Weekly Roundup, 13th June 2022

We begin today’s Weekly Roundup with inflation and recession.

Recession watch

Over on Pragmatic Capitalism, Cullen Roche looked at why everybody thinks that we are already in a recession.

We’re obviously not in a technical recession, but my theory is that a lot of people feel like this is a recession because of inflation. High inflation, even with low unemployment, has such a disproportionate impact that people still feel worse.

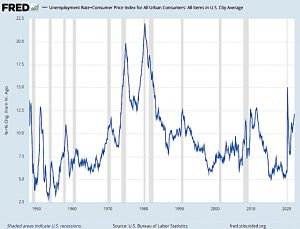

The so-called “misery index” calculates the unemployment rate and the inflation rate into one index thereby quantifying how much “misery” we feel in the economy at times.

The misery index is now up there with the readings for 2009, 2020, 1991 and the early 1970s and the 1980s, though we are still some way lower than the late 70s.

When inflation is high it doesn’t even matter if you have a job because you still feel like you’re going backwards in many ways.

Cullen also noted that the future direction of inflation is hard to predict:

- More inflation: Ukraine War, China shutdown, Booming commodity prices

- Lessflation: Fiscal tightening, Rising rates, Soft housing, Inventory restocking, Rising recession risk

Things could go either way.

La La Land

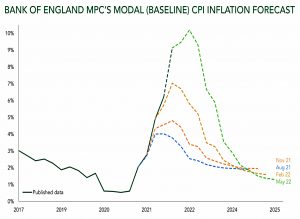

In Ruffer’s Green Line newsletter, Steve Russell said that the Bank of England’s inflation forecasts look like a triumph of hope over reality.

Just 12 months ago, the Bank of England was predicting inflation would be less than 2.5% today. In fact, it has just hit 9%, and the Bank expects it to exceed 10% by the year end. That is some forecasting error.

Steve is puzzled by the BoE’s continuing insistence that inflation will be back to the official target of 2% by early 2024.

It seems central bankers are still addicted to the notion of ‘transitory’ inflation.

Either the Bank intends to raise rates high enough to plunge the economy into recession. Or it is desperately hoping energy and food prices stabilise, supply chains are unblocked, deglobalisation is reversed and, most importantly, wages don’t rise.

A goldilocks scenario, you might call it.

There seems little likelihood of the extreme interest rates needed to tame inflation (there’s too much debt around, and mortgages would become unaffordable, crashing the housing market), and in particular, wages are already rising at 4% to 5%, and the tight labour market points to further rises.

Government payments to offset soaring energy costs, though welcome to those struggling to pay, can have much the same effect.

So if we are lucky, we are heading for a recession (which would crash inflation).

- If we are unlucky, we get the 1970s again – stagflation, with low growth and inflation.

None of this looks good for stocks or bonds.

Redwood

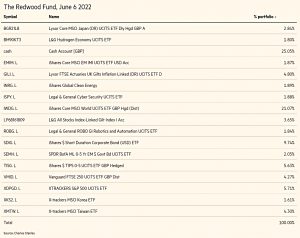

John Redwood’s regular portfolio update in the FT was also focused on inflation.

- John noted that the ECB is on the back foot in the fight against inflation -it’s still printing money when the Fed and The BoE have stopped. (( With typical timing, the ECB announced a halt to money printing a couple of days after John’s column ))

He noted the problems for fund managers as the indices fall:

They need to keep their funds with the minimum investment levels specified to retain their ratings as growth or balanced portfolios. They may try to switch into more defensive assets, but need to keep enough share risk to justify the fund description.

John expects more falls and has 25% cash as well as short-dated and index-linked bonds.

He worries less about the US than he does Europe:

Economies are closer to recession on this side of the Atlantic. The US has great strengths against the present poor outlook, with self sufficiency in gas, a lot of oil and plenty of homegrown grains. Europe in contrast has to import more at sky high and erratic world prices.

But he doesn’t expect inflation to last very long:

When do the central banks and governments start to worry more about recession and less about inflation? It seems likely we will be through the rate rising cycle more quickly than gloomy markets currently assume, as the forces of slowdown are very considerable. (( Friday’s inflation number in the US suggests he may be optimistic here ))

Pension projections

In the FT, former pensions minister Steve Webb was not impressed with the Financial Reporting Council’s plans to standardise growth assumptions for pension projections.

As a pension saver you might reasonably assume that pension companies and schemes are subject to strict rules about how they project your current pension pot into an estimated income in retirement. But those rules allow a remarkable degree of latitude.

Growth rates vary between assets and between providers.

The chart comes from an FRC survey in 2020.

- Equity returns range from 4% to 7% (I don’t know if these are real or nominal)

- Corporate bonds are from 1% to 4%

- Gilts are from 0.5% to 4% (!), and

- Cash was from 0.5% to 1.5%

Compounded over many years, these ranges can lead to massive differences in projected outcomes.

Consider a pension pot of £50,000 held by someone who is 20 years away from retirement and invested wholly in equities. If the provider assumes growth of 4 per cent per year this would generate a forecast pot of just under £110,000. But at 7 per cent annual growth, the pot would be projected to be worth just over £193,000.

Steve worries that the forthcoming pensions dashboard will be undermined by the variability of projections across multiple providers.

- The FRC response is to standardise projections from October 2023, but Steve doesn’t like their solution.

Steve would like to see a single rate of return for each asset class.

- Instead, the FRC will model historic volatility for individual funds and assume that more volatile funds will have higher future returns (because they are higher risk).

This is reasonable in aggregate, but there will be anomalies with a short lookback period.

Had it been in force five years ago, for instance, a fair number of equity fund values would have been found to be relatively stable while some government bond returns would have been relatively volatile.

The switch to a new regime is going to be confusing anyway.

- If it coincides with a period of market turmoil, or simply one of atypical recent volatilities, it will be worse.

So I agree with Steve – it’s probably better to use projections based on the asset allocation of the funds.

ISA season

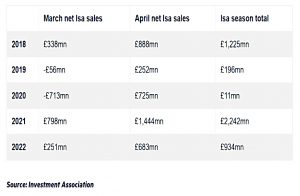

In FT Adviser, Sally Hickey reported that ISA season has boosted UK fund flows, but not as much as usual.

- April saw net flows of £553M, compared to outflows of £3.5 bn in March.

The table has all the numbers.

This year was a lot worse than 2021 but much better than 20209 and 2019.

Miranda Seath, of the Investment Association, of market insight at the IA, said:

Although inflows to Isa wrappers were half those of 2021, they were still the third strongest in the last 5 years. This is significant as April’s positive sales come after one of the most challenging first quarters for retail fund flows on record.

As the outlook for equity growth weakens, investors have looked for funds investing in companies that pay good dividends to top up the overall returns. Investors are also looking for alternative sources of income from bonds.

Benefits to bricks

The government made an announcement that I for one didn’t see coming – housing benefit payments can be used to repay a mortgage, rather than going directly to a private landlord or housing association.

- The right to buy was also extended to housing association tenants.

Boris Johnson said:

Just as no generation should be locked out of homeownership because of when they were born, so nobody should be barred from that same dream simply because of where they live now.

Between the two measures, some four million people are affected.

It makes sense from one angle – homeowners tend to vote Tory, and the government needs to reverse declining homeownership rates, especially amongst the young:

- The proportion of 25 to 34-year-olds who own their own home fell from 55 per cent to 34 per cent between1996 and 2016.

Britain now has the fifth lowest homeownership rate in Europe and the fourth highest stock of social housing.

The new policy does seem to be delaying the inevitable, though.

- If the economy can’t afford a house price crash (it would hurt millions of families, and probably make the banks insolvent) then it’s hard to see how an ever-increasing proportion of people can afford ever-more expensive properties.

And those on housing benefits wouldn’t be expected to be near the front of the queue – they are typically unemployed or on a low wage, and need to have less than £16K in savings – so adding debt to a cost-of-living crisis (inflation) doesn’t sound particularly smart.

- The £16K limit would get in the way of saving for a deposit, so Michael Gove committed to changing these rules by making savings into a Lifetime ISA or Help to Buy ISA exempt from the benefits calculation.

Gove said:

The Conservatives have always believed that giving people the chance to own their home, to be part of their community, to pass something on to the next generation is an important desire of the human heart.

It might still prove difficult to persuade lenders to take on these borrowers without some kind of government guarantee.

Right-to-buy is also subject to alternative interpretations.

- It makes sense for people to own their own homes, but if properties can always be sold to tenants, it disincentivises local authorities and housing associations from replacing the properties that are sold.

If this policy were to be extended to the private sector, you would expect to see a significant reduction in the size of the market.

- However, the Prime Minister’s speech did include a commitment to building replacement homes for each one sold.

This might prove expensive since properties tend to be sold at well below the replacement build cost (Right to buy includes discounts based on length of tenancy).

Quick Links

I have five for you this week, the first four from The Economist.

- The Economist looked at Britain’s productivity problem

- And said that tech investors are prizing cash generation again

- And that air travel is taking flight

- And that Foundation Models are turbo-charging AI progress.

- Alpha Architect looked at the unintended consequences of single-factor strategies.

Until next time.