Weekly Roundup, 2nd December 2014

Contents

Closet trackers part 2

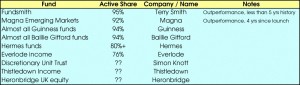

Today’s weekly roundup begins as do so many with Merryn’s column in the FT, where she followed up on last week’s piece about active funds, and closet trackers in particular. This week she provided a candidate list of funds with high active share which I have summarised in the table below.

Over the page was an article by Judith Evans on the backing of asset managers and fund platforms for the routine disclosure of active share. Threadneedle, Baillie Gifford, Charles Stanley and Hargreaves Lansdown were all in favour.

P2P on platforms

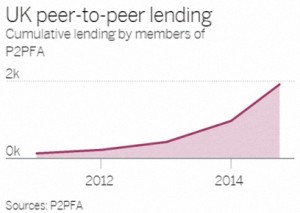

Judith also reported that Hargreaves Lansdown (HL) were in talks with peer-to-peer (P2P) lenders about allowing HL investors to place cash with them. P2P lending is growing quickly in the UK (see graph) and the government have announced plans to allow the product to be included in ISAs, probably from late 2015. Interactive Investor also said it was talking to three P2P platforms.

Ratesetter was the platform mentioned in connection with HL. It claims the largest monthly lending volume and offers returns of up to 6.1% over five years. It’s not clear if that rate includes defaults, which many predict will rise if / when UK interest rates climb.

Buy to let

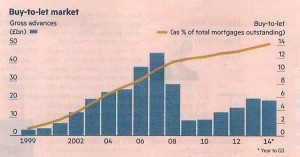

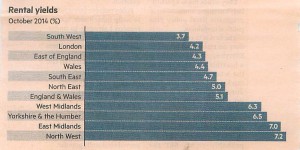

Our last article from the FT this week is a review of the buy-to-let market. Despite slowing house prices, the report concluded that there was still money to be made. Yields now average 5.1%, but that is supported largely by the midlands and the north. Buy-to-let in the south of England, and even in Wales, is a much trickier prospect.

Nevertheless, lending to the buy-to-let market has recovered strongly from its 2009 low, and the sector’s share of all outstanding mortgages continues to grow. Positive factors for the market outlook include:

- population growth (driven by immigration)

- lack of local authority construction

- a mobile younger workforce often priced out of buying property and therefore looking to rent

Corporate venture capital

The economist had a feature on the current enthusiasm within corporates to take stakes in startups. The idea is that this will be quicker and cheaper than in-house R&D, with the added bonus that they cannot be disrupted by a startup which they own. Investments total $6.4bn so far this year, more than 60% above the 2012 total.

Previous booms in corporate venture capital have ended badly (most recently, in the dot-com bust – $21bn was invested in 2000). Cheerleaders say that Intel and Google are using their expertise and connections as well as their money. Certainly the new ventures seem better integrated with the parent business and they are generating three times the patents per dollar of internal R&D.

Behavioural finance

A second economist article looked at a study of lying bankers. Bankers were more likely to lie (about how many coin tosses ended up as heads) when they previously answered questions about their work than when asked about neutral lifestyle issues. They were paid for each “heads” result, incentivising their lies.

Talking about stocks did not corrupt non-bankers, and those from other professions did not lie when asked about their work. The mechanism appears partly to be the bankers’ association of financial and social success. This seems problematic – who other than such types is likely to be attracted to banking?

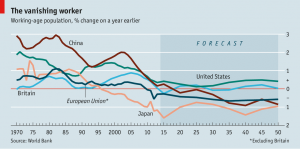

The demographics of stagnation

Finally in the Economist, Free Exchange looked at the impact of ageing populations on stagnation. The connection was first made by Keynes in the 1930s; Larry Summers revived the term “secular stagnation” in 2013.

Weak demand and excess savings prevent low interest rates from producing growth in three ways:

- reduced supply of labour, exacerbated by early retirement in the recession

- reduction in consumer markets and hence in corporate investment (net investment is at a post-war low, made worse by reduced innovation in recent years)

- saving – older populations and longer retirements must be funded by more savings

When these trends are active in all major economies simultaneously (even China), coupled with a parallel effect from rising inequality within societies, the result is stagnation. The most obvious cure is to increase the retirement age, but at some point in the future the savings will be spent and things will return to normal. A report from Morgan Stanley predicts that real interest rates will return to the long-term average of 2.5-3% by 2025.

Directors’ dealings

Over at The Right Side, Bengt wrote another article about the demise of Quindell, the insurance claims processor with profit margins too good to be true. The entire saga (triggered by a report from an american short-seller back in April) is interesting, but I want to focus on a single point.

The latest lurch downwards in the share price (it’s now down 90% since April) was triggered by the revelation that an announcement of share purchases by the directors at the start of November was in fact a share sale. The directors claimed that their buys were financed by loans against existing stock, but in fact the original stock – of much greater value than the new purchases – had been sold outright.

Like Bengt, I have always seen a purchase by a director as a (moderately) positive sign. Something needs to be done about this trick so that we can continue to trust this signal.

Until next week.