Weekly Roundup, 15th January 2019

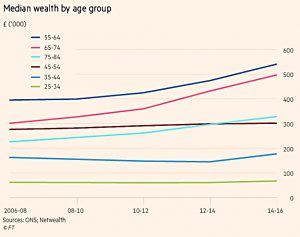

We begin today’s Weekly Roundup in the FT, with the Chart That Tells A Story. This week it was about household wealth by age.

Contents

Wealth by age

Nikou Asgari looked at the data from the last five ONS surveys of household Wealth and Assets, as analysed by Netwealth. (( It seems to me that there has been a lot of collaboration between the FT and Netwealth in recent months ))

- The surveys run from 2006-08 up to 2014-16 (2006-18 mustn’t be available yet).

As you might expect, older people have more money.

- As you might also expect, during a 10-year QE-fuelled boom in asset prices, the wealth of those who have assets (older people, who own more stocks and property) went up more quickly than those who do not.

DB pensions have also been boosted by falling interest rates.

Netwealth note that the share of wealth owned by those over 65 rose from 28% in 2006 to 36% in 2016.

- One in five people over 65 is now a millionaire, compared with 7% in 2006.

Total UK wealth increased by 51% during the period.

Open banking

Lucy Warwick-Ching looked at Open Banking, a year after its launch.

- The CMA (Competition and Markets Authority) forced the nine biggest banks and building societies to share customer information with other banks (at the request of the customer).

With a few swipes on a smart phone, you could find a better mortgage, compare household bills, cancel unwanted subscriptions, control direct debits and track payments across each of your accounts.

That’s the idea, anyway – I don’t think we’re quite there yet.

- The offers aren’t in place, and on the back of negative publicity for Facebook in particular, a lot of people have privacy concerns.

Added to that, a recent survey suggested that only one in four people have heard of Open Banking.

- Most people use the big four banks, and it’s not really in their interests to promote the concept.

The rate of bank switching is very low in the UK. It is said that you are more likely to get divorced than break up with your bank.

I signed up to Yolt last year, and I have a Starling account, but I haven’t noticed much value-add so far.

- I’ll be taking a look at some of the more popular “marketplaces” in more detail in a future post.

Tax avoidance

Henry Mance and Emma Agyemang reported that the Treasury is now back-pedalling on its plan to retrospectively charge contractors who used never-to-be-repaid loans from offshore trusts to avoid income tax.

There are two points here:

- Retrospective tax changes are never a good idea.

- The media campaign to spin the avoiders as innocent victims is largely that – a spin campaign.

I worked with a lot of people who used these arrangements, and they knew what they were doing.

New IPOs needed

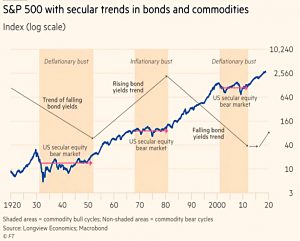

Michael Mackenzie argued that before the next bull run in stocks, we will need a few new disruptive tech IPOs.

- He notes that the long run (over 100 years) 20-year trailing compound growth rate for the S&P is 11% pa (7% pa real), but the current rate is just 5.6% pa (3.3% real).

Michael says that institutional investors are diversifying away from stocks into private equity, venture capital, infrastructure, farmland, paintings and commercial property.

Periods of poor long-term equity performance were associated with a deflationary bust from the Great Depression that ended in the late 1940s and then the inflation shock that peaked in the late 1970s.

Since the dotcom bust we have dealt with another deflationary shock.

Chris Watling at Longview Economics makes the case that a US secular bull market began in 2012 and will continue as the process of policy normalisation by the Federal Reserve continues.

This does not preclude the risk of cyclical bear markets.

Michael notes that demographics are improving for the US, in contrast to China and other EM economies.

But a bull market will need new IPOs, and tech firms are staying private and / or taking money from private equity.

- What will make that trend change?

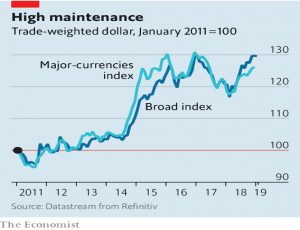

The dollar

In the Economist, Buttonwood looked at how the fate of the dollar will shape financial markets in 2019.

- The greenback rose 7% against a basket of other currencies during 2018.

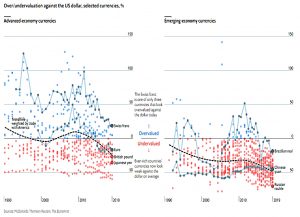

The Economist’s Big Mac index suggests that the dollar is now overvalued:

US GDP should slow as the effect of Trump’s tax cuts drops out of the figures, and further interest rate rises from the Fed will bite.

- A low oil price would normally help, but the US is now a net exporter.

- And while higher rates will depress the US economy, they make US deposits more rewarding.

An end to the trade war with China and an improvement in the European economy (perhaps via Chinese and then Asian stimulus) would also help to push the dollar down.

How the dollar falls will be shaped by events and in turn will shape them.

Investors who are wary of selling out of risk assets are advised by strategists at J.P. Morgan to take out some insurance by buying the yen, Swiss franc and gold—the assets that are likely to go up should things get rough.

Fund managers

As luck would have it, the pay deals of two fund managers of contrasting fortunes were revealed this week.

- Not that their pay deals were contrasting – they both did terrifically well.

Terry Smith – who had a good year – earned £12M.

- Neil Woodford – who had a bad year – earned close to £24M.

I draw two conclusions:

- Their funds could be cheaper.

- The practice of taking a percentage of assets under management needs to go.

It’s not twice as hard to manage twice as much money, and people shouldn’t be paid twice as much money for doing it.

- I’d like to see caps on how much a firm can extract from an individual investor, regardless of the amount of money that they invest.

Otherwise, all investors will large portfolios will have an incentive to take the DIY route, whether they have the passion or the talent to do so.

Fund lists

Hargreaves Lansdown have whittled their Wealth 150 list down to 50 funds.

- And they also admitted that most active funds are poor value.

There’s been a bit of a row over who is on the list.

- In particular, Terry Smith’s fund is excluded because he won’t reduce his fee so that HL can take a cut.

I can’t get too exited, for three reasons:

- I don’t like open-ended funds as they are too expensive and mostly closet trackers.

- The HL platform is too expensive, especially for open-ended funds.

- I don’t buy into the star manager approach to investing (though I have a lot of time for Terry, who is very smart).

HL’s continued success amazes me, but they must be offering something that people want.

Quick Links

I have a bumper fourteen links for you this week:

- Flirting With Models looked at Fragility in Dual Momentum

- They also had a follow-up to their earlier post on Process Diversification

- And looked at whether Multi-Manager Diversification is worth it

- Institutional Investor reminded us that most people Can’t Time Markets

- The Economist reported on the maturing of the smart phone industry

- And on Apple’s problems in particular.

- The Evening Standard looked at how risky bonds are marketed to retail investors

- James Anderson of Baillie Gifford had a go at “self-indulgent” investors

- Musing on Markets provided Part Two of the 2019 data update

- And Part Three

- The Adventurous Investor reported on Alternative Finance trends for 2019

- And on three paths for stock markets in 2019

- Alpha Architect revisited the Payday Anomaly

- Behaviour Investment looked at whether more information could lead to worse investment decisions

Until next time.