Weekly Roundup, 8th January 2019

We begin today’s Weekly Roundup in the FT, with the Chart That Tells A Story. This week it was about gold.

Contents

Gold

Kate Beioley reported that investors have been flocking to gold.

- The gold price (in $) is now at a six-month high of $1288.

In the first half of 2018, rising US interest rates dented its appeal (since it produces no income).

BullionVault reported a 10% increase in purchases between September and December (ie. during the equity market sell-off) to a 15-month high.

- Gold remains a good diversifier and a decent long-term store of value, but it’s difficult to justify more than a 5% to 10% allocation. (( I have even less than that at the moment ))

The price of gold is determined solely by demand and supply and the amount investors are willing to pay for it, rather than its utility or any natural income, making it volatile.

Financial advice

Merryn looked at the history of financial advice over the past 300 years.

Try Thomas Mortimer’s Every Man His Own Broker (1761), one that really got the genre going.

It educates and flatters the reader at the same time, says the Finders Guide, offering the promise that a “secret world will be laid out for the reader. All they have to do is buy the book.”

She draws out the best advice from the 300-odd books that were read by academics as part of the “History of Financial Advice” project:

- Buy high quality stocks when they are cheap, and sell them when they are not.

- Ignore short-term predictions.

- Diversify.

- Don’t expect success to come easily, or with no mistakes.

- Look at other people’s incentives, which will not usually match your own.

- Remember that money is a means to an end.

Materialism

Jason Butler advised us to find joy in 2019 by rejecting materialism.

People who have a highly materialistic orientation and lifestyle generally have a lower level of wellbeing than people who don’t.

Jason puts it down to childhood:

Those who have not had their basic needs for security and safety met in childhood are much more likely to have lower self-esteem and feel the need to seek the approval and acceptance of other people when they are adults.

This can manifest itself as an elevated focus on materialism, whether that’s earning money, buying possessions or seeking social status, recognition or validation from other people through spending.

I recognise this in myself, though luckily for me it was only a phase (lasting around 10 years) when I first had more money than I needed.

- I’ve been much better over the last 20 years.

Jason recommends that you ask yourself two questions before a big purchase:

- Do I really want and need this thing for this amount of money now?

- What can I not now do as a result of spending this money on this thing?

I did just this at Xmas (though it resulted in me declining the offer of an expensive gift, rather than not spending money myself).

- I always evaluate material objects in terms of how much they will be used,.

This makes it much easier to justify regularly replacing / upgrading things like TVs, mattresses and white goods in the kitchen than more specialised items that you won’t need every day.

Resolutions

Nikou Asgari and Claer Barrett collated the financial new year’s resolutions of the various writers and “experts” that the FT Money supplement employs.

- They are mostly quite dull – and in many cases virtue-signalling, as you might expect from the FT – but I’ve picked out a couple below.

To spend more in 2019. No need to save for a golden coffin – John Kay.

My resolution is to spend my time worrying about the things I can predict and affect — identifying and holding good companies— and not wasting time on those things which no one can predict, like the direction of markets – Terry Smith.

My own resolution is, like Terry’s, to spend my time more wisely.

- There’s a tempting infrastructure of free and cheap investor events in the UK, and particularly in and around London.

Last year I spent 45 days or evenings at such events.

- Many were enjoyable, but I can’t recall a single investing action that I took as a result of one of the events.

So this year I will spend more time at home, mostly reading books.

- Oh, and I must get around to sorting out our wills – so two resolutions for me.

Redwood

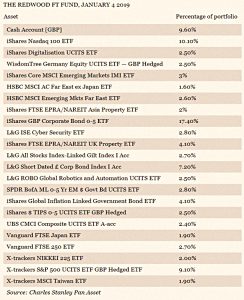

John Redwood had another of his monthly updates on the ETF portfolio he runs for the FT.

The FT fund fell a little over 2 per cent during the year. Holding more than half of assets in cash and short-term bonds cushioned the worst of the falls, while the accent on technology helped during the first nine months of 2018.

At the end of the year, John added another 5% to stocks, split between Germany and a digital fund.

It is important not to underestimate the impact that quantitative tightening is having on markets and economies, as it reverses years of bond buying by the central banks.

Just as quantitative easing drove down longer term interest rates as central banks paid up for the bonds they were buying, so the reverse tends to drive up longer term interest rates as that buying force is removed.

Bear market effects

In The Long View, Michael Mackenzie looked at the troubling lessons from bear markets.

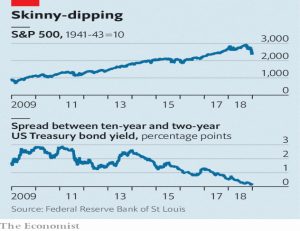

Wall Street’s bruising run means the earnings multiple for the S&P 500 has fallen sharply from its peak in late 2017, typically a harbinger of strong returns for the coming year.

Against this must be set the inverting yield curve which indicates that the Fed is tightening too fast and a recession is around the corner.

- There’s little sign of contraction in the US economy so far, with a bumper new jobs figure offsetting weaker than expected manufacturing activity.

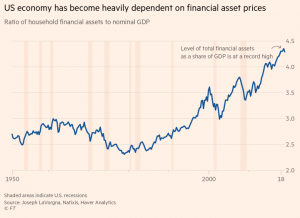

But US financial assets are now at a record multiple of GDP, something which usually signals a recession.

Non-financial corporate debt has also turned down, and this is usually followed by declining household consumption.

At the same time, China appears to have weaker demand (as does Japan and Europe) and the trade war is a worry.

For all the probability of a relief bounce at some point this year, investors should realise this most likely represents a limited trading opportunity.

Michael thinks that a savage bear market is coming – if not this year, then in 2020.

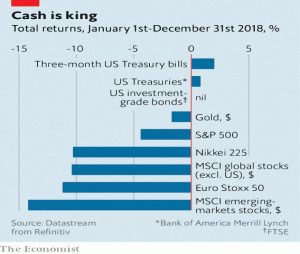

The Economist also looked at what the turmoil of 2018 might mean for 2019.

Economists at J.P. Morgan have developed a model based only on the historical predictive power of the stock market, credit spreads and the yield curve; that implies the probability of a recession in America in 2019 is as high as 91%.

The main problem is the risk of more rate hikes from the Fed:

The median expectation of members of the fomc for the number of interest-rate hikes in 2019 has fallen from three to two. The futures market suggests investors expect none at all.

The mismatch comes from the real economy’s data, which suggests that it is doing well.

A different model built by J.P. Morgan analysts, this time based on short-term economic indicators such as car sales, building permits and the unemployment rate, put the probability of recession in 2019 much lower, at 26%.

As long as inflation stays low, the Fed can afford to wait and see.

- But the Economist expects the Fed’s “data-driven” approach to translate into a bumpier and less predictable year.

Buttonwood also looked at 2018’s returns, and saw a silver lining:

For people with a long-term saving goal, there is an upside to falling stock prices. Bad returns today imply better returns in the future and vice versa. For those looking to build their stockholdings through recessions and recoveries, falling asset prices are good news.

This shows the usual media preoccupation with the accumulation phase of investment.

- If you are still adding money to your portfolio, then low prices can be good news (providing that they recover over time).

If, like me, you have already moved into the decumulation phase, then the opposite is true.

Housing demographics

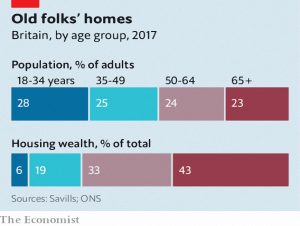

Another article in the Economist saw a silver lining in the state of the UK housing market.

- UK house prices have risen over the past 20 years because of restricted supply (planning rules) and increased demand.

The newspaper attributes the second factor to low interest rates, but they merely increase affordability of higher prices.

- The real divers of demand have been increasing population size (through immigration) and shrinking household size (though the breakdown of the family unit).

This is largely a problem for young people, fewer of whom have already managed to buy a house.

The supposed silver lining is that over the next 20 years, boomers like me are expected to (1) downsize (2) move into retirement accommodation and then (3) die.

- Please note that I personally have no such plans (though I suppose that we all die eventually) and am just as likely to own more property in 20 years than at present.

The increased supply from this process should depress prices, but the Economist notes that Britain – unlike the US – does not have much of a downsizing culture at present.

This is pretty easy to explain – there are no nice places / houses to downsize to.

- Cornwall (much as I love it) is not like Florida or California, and moving to the Med is too much hassle for most people.

- Our retirement homes are also pretty down-market, and many work a dual-purpose as dementia wards.

The other big problem is the lack of an incentive to move – stamp duty and estate agent’s fees are astronomical, so who would up sticks without good reason?

- Of course the Economist looks down the wrong end of the telescope and suggests higher taxes on people like me with “extra rooms”.

Funnily enough, when the same approach was tried with welfare claimants, they were not in favour.

The newspaper concedes that millennials might just have to wait for boomers to die.

- Peak Death is pencilled in for 2034 (way too soon for me).

There’s also the issue of inherited wealth.

- Bequests should double from here to 2035, but will be focused on the richer half of the population.

So not everyone will benefit from the lower prices in the distant future.

Hindsight capital

John Authers presented the annual report for Hindsight Capital, though this year it came in his Bloomberg newsletter (Points of Return) rather than in the FT.

Hindsight Capital is a very special hedge fund, able to invest using a strategy that beats all others every year without fail: hindsight.

It only puts on the trades at the beginning of the year that it knows will, with the benefit of hindsight, prove to be the best.

To prevent returns from being infinite, John imposes three restrictions:

- No leverage (though shorting is allowed).

- No single stocks.

- No trading on the basis of unknowable future events (earthquakes, for example).

He also allows switches on June 30th.

Last year was tough:

It was almost impossible to make any serious money on the “long” side.

Instead, Hindsight bet against stocks that would be hit by the trade war and tighter money, going long only in stocks that benefit from the strong domestic US economy.

- Short Chinese tech stocks / long US utilities (returning 75%)

- Short Japanese marine trade / long US managed care (75%)

- Short Euro-zone banks / long short-dated US Treasuries (62%)

Hindsight also relocates each year to the capital of the country with the weakest currency, in order to flatter returns.

- This year it was Argentina (and not the UK, as I imagine a few readers would have guessed – personally I thought it would be Venezuela).

The World index was down 10.2% for the year when John wrote his article, but up 78% in Argentine pesos.

Other trades included:

- Buying insurance against Italian default

- Short blockchain / long cloud computing

- Short Bitcoin / long volatility

Quick links

I have eight for you this week:

- The Economist reported on fears of a speculative bubble in fine Burgundy

- And on how robots will help Chinese firms cope

- The FT described a defining moment for Apple and Tim Cook

- Musings on Markets reminded us that equities are risky

- David Stevenson said that bank fears should worry all investors

- Collaborative fund listed investing ideas that changed my life

- And compared rational with reasonable

- Wealth of Common Sense looked at buying when stocks are down a lot

Until next time.