Weekly Roundup, 29th March 2021

We begin today’s Weekly Roundup with a look at robo advisors.

Robos

In the Times, Imogen Tew looked at why robo fund managers (robo advisors to you and me) have failed to start a revolution.

- It’s now nine years since the first UK robo (Nutmeg) launched, and still, none of them is turning a profit.

Click and Invest, Moola and Scalable Capital have already quit the UK, or shut up shop altogether.

Imogen frames the issue in terms of the problem she wanted robos to solve:

Savers were either keeping too much of their nest eggs in cash, so their money was not growing, or that they were taking too much risk by gambling their savings on one type of investment.

Imogen notes that only 1.3% of UK adults use a robo, and they control just 3% of UK invested assets.

One of the problems is the cost – robos charge between 0.5% and 1.2%.

- This is much cheaper than IFA networks like St James’ Place, which wants around 2.4% pa – but I can do a better job for myself for between 0.3% and 0.4%.

And remember, these numbers sound small, but over an investing lifetime (40 to 60 years) the differences become enormous.

Another issue has been workplace pension auto-enrolment, which also began in 2012.

Almost ten million people who had no investments, and who might have been tempted by a robo-adviser, suddenly had a pension plan.

And traditional and challenger banks flooded the finance app market, making it difficult for the robos to stand out.

I had lofty ambitions for robos.

- I wanted them to use their (potential) scale economies to provide sophisticated yet low-cost solutions to DIY investors.

I wanted them to be better than me, and cheaper than me – and they are neither.

- Both Imogen and I have been disappointed.

Fintechs

There’s been a lot of fintech activity over the past week or two.

- PensionBee has said that it plans to float on the LSE, within the “high-growth” segment of the main market.

- It plans to offer shares to its 130K existing customers, (( Who include my other half )) which is good.

- PensionBee has a competitive offer in the pension consolidation space.

- But the portfolios lack flexibility, which cost me last year when I couldn’t move away from the UK during the Covid crash.

- I’ve also found the process of withdrawing money from the pension – and of consolidating additional pensions into the platform – to be more difficult than it should be.

- So I will probably be moving away from the platform in due course.

- Interactive Investor also plans to float, having consolidated its way to being the second-largest UK retail platform after Hargreaves Lansdown – II has a 20% share.

- I’ve never used II because it has always fallen outside the top two or three offers on cost whenever I’m looking to make a move.

- I haven’t heard whether II customers will be offered shares.

- Deliveroo is planning an IPO too, and will be offering shares to its customers. (( This won’t be enough to convince me to start ordering takeaways ))

- Merryn Somerset Webb used the announcement to bemoan the lack of retail investor involvement in IPOs in general.

- Moonpig and Dr Martens were the examples she used.

- Freetrade has taken advantage of the lockdown share-trading frenzy to raise another £50M from institutions including Left Lane Capital.

- Until now, Freetrade has been raising cash through crowdfunding platforms, most recently in May 2020, when they raised £7.1M from 8,500 retail investors.

- I’ve never invested in Freetrade (though I am one of its 600K UK customers), so I don’t know what the pre-emption rights are for the crowdfunders but the potential for dilution is clear.

- Freetrade is another somewhat disappointing platform – the list of stocks on the free app is pretty limited, they charge a fee for the ISA and they have high FX fees on US stocks.

- Zopa has raised £20M to help with its transformation from a P2P lender to a digital bank (we need more of those, right?)

- Zopa now has a full banking licence and offers savings products and a credit card.

- What it doesn’t have is a P2P product offering interest rates that are half-way to borrowing rates – the original promise of P2P.

- I put money into Zopa when it launched more than 15 years ago, and it’s another story of fintech disappointment.

- An interview with the founder and MD of Monument, the digital bank targeting the mass affluent (those with £250K to £5M outside of their main property) suggested that the company might be drifting towards becoming a property investor.

- Their initial focus (they haven’t launched yet) will be the rapid approval of buy-to-let mortgages up to £2M.

- “Many of them [the mass affluent] have three, four, five, or six properties, and they almost become professional landlords on the side,” said Mintoo Bhandari.

- This lending will be funded from savings products, so let’s hope that there are some competitive rates on offer.

- There are no plans to offer current accounts or credit cards.

Patsies

Joachim Klement claimed that Robinhood traders are patsies.

- He begins by noting that GameStop shares are down by more than 90% from their 28th Jan highs, which implies that a lot of novice retail investors have had to pay what Joachim calls “school fees”.

But what he really wants to know is whether retail investors – when organised to an internet army – can influence the markets.

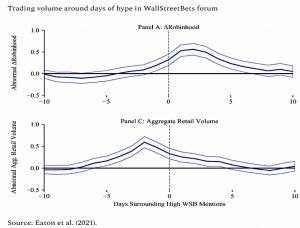

A recent note looks at the like between r/wallstreetbets and Robinhood.

To figure out the impact of Robinhood traders on the stock market overall, they used the [2020] trading outages the app had to compare share price volatility and liquidity in times when Robinhood traders could not trade compared to when they could.

Markets were more efficient when the app was down – spreads reduced and volumes were more settled.

More significantly:

Hype about stocks on WallStreetBets followed general inflows by retail traders from all kinds of platforms by a couple of days. And then it took another couple of days until Robinhood traders picked up on the hype.

Robinhood traders bought a stock about a week after the average retail trader bought it.

There was an increase in share prices three to five days after retail traders bought, but no such effect from Robinhood trades.

- So RH traders are noise traders.

[They] react to short-term noise and distort share prices but have no discernible investment edge or impact on the market.

A second paper found that RH customers underperformed the S&P 500 by around 5% on each trade.

Tax dodging

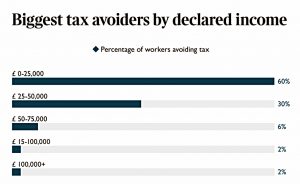

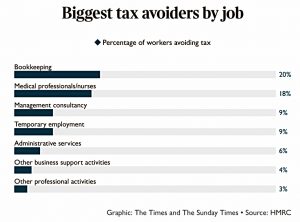

In the Times, David Byers reported that it’s not just the rich that avoid tax.

- He was looking at an HMRC report on the use of tax avoidance schemes like the umbrella company offshore loans scheme which was popular fifteen years ago.

We need to be clear on the terminology here: HMRC may call these tax avoidance schemes, but tax avoidance – carefully arranging your affairs so as to minimise your tax bill – is legal, whereas these schemes have been found to qualify as tax evasion (trying to cheat the taxman out of his cut).

The context for the article was last week’s Treasury Tax Day, which was expected to announce more measures towards the digitalisation of tax recording in order to clamp down on dodging.

David began with a postcode analysis:

HM Revenue & Customs has named the postcode area of Barking and Dagenham as the national leader for workers using tax avoidance schemes. It said that 229 out of every 100,000 residents have used some kind of scheme to dodge tax.

The surrounding area seems to be a hotspot too, with Thurrock, Greenwich, Croydon, Lewisham, Havering, Dartford and Bexley all also among the top places for avoidance.

Nine out of ten people who use the schemes earn under £50,000 a year and in London there has been a noticeable shift in tax avoidance away from richer boroughs such as Kensington and Chelsea.

In the 2018-19 tax year, 20 per cent of the people using avoidance schemes were book-keepers, 18 per cent were doctors, nurses and managers, 9 per cent were management consultants, 9 per cent were office temps and 6 per cent were office admin workers. Some 2 per cent worked in primary education, for example as supply teachers.

Quick Links

I have nine for you this week, including five from the Economist. The first two are on the benefits from the vaccine research program and the next two are about American fintech:

- The newspaper looked at the bright side of the moonshots

- And noted that Covid-19 vaccines have alerted the world to the power of RNA therapies.

- They also said that fintech has come to America at last

- And that the US is no longer behind on digital payments.

- The last article from The Economist claimed that VW will catch up with Tesla.

- Musing on Markets looked at Interest Rates, Earnings Growth and Equity Value

- Alpha Architect provided an Economic Framework for ESG investing

- Slow Boring said that Asset Price Inflation is not a thing

- And MoneyWeek reported on the mogul shaking up the music business.

Until next time.

Mike,

Fascinating article by D Byers – which I missed. Thanks for bringing it up.

Have you had a change of heart re Pension Bee?

I ask as the last time you mentioned them in chatter I was left with the impression that they were pretty slick around withdrawals – see comments to https://the7circles.uk/annual-portfolio-review-2019/.

As it happens, my own experience to date with drawdown remains poor and if anything has deteriorated over time rather than improving. I suspect that I am not alone but have so far been unable to find any supporting evidence from e.g. surveys , reports etc. Are you aware of any reliable data on user perceptions/experience of drawdown providers?

The first time I made a withdrawal they were good. This time not good.

We also talked about this on the 2020 portfolio review in January – my main reason for moving away is the lack of investment flexibility, which made a big difference to performance last year.

You are spot on re 2020 review chatter – my bad!

I get the lack of investment flexibility.

However, out of interest, what more can you add about first w/d good; second not so. I am guessing this must have been something to do with back office stuff as I suspect the front-end [user interface, if you prefer] to PB is unchanged.

I strongly suspect that [possibly even across the market] drawdown nuts and bolts is a bit of a shambles – but so far I have been unable to find any reliable data on user perceptions/experiences to substantiate this. Do you know of any reliable data on this?

You’re right, the front end was the same. The first time, the cash just turned up in the linked current account. The second time we needed passports and selfies (which were rejected several times for lacking the EXIF data they needed to show where and when they were taken). They have outsourced this ID process to a third-party and the experience was awful.

I don’t know of any smooth drawdown process. HL are the other one I have first-hand knowledge of. It’s one online and two paper forms, and it takes around a month before the cash is in your account. And don’t get me started on HMRC taxing you as if you plan to withdraw the same amount every month …

Not much to do with pensions is easy.

Mike,

Your experiences sounds remarkably familiar.

I just do not get why it takes so long given that all that is really required is to:

a) sell some units;

b) run payroll; and

c) pay you and HMRC some cash.

FYI, over the last couple of years I have discovered that the quickest way to find out what net amount you will receive is to log into your HMRC personal tax account – as HMRC seem to be advised before you!!

I think I might have also worked out how they calculate the tax owing too.

I am surprised how little push back / chatter there has been about this whole area. IMO it is really a bit of a scandal!

By way of a comparison I am pretty sure no reputable company would get away with running its employee payroll in such a shoddy manner.