Weekly Roundup, 6th April 2021

We begin today’s Weekly Roundup with a tale of two fund managers.

Fund managers

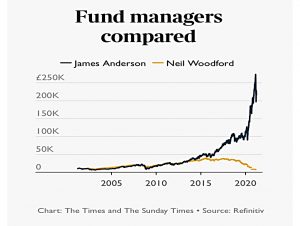

In MoneyWeek, Merryn Somerset Webb compared the contrasting fortunes of fund managers Neil Woodford and James Anderson (who announced his retirement from the Scottish Mortgage IT last week).

The second part of Woodford’s career (after he set up his own fund house) was about losing people money:

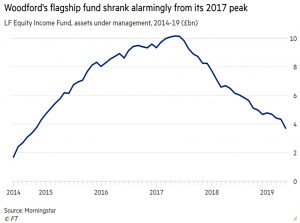

Anyone who invested in his Woodford Equity Income fund at launch will have lost just over 20% of their money. Anyone unlucky enough to invest at its peak in 2017, when the fund was managing more than £10bn, will be down over 40%.

Whereas Anderson has made people a lot of money:

In 2000, he took over management of the Scottish Mortgage investment trust. Since then it has returned 1,530%. The MSCI World has barely managed 270%.

But are they really that different, or is it more the case of which style has worked recently?

[Woodford] made his reputation as a value investor, and value has long been nastily out of fashion. And now might be a good time to ask if Scottish Mortgage’s high-conviction growth style is still one we want to own.

Indeed, SMT dropped 28% this quarter as investors rotated back to value and the spectre of future inflation appeared.

- A lot of buy-and-hold investors could have big positions in SMT, and some judicious rebalancing could be in order.

The FT had an article from Owen Walker, author of a new book about Woodford – Built on a Lie.

He’s not a fan of star managers in general – he mentions Bill Miller, Peter Lynch and Anthony Bolton as well as Woodford.

The more companies fired up the profiles of these stars, the more they relied on them to attract and retain clients. A cult of personality developed around the best-known managers, who lived rock star lifestyles, buying fast cars and luxury mansions.

Things went wrong for Woodford once his name was above the door:

The Woodford-centric business at Woodford IM also fostered a culture where anybody who stood up to Woodford and his ally Craig Newman had little future at the business. Woodford and Newman extracted dividend payments — £90m over five years — while paying staff fixed salaries.

The key lesson is style shift:

Woodford’s reputation at Invesco had been forged on his investment style of selecting large, blue-chip British companies that could be relied upon to produce steady dividend payments.

[Woodford] Equity Income was designed to mimic Woodford’s popular Invesco funds and prise away as many of his former followers as possible. But as the cash poured in, Woodford wrote scores of hefty cheques to poorly-researched private companies, whose tribulations would ultimately contribute to his collapse.

In the Times, Ali Hussain reported that Hargreaves Lansdown (who had Woodford’s fund on a best buy list) repeatedly raised questions about the fund with him and manager Link Fund Solutions.

HL became concerned about the amount of unquoted stocks Woodford was holding in November 2017. A month later Mark Dampier travelled to the fund manager’s headquarters in Oxford to interview him.

In February 2018 Woodford breached the 10 per cent rule. Link knew, and the breach was reported to the FCA. HL and other investors were not informed.

In an ironic coda, Oxford Nanopore – one of Woodford’s most promising unquoted investments – announced last week that it will list on the LSE later this year.

- Investors trapped in the LF Equity Income fund will miss out on a potential £200M windfall as the fund’s holding was sold by Link for a fraction of its likely future value.

The shares were sold to Acacia research, with whom Woodford plans to run a biotech fund for professional investors.

- Holders of what is now Schroders UK Public-Private Trust (formerly Woodford Patient Capital) will make money, as this fund has a 13.7% position in Nanopore.

FinTech

There were two big stories from the world of FinTech last week – Robinhood’s IPO announcement, and the end of the proposed Seedrs and Crowdcube merger.

Robinhood said:

Robinhood Markets, Inc. has confidentially submitted a draft registration statement on Form S-1 with the Securities and Exchange Commission (the “SEC”) relating to the proposed initial public offering of its common stock. The number of shares to be offered and the price range for the proposed offering have not yet been determined.

Despite a massive funding round of $3.4bn in February this year, negative publicity around the suspension of trading in GameStop had dampened the previous speculation that Robinhood would capitalise on its rapid growth in user numbers during the pandemic to go public.

- There was also a major outage during the Covid crash in March 2020, and the cancellation of the UK launch after attracting 25,000 investors to its waitlist (over in the US the firm has 13 million users).

The firm has also attracted criticism for its gamification of investment and was condemned when a customer committed suicide after his account appeared to show a negative balance of $700K during the option settlement process.

- Robinhood is likely to list on NASDAQ (though that hasn’t been confirmed) and its latest valuation was $11.7 bn.

Here in the UK, the Competition and Markets Authority (CMA) put an end to the proposed UK crowdfunding merger:

[It] may be expected to result in a substantial lessening of competition (SLC) within the supply of equity crowdfunding platforms to SMEs and investors in the UK. The only effective remedy is likely to be a prohibition of the merger.

In the end, no prohibition was required – Seedrs walked away the next day and raised some capital instead.

Seedrs chairman Jeff Lynn said:

We are deeply disappointed with these findings, and we firmly disagree with the CMA’s view that this would be an anti-competitive transaction. We believe strongly and unreservedly that this merger would have a highly positive outcome for British small businesses, helping to provide vital funding for thousands of ambitious companies in the future.

AltFI noted that this was the second failed FinTech merger of 2021, after Visa’s acquisition of Plaid was blocked by the US Department of Justice.

The site sees being acquired as the natural endgame for most startups:

Whether it’s open banking providers, SME lenders, current account providers, digital wealth platforms, or indeed, equity crowdfunders, there’s a clear over-supply of players and M&A is the obvious outcome. But regulators don’t always recognise that.

Market definition seems to be the problem:

Merging companies will always paint a picture of operating in the broadest possible market, to deny that their coming together could possibly alter such a vast competitive landscape.

The CMA clearly didn’t believe submissions from each platform that the merger was essential to guarantee their survival.

To be fair, the combined firm would have had a 90%+ share of UK crowdfunding.

- There’s plenty of competition in VCTs and a reasonable amount in the EIS fund market, but the £10 punter really only had these two platforms to choose from.

Moral panic

Robinhood is implicated in the moral panic referred to by David Stevenson on his Adventurous Investor blog.

- The FCA has warned that young investors, in particular, are being attracted to digital “get rich quick” schemes (FX, options, CFDs, spread bets, fractional shares, TikTok, crypto and now NFTs).

There’s no doubt that leverage is a problem for some people, but my concern is that the usual regulatory reaction is to throw out the baby with the bathwater and restrict access to certain tools and products, or even worse to ban retail investors entirely.

- We saw this in January when UK retail investors were prevented from using crypto derivatives – the bitcoin price has tripled since then.

I like using (modest) leverage and I would like to continue to use it, so please let’s introduce a net worth or “sophisticated investor” qualification instead.

David points out that older investors may not be influenced by TikTok videos, but they do scour bulletin boards for ideas.

- David thinks that young investors are more sensible than the media think. (( He may be influenced here by his son and his son’s friends – my time on Reddit would suggest that things are even worse than the Sunday Times thinks ))

He thinks that high fees should be the target, but I disagree:

- I’ve given up hope that this will change much in the UK – most investors just don’t care enough about fees, and

- younger investors largely lack the long-term mindset required to make the most of low fees even if they existed.

Ian Cowie wrote about the same topic for interactive investor.

He was at pains to explain the difference between gambling and investing:

Most betting slips are worthless at the end of every race or game, but very few funds or shares ever go to zero. It’s as simple as that.

I think it’s actually more complicated than that – products like options can go to zero, but still be part of a valid investment plan.

- I think a better definition of investing is that it has a positive long-term expectation – however you choose to achieve this.

Inflation

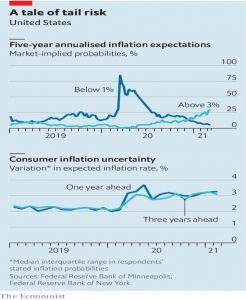

The Economist revisited US inflation expectations.

- For technical reasons (low numbers from a year ago falling out of the sample and into the comparison year) inflation will rise in the becoming months.

The next phase is a second wave of inflation as spending by newly vaccinated consumers rebounds from the pandemic faster than production can keep up. Even stimulus advocates typically admit that overheating is a risk, and it would be more likely should more deficit spending pass.

The third stage would be public expectations of future inflation, which become self-fulfilling through higher wage demands, and hence prices.

- This way lies 5% pa to 10% pa inflation and lots of pain.

Fed Chairman Jerome Powell isn’t worried:

Having [inflation expectations] anchored at 2% is what gives us the ability to

push hard when the economy’s really weak.

But are they? The Economist points to three sources of expectation:

- markets

- households and business surveys

- professional forecasters

The market-implied probability of average consumer-price inflation exceeding 3% per year for the next five years is over 30%.

This is not exactly panic stations, but it’s higher than the Fed would like.

Firms and household don’t expect more inflation, but they have become less certain about the future.

- Unfortunately, they are poor forecasters:

Both firms and households chronically overestimate price rises. Consumers seem unduly swayed by the price of petrol.

Professionals back the Fed, but:

Their historical record as an early warning signal is not encouraging. As the economy overheated in the late 1960s prognosticators were behind the curve.

It might be best for the Fed to commit to raising rates to fight prolonged inflation.

- But instead, it has emphasised a commitment to jobs and reducing inequality.

Which won’t stop inflation once it takes hold.

Drawdown calculator

In FT Adviser, Amy Austin reported that the Money and Pensions service (MAPS) has pulled its drawdown calculator because the complexity of drawdown charges made it too hard to compare products.

- This is bad timing for me, as a review of drawdown options is on my to-do list.

A MAPS spokesman said:

The related educational resources can still be found elsewhere on the Money Advice Service, The Pensions Advisory Service and Pension Wise websites.

But not a cost comparison, sadly.

The calculator was launched in April 2019, but I have never used it.

- It was criticised last month by Romi Savova, CEO of PensionBee who said that it was “highly misleading” and “not fit for purpose” because it left out “major providers” (presumably including PensionBee, but also AJ Bell and Vanguard).

MAPs plans to relaunch its three legacy brands in June under the new label “MoneyHelper”.

- Here’s hoping that goes better than the drawdown calculator.

Quick Links

I have eight for you this week, the first five of which are from the Economist:

- Buttonwood looked at VCs and startups

- And the newspaper also wrote about the Fed and the bond markets.

- The newspaper also wrote about Intel

- And about WeWork’s float

- And about Deliveroo’s IPO.

- Alpha Architect looked at fixed income between a rock and a hard place

- Kepler Intelligence reported on the Hipgnosis Songs fund

- And Pragmatic Capitalism wanted to talk about Asset Inflation.

Until next time.

Slightly tongue-in-cheek, but do you think Romi Savova might just live in a glass house?

I can see where she’s coming from – if PensionBee offers cheap drawdown (which they do), then they should be included in the calculator results. But I didn’t get to see the calculator before it was withdrawn, so I can’t be sure how misleading it was.

I think I would find it hard to resist free publicity if it was on offer. Unfortunately, there aren’t many outlets interested in DIY investing.