Weekly Roundup, 12th April 2021

We begin today’s Weekly Roundup with another look at inflation.

Inflation

In the FT, Martin Wolf looked at the potential return of inflation.

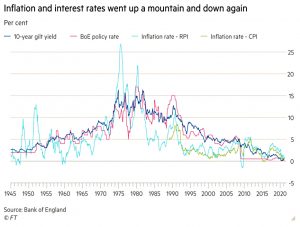

The last time inflation exploded out of control in high-income countries was the 1970s. The UK was very much in the forefront. In August 1975, year-on-year retail price inflation reached 27 per cent. In April 1980 it spiked to 22 per cent.

We had oil price shocks, but also a spiral of wage demands, strikes and even the three-day week.

- With high inflation and low growth, bonds and stocks did badly.

- The CAPE fell from 24 in 1966 to 8 in 1974 and 7 in 1982.

Control over inflation became central and unemployment less important, as Thatcher (and Volker) imposed tight monetary policy.

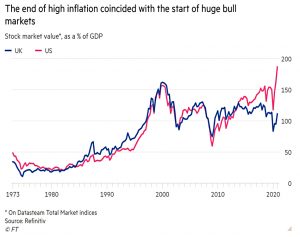

The successful control of inflation coincided with the beginning of a prolonged and remarkable boom in asset prices.

As inflation fell, so did interest rates, leading to bull markets in bonds and stocks.

- The US CAPE hit 44 in 2000, and the ratio of the stock market to GDP hit 157% in the UK.

The other factor driving the bull markets was free-trade globalism (including the rise of China) and a widespread move to deregulation (of taxes, finances and capital flows).

- This in turn led to a decline in labour-power and trade unionism.

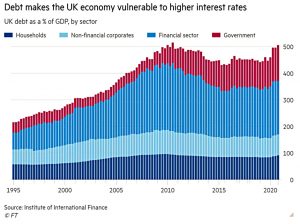

And to a rise in debt.

Which in turn supported low interest rates.

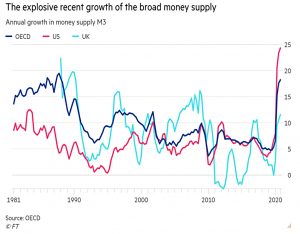

It was feared that the money printing in response to the 2008 crisis would end the era of low inflation, but this didn’t happen.

The lesson learned from this disappointing experience was that the response must be quicker, bigger and more determined next time. Covid-19, a quite different kind of shock, turned out to be that “next time”.

So last year, we got even more money printing.

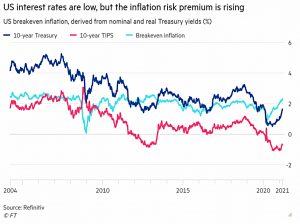

Yet the markets are still predicting a healthy recovery:

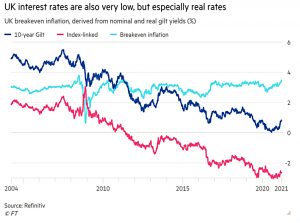

Bond markets merely indicate a modest and desirable rise in inflation expectations and inflation-risk premiums, especially in the US. Stock markets also remain confident of future profitability.

Martin also notes that the central banks are still trying to create inflation (and reduce unemployment) rather than keep it down.

- They would like to get interest rates significantly above zero so that they have ammunition for the next shock.

Furthermore, central banks believe that, in today’s economy, the response of wages to unemployment is very weak. This means they are able to run economies “hot”, with little fear of an unduly strong rise in inflation.

With the rise of MMT on the left and Biden’s green infrastructure spending, the chances of inflation are increased.

Martin notes that initially inflation will increase profits and will be good for stocks (though bad for bonds).

- But higher interest rates will lead to insolvencies and a debt crisis.

The demographics of ageing populations mean more consumers chasing goods from fewer workers, which could mean inflation.

- The alternative would be global Japanification.

Gold

In his Bloomberg newsletter, John Authers looked at the prospects for gold.

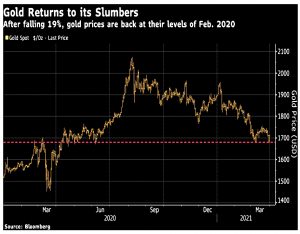

- The recent high was back in August, but the price is now back to where it was at the start of the Covid crisis.

Since then we’ve had the wait for a vaccine, then a lot of vaccines, then a third wave in the US and now in Europe.

- This is probably net bearish for gold, but more important is the fall in bonds in response to the threat of inflation and rising interest rates.

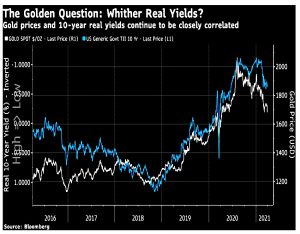

Although the metal is regarded as an inflation hedge, it isn’t as simple as that. It is more sensitive to interest rates. When rates rise, because of fears of long-term

inflation, gold can be expected to fall.

The chart above (from Capital Economics) plots yields for notional 2-year and 10-year zero-coupon bonds against an inverted gold price.

Normally, they track each other, but they have parted company dramatically this year, reflecting the belief that the Fed will be lenient for a while (keeping short rates low), and will have to intervene more strongly with higher rates in the longer term. Gold, unfortunately for investors, follows longer-dated bond yields.

Gold lasts forever and has no yield, so it’s easy to view as a zero-coupon long bond.

- Higher rates make the lack of yield more unattractive.

But gold has fallen more than would be expected, and there are several reasons.

Cashflows, as shown by the US gold ETF (GLD) are one factor.

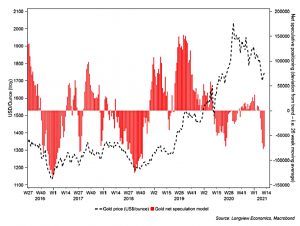

Net speculation (as shown by futures) is another.

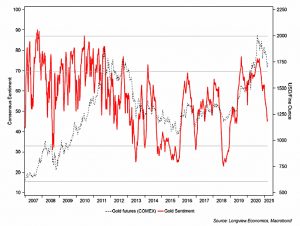

Sentiment has turned negative.

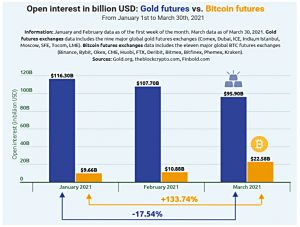

And bitcoin has become a competitor to those who want protection against the devaluation of fiat currencies.

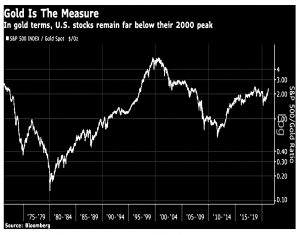

John also notes that – measured in gold – the S&P 500 remains just short of its post-dot-com high (from September 2018) and significantly lower than during 1999.

- Given that bond yields can be expected to continue to rise, we should be prepared for that 2018 high to be taken out soon.

Second mover advantage

In Money Week, Matthew Lynn looked at the “second-mover advantage” available to established firms who are striking back at tech upstart disrupters.

- His first example is Volkswagen.

The German car maker has unveiled plans for more than 30 electric vehicles across its VW, Audi, Porsche, Seat and Skoda brands. That is going to be quite a line-up for anyone in the market for a new battery-powered car, and investors are starting to wonder if it won’t look a lot stronger than Tesla’s.

The second example is Disney, whose streaming service has signed up 100M subscribers in just over a year.

- It took Netflix a decade to get to that number.

Over the last decade, a lot has been made of the advantages of getting there first. And while that is often true, there are also benefits to being the second company to come into a market, especially if you have plenty of money and a long history.

VW had a lot of production capacity, and an electric Golf can draw on a reputation for reliability and customer familiarity.

- Disney has Star Wars, Marvel and Pixar plus the dominant family back catalogue.

Second movers can copy the good stuff that the pioneer does, and avoid the missteps.

- And they usually have the deep pockets needed to catch up.

Divestment

Back in the FT, Merryn Somerset Webb was advising against the divestment of fossil fuel and mining stocks.

- She argued it was better for investors to hold the shares and try to influence company managers.

The context was a report from Friends of the Earth that UK local government pension funds have £10 bn invested in “climate-wrecking companies”.

Merryn says that selling the shares achieves nothing good:

It makes it harder for firms that might want to raise new money via the equity markets and if [it] makes banks wary, it might raise the cost of debt too. But for firms already chucking out cash, it makes no difference at all.

And she warns that the transition to cleaner energy will take decades:

In the meantime we need traditional sources of energy. Shouting at oil

doesn’t change that.

The same goes for the miners.

You will need copper, as copper wire is one of the best ways to move electricity

around. You will need mountains of rare earth metals too. What we want is not no oil, no tin and no copper, but more carefully produced oil, tin and copper.

Which means impact investing.

Big investors should stay invested and encourage better behaviour.

Quick Links

I have seven for you this week, the first five from the Economist:

- The newspaper shared the thoughts of Pfizer’s boss on how Covid is improving Big Pharma

- And reported that foreign students are still keen on UK universities.

- The Economist also noted that virtual meetings are here to stay

- As is group voice chat

- And noted that Cairn Energy is taking on the Indian Government.

- Alpha Architect tried to estimate the Stock-Bond Correlation

- And Validea claimed that although we might be in a bubble, you probably shouldn’t care.

Until next time.

Just in case you missed it, problems with drawdown made it to Saturdays Times Troubleshooter page this week, see https://www.thetimes.co.uk/article/the-pru-wont-hand-over-my-20k-jllkqpkqt

Thanks for that, I had missed it. Perhaps I can squeeze it in next week.

I got my money eventually, but I haven’t had any tax back from HMRC for more than a year now.

As suspected, seems that problems with drawdown are wide spread.

I have not had delays with getting overpaid tax [on drawdown] back from HMRC. This might be due to the particulars of the “reclaim” process followed – more details follow.

I have, however, had similar significant delays reclaiming other refunds due to me from HMRC. I gleaned that this was because the staff who usually work that part of the process had all been re-allocated to work on C-19 related tasks.

Loving these weekly round-ups!