Weekly Roundup, 25th September 2018

We begin today’s Weekly Roundup in the FT, with Merryn Somerset Webb. She was explaining that investing is simple.

Contents

Investing is simple

She was backing the three proven strategies:

- Momentum

- Value

- Small cap

Growth – which many investors favour at this point after a nine-and-a-half bull market – doesn’t work.

The explanation for each of the effects is behavioural (fear and greed).

What Merryn wants to know is why the investment industry doesn’t provide these solutions as defaults for retail investors.

- There are plenty of small cap funds and ITs, and a few momentum and value ETFs, but there are far more products that avoid the winning factors.

The problem is that none of the strategies work all the time.

- And the cost of short-term underperformance to a fund manager is the loss of investors’ funds, or even their job.

A second issue is that the strategies are so simple (momentum is just “we buy stuff that is already going up”) that investors would not be willing to pay high fees to access them.

Merryn mentions the iShares Momentum EFF (which I hold) and the SaltyDog and FundExpert subscription services.

She also discusses the TB Enigma Dynamic Growth Fund, which combines trend-following (momentum) with value.

- This funds sells stocks when they are no longer cheap.

But you can also use a stop loss to avoid the sudden crashes that momentum is prone to.

Satisfaction

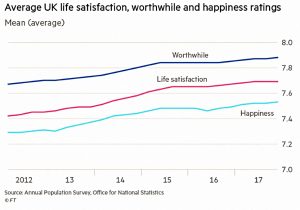

Jason Butler looked at the relationship between income and satisfaction.

- Despite stagnant real wages, people in the UK have been getting happier since 2011.

Apparently genetics explains 50% of happiness, with the rest depending on health, employment and relationships.

- As someone without a “real” job, I’m not sure about employment.

A bad job can certainly make you unhappy, but you don’t need a good job to be happy.

- Of course, once you reach financial independence, the financial aspects of a job become less relevant.

But the non-financial angles (socialising and status) are personality dependent.

- I don’t miss work at all, but I know my partner would.

We’re all familiar with the study that increases in income beyond $75K pa (£57K pa) don’t increase happiness.

- But a new study which looked at both happiness and satisfaction with life relative to others suggests that too high an income can lead to declines.

In developed countries, satisfaction plateaued at around£50K, and happiness at £72K.

- Above this, their scores started to decline.

- Jason speculates that this could be because high-paying jobs are more stressful.

I’m quite surprised that satisfaction is reached at £50K, since as Jason says, many people compare their income to that of others, which ought to mean there is no plateau at all.

Los of nerve

David Stevenson was explaining why he has “lost his nerve” and reduced his exposure to equities.

- He’s now down to 50% stocks.

- He has 20% in cash and 30% in bonds / alternatives / special situations.

I guess we can assume that David excludes his house (if he has one) from his portfolio.

He thinks that infrastructure stocks (and high yield funds in general) are over-priced but he’s still bullish about the energy sector.

- He’s also worried about private equity and in particular the valuations at which M&A transactions are taking place.

And he’s taken some profits from Syncona and put them into Allied Minds.

David says he’s cautious because Trump is serious about the trade war with China and confronting Iran.

- But he also thinks that Trump will intimidate the Fed if it tries to put up interest rates too quickly.

In my opinion, that’s bullish for stocks.

- A correction is coming, but I think that Trump will do all he can to push it back beyond the 2020 election.

Bonds and stocks

John Authers looked at why rising bond yields are not yet hurting US stocks.

He starts by describing the Fed Model, which says that bond yields move in line with the earnings yield on stocks.

- The earnings yield is the inverse of the PE ratio.

The theory rests on the idea that investors have a choice between stocks and bonds.

- When bond yields rise, stocks need a higher yield in order to compete.

But US bonds yields are rising as the US stock market sets regular records.

- In fact, John says that the rule hasn’t worked since the dot-com bubble.

But even if the Fed model doesn’t work, rising bond yields should still be bad for stocks:

- Higher rates make it more expensive for companies to service existing debts and to raise new capital.

- And they make it more likely than investors will sell stocks to buy bonds.

And in the first half of 2018, this is exactly what happened.

- Stocks sold off everywhere, but the US market has recovered.

The strength of stocks could reflect inflation fears (inflation hurts bonds more than stocks) or optimism about the future of the economy (bond sales to purchase riskier assets).

- The strength of the US jobs market would support either conclusion.

So stocks can prosper as long as the trade war doesn’t get too serious or the Fed raise rates too quickly.

Exit fees

Kate Beioley reported that Interactive Investor is to scrap its exit fees.

- The FCA is mulling a ban on them, so jumping before being pushed should give ii some good publicity.

Hargreaves Lansdown has also said that it’s not opposed to a ban.

- The Share Centre and AJ Bell are against a ban.

A decision is expected from the regulator in 1Q2019.

AIM and IHT

Over on FT Adviser, David Thorpe (( I couldn’t find a picture )) had another piece of good news:

- The Treasury confirmed that the review of inheritance tax being undertaken by the Office of Tax Simplification would not affect the exemption enjoyed by AIM shares.

A Treasury representative said:

We are fully committed to supporting Aim, which saw £5bn of shares traded on it in August 2018, and has helped thousands of UK entrepreneurs to raise the capital they need to innovate and grow.

As I run an AIM IHT portfolio for my mother-in-law, this is very welcome news.

Social wealth fund

The Economist looked at the creation of a social wealth fund in order to reduce inequality.

I should say at the outset that I don’t see the big issue about inequality, so long as the individual outcomes are well-aligned with the inputs.

- Equality is an impossibility, and there is no moral argument in its favour.

That said, there has been a downward shift in the share of national income going to labour since the 1980s.

- The Economist believes that labour doesn’t get the share it deserves because markets are distorted by the excessive power of business owners.

Matt Bruenig has written a paper suggesting that a social wealth fund (SWF) should acquires stakes in equity, bond and property markets.

- The state would own a share of the economy on behalf of the population, and distribution a universal basic dividend.

- This is a twist on the unaffordable basic income idea.

A template for the idea is the Alaska fund, but the money in that comes from oil, as does the cash in the Norwegian sovereign wealth fund.

- An SWF would mean new taxes, on wealth and inheritance.

The key risk of state ownership in markets is loss of competitiveness, as already seems to be the case with the rise of passive asset managers like BlackRock and Vanguard.

A smaller issue is the conflict of interest for workers, where higher wages mean lower dividend.

- The SWF would have get pretty big before that was a real problem.

I like the idea as a way of making capitalism popular once more, but I imagine that the negative effects of raising the money in the first place would outweigh the benefits.

Quick links

I have five for you this week:

- Musings on Markets had two follow ups to its post on Trillion Dollar Companies – 1 and 2.

- A Wealth of Common Sense wrote about Knowledge vs Skill.

- Research Affiliates wrote about Alternative Risk Premia, and

- Alpha Architect illustrate The Value of Retirement Accounts.

Until next time.