Weekly Roundup, 21st August 2018

We begin today’s Weekly Roundup in the FT, with Tim Harford. This week he was writing about inequality.

Contents

Inequality

Tim worries that people focus too much on the income or wealth share of the top 10%.

- This has risen from 11% in 1980 to 20% in 2016 – in the US.

- In Western Europe, the increase is only from 10% to 12%.

The Gini coefficient is a better measure, and stands at 40% for post-tax income in the US.

- The global number is 65%, but that is falling, whereas the US Gini is increasing.

The UK figure is 35%, and has been stable since the 1980s.

- Two hundred years ago it was more than 50%.

Tim notes that inequality in sexual activity and number of lifetime partners is much higher than for income, but we don’t seem to get as worked up about it.

- On the other hand, the inequality of life expectancy is now down to 10% in the US, and 18% globally.

This is handy, as it’s pretty difficult to redistribute life expectancy.

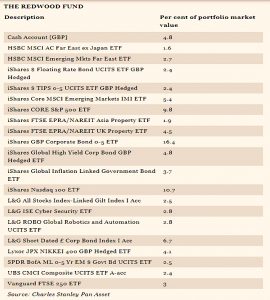

Redwood fund

John Redwood had another update on the fund he runs for the FT.

- They seem to come around very quickly these days.

He’s up 4% for the year-to-date, which I think is pretty good in such a dull year.

- He’s out of China and Germany because of a possible trade war, and doesn’t like the Euro zone either.

He worried about the impact of the end of ECB money creation on Italy in particular.

- He likes the US and tech, and thinks that the UK is good value.

Quarterly reporting

John Authers looked at quarterly reporting, in the light of Trump’s tweet saying that he wants to get rid of it.

- Some people think this means that he is “in the pocket of big business”.

Like John, I think that switching to six-monthly reporting (as in the UK) would be a good idea.

In theory, quarterly reporting provides great transparency.

- But in practice, US corporate guidance is manipulated so that companies have a low bar to beat.

Anything that leads to more long-term behaviour from firms and investors must be a good thing.

- Public markets make long-term decision-making more difficult, which is why more startups stay private for longer (the unicorns), and some CEOs decide that going public was a mistake (see Musk and Tesla, below).

Global equity markets are now shrinking at the fastest rate on record, and something needs to be done about it.

Super

The Economist looked at Australia’s superannuation pension scheme, known as the super.

- It’s a compulsory levy of 9.5% on all but the lowest wages.

- The contribution rate is due to go up again in 2022.

Funds are managed by industry bodies, the government, company schemes and also by banks and asset managers.

- A royal commission has criticised these last two groups for prioritising their own profits.

Australian fees are more than three times the OECD average, with the average saver losing 25% of their pot.

- Even worse, the most expensive funds are the worst performers (because of their higher fees).

One of the problems is that job-hoppers forget to merge their super funds in to one larger and more efficient pot.

- It’s likely that default “best in show” funds will be adopted to improve things.

And early access to the pot – for housing or education – might be allowed.

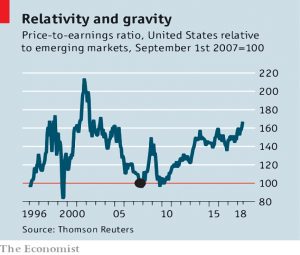

Emerging markets

Buttonwood made the contrarian case for emerging markets.

- After a sell-off driven by the Turkish Lira, EM currencies look fairly valued.

And EM stocks are 60% cheaper (in PE terms) than the US.

Of course EM stocks could get cheaper from here.

- But the Economist thinks that they are worth a look.

Mangonomics

The newspaper also profiled Nick Rowe, an economics professor who just retired from Carleton University in Ottawa.

- Nick used mangoes to teach macroeconomics.

For him, the fundamental issue is Say’s law:

- Does supply really create its own demand?

The answer is no, but this is strange:

- People make stuff (add to supply) to get equally valuable things made by others (adding to demand).

Nick’s explanation for recessions is an excess demand for money, which is where fruit comes in.

- In his model, half of people have apples and the other half have bananas; both groups have mangoes, but not as many.

Those with apples want more bananas, those with bananas want more apples.

- But both groups want more of the scarce mangoes.

Now what if the mangoes are used as the medium of exchange (money)?

- This means that bananas and apples cannot be traded directly (via barter) but can only be swapped for mangoes.

Now less fruit is traded and some gains from trade are lost.

- People begin to hoard mangoes.

- Which mean that people can’t sell much of their fruit, because people prefer to hold mangoes.

This is a recession – workers can’t sell their labour because everyone prefers to hold onto money rather than have the fruits of other people’s labour.

- If anything else is in demand, it price will rise to quench that demand.

But money has no price, and only rises in value during deflation (when the price of everything else falls).

- Not by coincidence, deflation is linked to recessions.

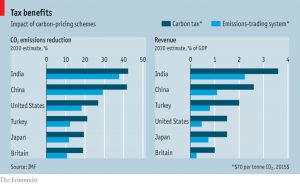

Carbon taxes

The Economist also looked at carbon taxes.

- There are 70 schemes globally, but they only cover around 20% of emissions.

There are two main types of scheme:

- Tax CO2 by the tonne.

- Issue permits to a maximum emission level and allow companies to sell them (“cap-and-trade”).

- These are normally used in carbon-intensive industries (steel, cement, power).

The IMF has found that levies (a more palatable word than taxes) raise twice as much money as cap-and-trade, and are 50% better at cutting emissions.

- But politicians prefer cap-and-trade, since more permits can be issued to depress prices (and appease lobbyists).

Only 1% of emissions covered by a scheme generate the minimum $40 per tonne needed to meet the goals of the 2015 Paris climate agreement.

One idea to improve things is a “fee and dividend” approach where higher taxes support a lump sum payment to each citizen every year.

- But at the moment, it’s only places like California and Massachusetts that are talking about this.

Funding secured

MoneyWeek put out something of a Tesla special, with three articles mentioning Musk’s firm.

Merryn focused on Musk’s comment that Tesla might return to the public markets once it had begun a “phase of slower, more predictable growth”.

- That’s code for once the new private backers have extracted all the cash they can.

They then extrapolate the high-growth phase to price the new listing at a multiple that “will eventually seem insane”.

Marina Gerner looked at the wider issue of the decline of public markets (as discussed by John Authers above).

And Alice Grahns looked in more detail at whether the company would actually go private.

- Plenty of people are sceptical.

Quick links

I have five for you this week:

- The Economist reported that litigation finance offers attractive yields.

- Flirting with Models looked at the State of Risk Management.

- FT Adviser noted that doctors are calling for the abolition of the LTA.

- They also covered the proposal for a drawdown-linked care insurance scheme.

- And the Adventurous Investor looked at share buybacks.

Until next time.