Weekly Roundup, 14th August 2018

We begin today’s Weekly Roundup in the FT, with John Authers. This week he was talking Turkey.

Contents

Turkey

The Turkish lira is in trouble because of Trump trade tariffs.

- It’s not just the lira, of course – the emerging markets currency index hit an all-time low last week.

And it’s not just tariffs – the dollar is strong in any case.

- With US inflation now at 2.4% pa, more interest rate rises – and dollar strength – are likely.

EM economies benefit greatly from free trade, which is now under threat.

- Turkey has a particular problem that 40% of its debt is held in foreign currencies.

- Credit default swap rates show that only Argentina and Venezuela are seen as riskier bets.

So, as John puts it:

For those of us who are not Turkish, should this affect us?

Since Turkish GDP is less than 1% of global GDP, a Turkish recession will not have a wide impact.

- There could be some banking contagion to European banks if Turkish banks suffer, but the extent is unknown.

More worrying is market contagion, where losses in Turkey prompt a need to take profits elsewhere (probably in other emerging markets).

- Of course, China (whose markets have fallen heavily this year) is a much bigger problem in this regard than Turkey.

John thinks that EM markets would be attractive now, were it not for the strength of the dollar.

Tax reform

The Economist had a couple of articles about tax reform (1 and 2).

- They have a problem with expensive property, and the untaxed “windfall gains” it has produced.

- They think tax systems are becoming less progressive.

- And the multinational tech firms are not paying their share.

Working backwards, most people would agree with the third point.

- But it’s important to remember that unless you are a net beneficiary of the state’s welfare programmes, raising more tax doesn’t necessarily help you.

- Half of Amazon’s UK customers would lose out if they paid more tax (though paying higher prices for goods).

It’s also not entirely clear how the problem can be resolved.

- The Economist suggests a shift in focus to the investors in the tech firms, and the dividends they receive.

According to the newspaper:

Few people are likely to emigrate to avoid taxes on their investment income.

Famous last words, I fear – I know that I would move.

They also want to see the tax deduction on debt interest scrapped.

- This is a good idea but would need international cooperation.

The second point (about tax systems) may be true in the US, but the UK’s taxation system remains strongly progressive.

On the first point, I reject the argument that gains from property have been a windfall, except in the sense that an apple can only be blown from a tree once.

- Deferred consumption has to be invested somewhere, and it makes sense to use the asset classes that are most keenly priced at the time.

- UK property was cheap in the 1990s, and those who invested at the time have no more made windfall gains than the people who made money from the 30-year bull market in bonds, as interest rates fell from the 1980s.

The newspaper is in favour of more taxes on property and inheritance, both of which are unpopular, and not just with me.

Inheritance tax is double taxation, as I’ve pointed out many times before.

- It could be replaced with a more popular gift tax system.

Property taxes are problematic because:

- It’s a good thing that people should own the home they live in.

- Changes to the taxes can have dramatic effects.

The second article focuses on the land value tax, something that has never caught on.

- Apparently the first book on the topic was a hit in the 1890s.

It led to the board game Monopoly, which was intended to show how property markets tend towards monopoly.

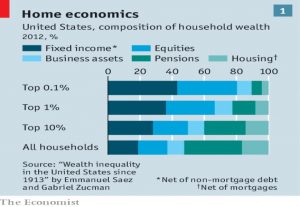

The Economist accepts one of the big problems with such a a tax – that urban land is not sold without the improvements (buildings) upon it.

- So its value is hypothetical and subject to legal challenges.

Nor would a land tax greatly impact inequality.

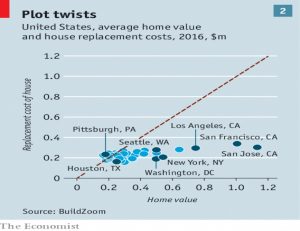

- The middle classes have a lot of their wealth tied up in property, but the rich do not.

It’s also the case in the UK that property taxes are already high, at 4.2% of GDP (cf. an average of 2% for the OECD).

- So it’s unlikely that any new money could be raised.

And many people who are property rich with be cash (income) poor.

- The land tax could be deferred until sale or death, but this would still frustrate the desire of most people to pass on their property.

Nor would a land tax stimulate development in rich cities, where the constraints are mostly regulatory.

On the downside, the land tax should cause land values (house prices) to fall by the present value of the future taxes to be paid on it.

- So it would act precisely as a windfall tax on those who currently own property.

In effect, this is like a partial socialist confiscation of private property.

- Unsurprisingly, the Economist has no problem with this, but I do.

Labour’s plan was for a 1.65% pa tax (3% on 55% of a house’s value).

- On a £1M house (commonplace in London) that’s £16,500 a year.

With interest rates at 2% (variable mortgage rates, not base rate), that tax could be expected to knock a staggering £825K off the value of the property.

- The impact is exaggerated by currently low interest rates, but even using a 5% pa fixed mortgage rate the expected fall in price is £330K.

- And of course it’s a double whammy – you lose 30% of the value of your house, and you still have to pay the 1.65% pa tax.

Imagine the chaos and pain caused by a 30% fall in the London property market.

House price index

According to the Economists new city house price index, London prices are 59% too high. compared with disposable incomes.

- But the global rate of increase has slowed, from 6.2% pa a year ago to 4.7% pa now.

Stamp duty

The Times reported that stamp duty receipts have declined since the rates were increased at the top end.

- Not too surprising – the rates should be cut to free up the market.

Equity release

The Adventurous Investor reported on a a paper from the Adam Smith Institute which warned against equity release.

- I’ve never been a fan.

- But now Professor Kevin Down of Durham University has uncovered a problem with the options pricing models which underpin the “no negative equity” guarantees that are attached to equity release schemes.

The models assume that longevity will stay as it is, but that house prices will continue to increase.

- So the guarantee is under-priced, presumably creating an exposure for the insurers that provide the guarantees.

Charles Stanley

A lot of Vanguard fund passive investors have been complaining that Charles Stanley is hiking its fund platform fees from 0.25% to 0.35% (on the first £250K – charges are tiered).

- For those of us who prefer ETFs and investment trusts, the annual charge cap is £240, across all accounts (so potentially an ISA, a SIPP and a chargeable account).

Fees are waived during any month where a trade is made (at a charge of £11.50).

- So with 12 evenly spaced-trades, the annual fee falls to £138.

- Apparently Interactive Investor operates a similar model.

Not bad for three accounts with potentially unlimited funds.

- iWeb remains cheaper for an ISA and YouInvest for a SIPP, but Charles Stanley looks competitive for multiple accounts.

And perhaps its the best home for an actively-traded SIPP – 12 trades in a YouInvest SIPP would cost £220 (including the £100 annual fee).

Tesla

Elon Musk threatened to take Tesla private this week, at a share price of $420 (internet slang for marijuana).

- This would cost about $70 bn, and would value the firm (including debt) at $82 bn in total.

James Anderson of Scottish Mortgage Trust said the shares were worth much more.

At first Musk’s tweet sent the price higher, but as doubts emerged about the “funding secured” part of the announcement, they fell back.

- They closed at $355 on Friday 13th August.

Mobius

Mark Mobius, former head of the Templeton Emerging Markets investment trust (TEM) announced that he would be starting his own fund.

- TEM was probably the first investment trust that I bought, way back in the 1980s, so I have a soft spot for Mark.

So does Ian Cowie, who nevertheless explained why he wouldn’t be investing.

- It’s nothing to do with timing, since EM assets look attractively priced at the moment and EM currencies are weak.

He also agrees with the thesis that future rises in US interest rates are already priced in, and there will probably be an EM relief rally when they finally happen.

But even if Mobius can avoid joining the list of star managers who overstayed their welcome, the new fund will launch at par.

- There are plenty of EM trusts trading at a discount of more than 10% to NAV.

These are a better home for your cash.

Quick links

I have sIx for you this week:

- Retirement Researcher looked at investor behaviours that hurt investments

- Moneyweek looked at portfolio rebalancing

- Musings on Markets looked at Musk’s plan to take Tesla private

- Alpha Architect pointed out that correlations between stocks and bonds depend on the level of bond returns

- Hargreaves Lansdown had a quick trick for increasing your chances of finding a winner on AIM, and

- The Guardian quoted a Bank of England economist’s prediction that interest rates would remain low for another 20 years.

Until next time.