Weekly Roundup, 19th October 2020

We begin today’s Weekly Roundup with a look at endowments.

Endowments

In his Bloomberg newsletter, John Authers wrote a couple of times about university endowments.

- The key advantage of these funds is that they can look decades into the future, taking a perspective that is even more long-term than pension funds.

The allocations within these funds have changed significantly over the years.

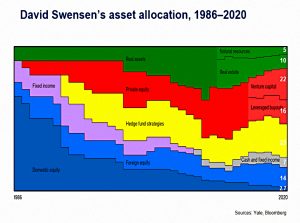

The chart shows the Swenson allocation at Yale since he took over in 1986.

- The biggest change is the fall in US stocks from perhaps 70% to only 2.7%.

The other big change is the addition of hedge funds, private equity and venture capital, which now make up 61% of the allocation.

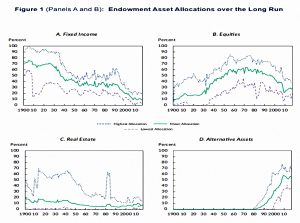

A paper from Dimson et al at the Cambridge Business School looked at allocations across 12 US endowments from 1900 to 2017 and tells a similar story.

Alternatives are up, stocks are down (after rising in the 20th century), and bonds and real estate are way down.

- Before World War 2, bonds and real estate dominated allocations.

Now the big bets are hedge funds, PE and VC.

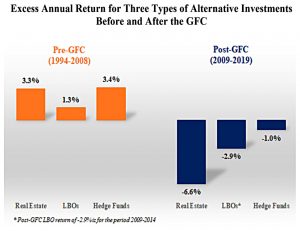

Of course, those bets in recent years aren’t generally working out very well, thanks to low interest rates and the persistent bull market in equities.

But this counter-cyclical bet is typical of a long-term outlook.

But since 1900, on average, endowments have been very counter-cyclical, cutting equity exposures a little ahead of major stock market crises, and loading up on stocks

immediately afterward.

Over the long-term, the funds have done well – average real growth since 1900 is 4.1%pa.

- From 1950 to 2017, the funds returned 6.6% pa, with an SR of 0.54.

Over the same period, stocks returned 9.0% with an SR of 0.48 and government bonds returned 3.0% with an SR of 0.21.

For an alternative review of the same paper, try Buttonwood in the Economist.

John’s second article looked at a paper by Richard Ennis which argues that endowments should follow a simpler approach.

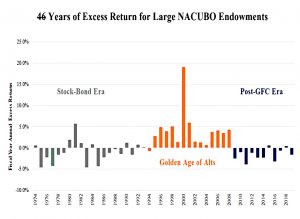

Ennis shows that the endowment outperformance over the last 50 years is limited to the 15 years before the 2008 crisis.

- This is partly a “ruler” problem – when the largest stocks in the largest markets (US Tech stocks) are the best performers, anything more complicated is bound to look inferior.

Interestingly, real estate seems to be the biggest culprit.

Ennis makes two points:

- the complicated models used by endowments leads to higher fees, which need to be justified by higher returns, and

- they waste a lot of time searching for active managers when the prospective additional return is low

The law of diminishing returns shows that risk reduction tails of badly after the fourth active manager is added.

- Staggeringly, endowments use more than 100 managers on average.

John concludes:

The great run of success beginning a quarter of a century ago benefited, it appears, from “first-mover advantage.” There were relatively few hedge funds and private equity managers around, trying strategies that nobody else had yet attempted, and aiming at market anomalies that had yet to be exploited.

I agree with this, but there’s no need to throw the baby out with the bathwater.

- Private investors are unlikely to allocate 60% to alternatives, but a 5% to 10% allocation is likely to improve risk-adjusted returns without pushing up costs by too much.

And indeed, Ennis recommends that funds should be built around a large passive core, to take advantage of diversification whilst keeping costs down.

- This core and satellite approach is the one that I use.

John explains the problems with this for institutions:

Many trustees would balk at leaving their endowments or pension funds wholly dependent on the prevailing direction of markets. As such long-term institutions genuinely have great advantages over others, it is incumbent on them to try to do better than match the index.

There is also the issue of price discovery, should passives dominate – but I don’t think we are there yet.

Volatility

Joachim Klement looked at volatility as experienced by individual investors.

- It’s well known that investors underperform the funds in which they are invested because they tend to buy high and sell low.

And it turns out that they also experience higher volatility as well.

A recent paper from Dichev and Zheng looked at this by making a couple of assumptions about investor behaviour:

- individuals don’t reinvest their dividends in the stocks which produced them

- this is a reasonable assumption for many, but doing this would introduce a dollar-cost-averaging effect which would reduce volatility

- individuals do participate in any capital raises according to the shares they own/dividends they receive

- I don’t have any stats on how many private investors (PIs) participate in raises – but I don’t personally

Then they compared simulations of dollar-weighted returns of individual stocks and portfolios compared to buy and hold returns.

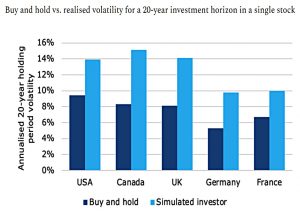

The first scenario they looked at was holding a single stock for 20 years.

For every country tested, the volatility experienced by the investor was significantly higher than the volatility experienced by a buy and hold investor who reinvests all dividends.

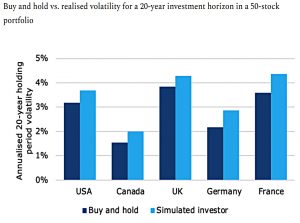

This extra volatility increases with investment horizon, and moving to a 50-stock portfolio didn’t fix things:

The authors explain:

Investors tend to “chase stability” but have bad timing, adding capital to stocks after low past volatility but before high future volatility.

Combined with the earlier finding that PI returns are also lower, their risk-adjusted returns (Sharpe Ratios) must be significantly lower.

Big Exchange

The Big Issue has extended its remit from homelessness to ESG by launching an investment platform – The Big Exchange – in partnership with a number of asset management groups, including Aberdeen Standard Investments, Liontrust, and Columbia Threadneedle.

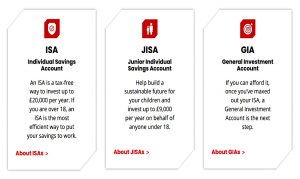

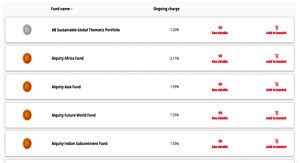

The platform offer access to 36 ethical funds – all actively managed OIECs – from 11 fund groups via ISAs or general investments accounts (GIAs), with as little as £25 per month (£300 per year).

There is no SIPP yet (coming “later this year”), but there are some ready-made portfolios (known as bundles).

The funds have been selected on the basis of their contribution to UN sustainable development goals, which are:

To end poverty, protect the planet, and ensure populations enjoy peace and prosperity.

Sounds good, if not necessarily profitable.

The timing is likely Covid-driven:

According to a 2020 YouGov poll, 54% of people hoped they will make some changes in their own lives and for the country due to the Covid-19 crisis.

The Big Exchange provides people with an opportunity to make a positive social and environmental difference with their money, without sacrificing financial returns.

I’m not too sure about that last bit.

Nigel Kershaw, the Big Exchange/Big Issue chairman said:

We created The Big Exchange to transform the financial system and give the

opportunity for everybody with savings to invest in funds that give them a financial return as well as making a positive impact on the world around them.Through the tragic COVID-19 crisis we are seeing more and more people wanting to make their money count for more both for today and for future generations.

Apart from mission creep, the big problem is fees – the platform charge is 0.25% pa, but the average charge from the OEICS is 1.2%, to give an overall charge of 1.55% pa.

- Given current prices and prospects for growth, that charge is ridiculously high.

Of course, the platform claims that low fees are important to them, and they disguise the impact of the charges by showing them in monthly terms, on a ridiculously low asset base.

- 1.55% of £100 may be 12p per month, but it’s still 1.55% pa.

I’m not suggesting that you ignore the ESG theme, but as usual, you’d be better advised to go DIY and save yourself a lot of money.

Freetrade SIPP

I seem to be writing about FreeTrade every week at the moment, but I assure you I am not being rewarded for this.

- It emerged last week that they will be launching a SIPP in December.

The SIPP can hold stocks, ETFs and ITs, but not OEICs.

- It will charge £9.99 a month (£120 a year), which puts it just above the AJ Bell SIPP (£100 pa) in terms of costs, and well below Hargreaves Lansdown (£200 pa).

Of course, the minority who actively trade their SIPPs will benefit from FreeTrades lack of commissions.

For FreeTrade Plus customers – who already pay £120 pa for access to an extended stock list – the SIPP will be £7 a month (£84 a year).

- This is the same discount as Plus customers get on the ISA (£3 per month discounted to zero).

The complete bundle of ISA + SIPP + extended stock list will be £17 per month (£204 pa), which remains far from compelling.

SIPPs continue to be a problem area, with first Vanguard and now FreeTrade disappointing in terms of costs.

Quick links

I have eight for you this week, six from the Economist and the first two from Alpha Arhcitect:

- Alpha Architect looked at the performance of equity trend following around the globe

- And at the impact of news on risk and returns.

- The Economist reported that the IMF is expecting a “long covid” effect not he world economy

- And that Apple has finally unveiled a 5G phone (later than its rivals)

- The newspaper also listed the lessons from the Vision Fund

- And wondered what SoftBank’s Masa will do next

- The Economist also said that a subsidies scrap between Boeing and Airbus was coming to an end

- And looked at the prospects for Andy Bird, the new boss of Pearson.

Until next time.