Auckland was 20%.

Property in stable cities (Hong Kong, San Francisco, Vancouver, Sydney, Paris and London have become a separate global asset class, or as Boris Johnson said:

Blocks of bullion in the sky.

But the impact on the wider property market is questionable.

Quick links

This is a bumper week, with twelve links:

- Flirting with models looked at the misleading lessons of history in asset allocation.

- And at Timing Equity Returns Using Monetary Policy.

- FT Advisor reported that the government will consult on collective pension schemes.

- I wish they wouldn’t – I’m not a fan.

- In MoneyWeek, John Stepek explained why IPOs are best avoided.

- For more detail, see Don’t Invest in IPOs.

- The Economist looked at the forthcoming IPO for Funding Circle.

- Alpha Architect buried the term “Smart beta“.

- They also explained why academic factor portfolios are so painful to stick with.

- And why BuyBacks Do and Don’t Matter.

- UK Value Investor explained why he sold Senior.

- Adventurous Investor looked at aircraft leasing funds.

- Irrelevant Investor asked what Gold was good for.

- And Hussman Funds looked at optimism in the Eternal Sunshine of the Spotless Mind.

Until next time.