Weekly Roundup, 13th July 2021

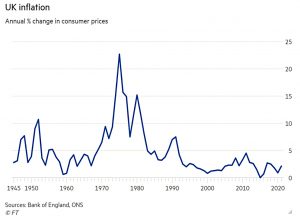

We begin today’s Weekly Roundup with a look at protection against inflation.

Inflation

The FT got around to looking at portfolio protection from inflation, with an article by John Plender.

Inflation remains low in comparison to the 1970s and 1980s, but it’s rising (and few current investors were around then in any case).

Between July 1945 and May 1979, retail prices rose cumulatively by 632 per cent. Over that time the gilt market saw undated War Loan fall in value in nominal terms by two-thirds, inflicting a capital loss in real terms — adjusting for inflation — of 95 per cent.

At one point the yield on War Loan reached 17%.

- The potential for capital loss in fixed-interest gilts (the 10-year currently yields 0.7%) is clear.

Stocks also suffered, in part because of an oil price shock.

Between May 1 1972 and December 13 1974 the FT All-Share index lost 72.9 per cent of its value.

The commercial property market also collapsed.

Official forecasts currently claim that Covid recovery inflation will be transitory, driven only by a mismatch between growing demand and supply bottlenecks.

- Cost increases (like potential wage rises) will be absorbed by company margins or passed onto consumers.

At the moment, the markets agree:

The giltedged market’s expectation of inflation, as reflected in the difference between the yield on nominal gilts and on index-linked gilts of the same maturity, was 3.3 per cent on 30-year paper in mid-June. This was above the BoE’s 2 per cent inflation target, but scarcely points to Armageddon.

It’s worth remembering, however, that officials said something similar in the 1970s.

- If inflation does persist, the question then becomes whether governments will raise rates (and their own borrowing costs).

The advice for investors was predictable if reasonable:

- Avoid bonds and commercial property (which is structurally challenged by the effects of Covid and the move to online shopping)

- Stocks and residential property are better.

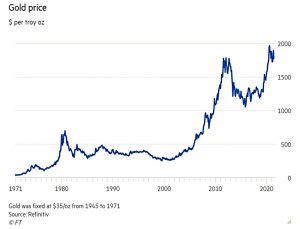

- Gold and commodities might also work, especially whilst inflation is still increasing.

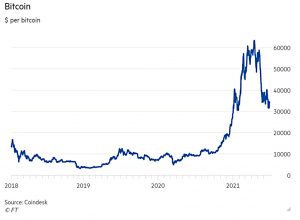

- But bitcoin is a step too far.

CDC Pensions

The FT also had an article by John Ralfe arguing against Collective Defined Contribution (CDC) Pensions.

- I’m not a fan of CDC either, as it removes individual freedom and responsibility.

CDC works by setting a “target pension” amount for members each year, based on member and employer contributions. Target pensions, including pensions in payment, are not guaranteed, but move up or down every year, in line with the value of assets.

CDC claims to provide better average outcomes through “inter-generational risk-sharing”.

- In practice, this means treating the pooled pot as an asset with an infinite life (rather than a defined life as an individual’s DC pot would have.

In turn, this supports a higher allocation to higher-risk, higher-return assets (stocks over bonds).

- The Royal Mail CDC plan will hold 100% equities.

The cost of this is a higher risk of downside risk, and a future cut in the target pension.

- And of course, an individual can access the same risk profile within their own DC pot.

Ralfe is also concerned about fairness:

DC must be designed so each age cohort receives a pension equal to member and employer contributions, plus investment returns — no more, no less. If a cohort receives more, it is being paid from other members’ contributions.

For example, the Royal Mail CDC scheme will penalise those who leave it long before retirement.

A final problem for CDC is the choice of a single asset allocation for the whole scheme.

- Younger members will usually prefer a higher equity allocation than older members.

The key advantage of CDC is the pooling of longevity risk:

If you live longer than average you are less likely to be squeezed. But longevity insurance comes at a cost — those dying “early” pay for those dying “late”, and many people would choose DC, allowing then to leave their unused pension to family.

Ralfe has four recommendations:

- Valuations should use long-term market interest rates

- Current legislation allows each scheme to decide its own method

- Target pensions should be age-related to reflect the time value of money

- Pensions should be inflation-linked rather than expressed in future nominal terms

- There should be a DC alternative with the same company contribution.

Which all sounds good to me.

Private equity

Again in the FT, Merryn Somerset Webb had a couple of articles (1 and 2) on private equity.

- In the wake of the big from US PE for supermarket chain Morrisons, the first article defended the PE groups as having a sharper eye for undervalued listed companies.

PE firms are often characterised as asset strippers and financial engineers, but Merryn disagrees:

While private equity often shows a tendency to over-leverage and underinvest, there is nothing intrinsically good or bad about private equity when it comes to management. It is just a different corporate governance model, the success or not of which will depend, as with listed companies, on the competence and creativity of the managers.

The real issue is transparency and the lack of access and participation for private shareholders.

- I’m not a massive fan of shareholder activism – other than in cases of massive undervaluation (which a PE bid should partially fix in any case) – so this is not a big issue for me.

Merryn also worries that many listed UK stocks are undervalued because fund managers have moved their focus:

Ask a fund manager what his plans are and odds are he’ll say he intends to buy private companies — because that’s where the growth is. But it turns out that, while traditional fund managers have been eyeing up the cool growth stuff private equity is supposed to buy, private equity has begun to eye up the stuff the traditional fund managers are supposed to buy.

The second article looked at the advantages of PE:

- A single PE owner can have more effect on management than disparate groups of public shareholders.

- PE can use more debt to enhance returns.

Merryn also pointed out that private investors can think more like PE than like public fund managers when considering undervalued shares:

You can wait three years, five years or even more for the catalyst — particularly if you are collecting dividends along the way. You need some certainty about value — but very little about change. No time-sensitive probability calculations are required.

And since the UK market remains one of the cheapest globally, taking advantage of this need be no more complicated than buying a cheap FTSE 100 ETF.

Liontrust ESG IT

Liontrust Asset Management (LIO) has pulled the launch of an ESG investment trust (to be known as The ESG Trust or ESGT) after failing to raise a self-imposed £100M.

- 2,000 retail investors pledged support, but to get to £100M they would have needed to offer £50K each.

LIO may have been a bit late to the party – ESG was massively popular pre-Covid, but valuations have fallen back through the first half of 2021.

- At the same time, inflows to open-ended ESG funds were still net positive in May 2021.

LIO CEO John Ion said:

We are disappointed we won’t get the chance to repay [backers’] faith through an investment trust after everyone worked so hard to secure its launch. We will take the ideas we had developed for ESGT and continue to apply them to our open-ended funds for which there is strong demand.

Crypto

Cathie Wood’s ARK Investment Management has filed to list a bitcoin ETF on the CBOE BZX Exchange.

- Wood famously thinks that bitcoin will hit $500K in the future.

ARK is the latest in a long line of firms (Fidelity, VanEck, Goldman Sachs, Grayscale, Skybridge, Galaxy Digital and of course the Winklevoss twins at Gemini) hoping to launch a bitcoin ETF in the US, but none have been approved so far.

- The SEC postponed its decision on the VanEck filing and asked for further comment, giving some people hope that the tide might be turning.

I think an ETF is inevitable at some point, but the regulatory crackdown around exchanges like Binance might mean that approval is delayed until that situation is resolved.

- Which might mean 2022.

Interactive Investor released the results of a poll of 1000 young UK investors (aged 18-29).

The first finding was that crypto is taking over from stocks for these investors:

Almost half (45%) of 18–29-year-old investors had their first taste of investing via crypto. That’s more than twice the number who had first invested via funds (23%) and way ahead of investment trusts (13%). Almost one in five (18%) of respondents said their maiden investment was in listed company shares.

This is confirmed by their assessment of risk:

With a 10-year horizon in mind, cash was considered the best home for the biggest chunk of savings (20%) followed by cryptocurrency (16%), shares (14%), funds (11%) and investment trusts (8%).

A more worrying finding was the use of leverage:

A fifth said they had invested in Bitcoin at some point, with half of these turning to debt to fund it: 23% used a credit card, 17% used a student loan and 16% used another type of loan. 27% admitted to using their credit card to invest in Dogecoin, 17% said they used their student loan and 12% cited another type of loan.

Quick Links

I have just four for you this week, all from The Economist:

- The newspaper asked which airlines will soar after the pandemic

- And reported on the private equity firms battling to buy Morrisons

- And said that the Wise IPO was a boost for London’s equity market

- And noted that China seems determined to decouple its companies from Western markets.

Until next time.

Do you have a [free to access] reference for the BoE sourced inflation projection graph? I ask as I am not sure what the various projection coloured bands represent and as only the central band shows recovery over the timescale shown [to end of 24Q1 ?] to around 2% (the target) I am struggling to understand how this can be described as “transitory”. Perhaps, they meant to say something like ‘is most likely to be transitory to target’. Thanks.

FWIW (nothing!) I have long struggled with anything being described as a pension that is not guaranteed. I suspect the majority of DC members may be suffering this delusion. And, this may be why some employers have started changing the nomenclature of their DC schemes to retirement savings plans or similar.

Afraid not – I had a free link to the FT article (I usually get them from Twitter).

The coloured bands will be probability levels, with the darkest most likely. A standard deviation is a common bin size, which would mean that the central band has a 67% likelihood and the mid-blue has a 95% probability (though I can’t be sure that’s the dividing line on this graph).

I’m sure they meant to say that the central forecast is for transitory inflation. To be fair, if we don’t get above 5% pa for a sustained period it probably won’t make much difference in the long run.

So less than a 1 in 333 chance that CPI inflation will ever exceed 5% over the next two years. Time will tell.

You are correct. But we don’t know if they were using standard deviation bands. And we don’t know what their definition of “exceeds” is.

After looking a bit closer at the graph I note that 5% is breached for a few months at the start of 2022 – my bad, I had mistakenly assumed it was never breached. In any case this mornings CPI inflation report from the ONS already has overall CPI at 2.5% and the Transport component alone at 7.2%.

Funny old world, but earlier this evening I watched a BBC4 programme called Tails You Win with David Spiegelhalter, see e.g. https://www.bbc.co.uk/programmes/p00yh2rc.

Towards the end of the programme (approx 53 mins onwards) he discusses unknowns. During this sequence, he visits the BoE – where it is explained that it is not unusual for BoE fan charts to sum to 90%. That is, there is a one in ten chance of an event occurring that is outside of the range covered by the fan chart. IMO, that seems somewhat more credible than 1 in 333.

The FT should know better than to publish graphs without sufficient explanatory text.

Good old Spiegelhalter.

Chart 1.4 from this recent BoE quarterly Monetary Policy Report might look familiar (see https://www.bankofengland.co.uk/-/media/boe/files/monetary-policy-report/2021/may/monetary-policy-report-may-2021)

And, according to the note under the chart, the fan chart does sum to 90% with each coloured band representing 30%.

Inflation is mentioned 179 times in this 49 page report – so there is plenty more related info including at Annex 1 the Chart A which compares BoE inflation projections with other forecasters views.

Every day is indeed a school day!

An odd convention if you ask me, but at least we’ll know for next time.