Weekly Roundup, 16th November 2020

We begin today’s Weekly Roundup with a look at the recent market rotation.

Rotation

John Authers wrote about the possible market rotation for three days running in his Bloomberg newsletter.

- Monday’s encouraging Covid vaccine testing news led to the biggest single-day market rotation in the 30 years that John has been covering markets.

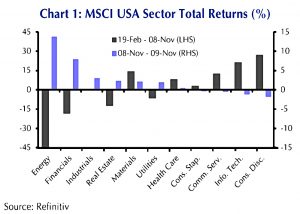

Here’s a sector chart:

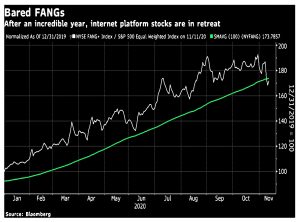

The FANG+ index actually fell, and the FANGs lost 8% relative to the average S&P 500 stock – in one day.

- The Dow had its best day of outperformance against the Nasdaq since the end of the dot com bubble in 2000.

Other than that, the only times the Dow managed to beat the tech-heavy index by this

much were on days when both were down, most dramatically during the Black Monday crash of 1987. If there is another example of a rotation this extreme on the back of good news, I cannot think of it.

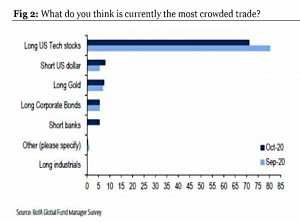

Longview Economics looked at a survey of global fund managers which asked about crowded trades:

Long Tech was the runaway winner.

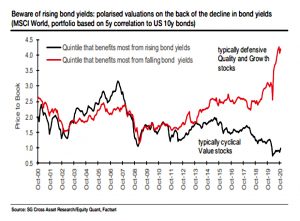

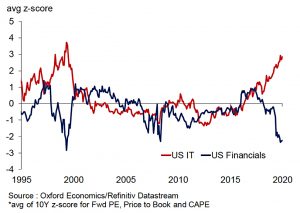

Andrew Lapthorne at SG focused on the link between quality and growth stocks (like tech) and falling bond yields.

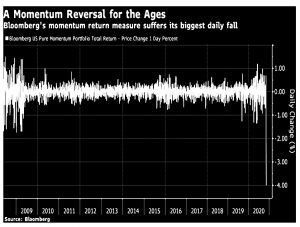

Moving on to factors, Momentum dropped by 4% on Monday, having never dropped by more than 2% since 2008.

Momentum also gave up four months of gains against value.

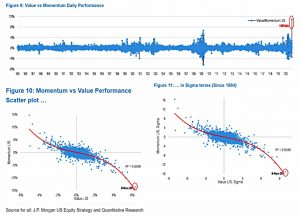

This chart from JP Morgan shows how extreme the move was.

It was also a good day for energy stocks – the third-best ever.

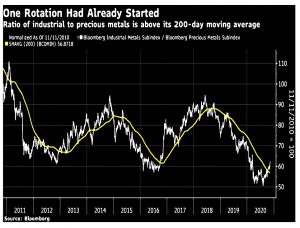

The ratio of industrial to precious metals moved above its 200-day MA.

Of course, covid-hit sectors still have a lot of catching up to do.

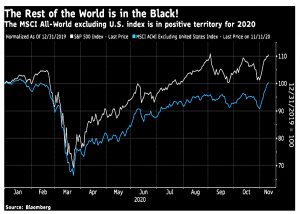

But world stock markets outside the US are now finally back in the black.

Of course, it’s not rotation unless it sticks.

Value

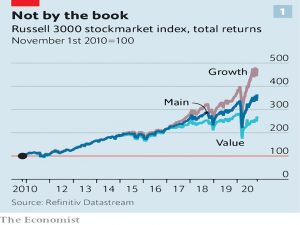

The Economist also took another pass at value investing, which has been “the dominant ideology in finance” since the Depression and became well-known through Warren Buffett’s fortune (though he himself had moved on by then).

The trouble is that value investing has led to poor results. If you had bought value shares worth $1 a decade ago, they would fetch $2.50 today, compared with $3.45 for the stockmarket as a whole and $4.65 for the market excluding value stocks.

Of course, the last time value was doing as badly as this, we had the dot com bust and a value recovery.

The Economist highlights two problems with traditional value investing:

- It doesn’t handle intangible assets well, making tech look expensive.

- It ignores potential future liabilities from externalities, making car firms and oil companies look cheap.

A second article went into more detail but sticks with the same two problems.

A firm that has acquired brands by merger will have those reflected in its book value. A firm that has developed its own brands will not.

But it describes an important secondary characteristic of intangibles:

Intangible assets are “non-rival” goods: they can be used by lots of people simultaneously. Think of the recipe for a generic drug or the design of a semiconductor. That makes them unlike physical assets, whose use by one person or for one kind of manufacture precludes their use by or for another.

Intangibles have the four Ss: scalability, sunkenness, spillovers and synergies.

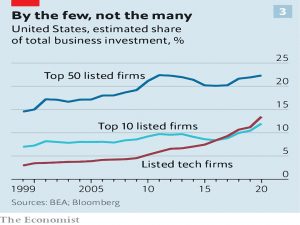

- Scalability – driven by network effects – has been the big factor in recent years.

Industries become dominated by one or a few big players. A small number of leading firms now account for a large share of overall investment.

Sunkenness (of costs) reflects the fact that many intangibles (eg. supplier relationships) are not tradeable.

- But the copying of ideas leads to spillovers (to another firm).

Perhaps crucially, value investing relies on mean reversion.

- A growth stock that gets ahead of itself will stall, allowing value stocks to catch up.

But with increasing returns to scale, early winners can keep on winning.

Bad year for quants

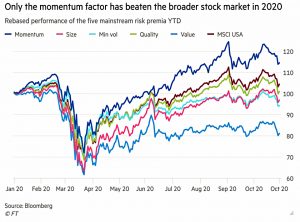

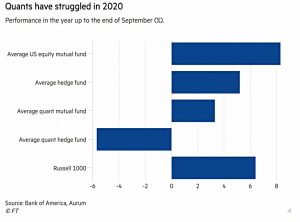

The decline of value is one of the reasons that before last Monday, 2020 was shaping up to be a bad year for quants – as Robin Wigglesworth pointed out in the FT.

- Other factors, apart from momentum, have also underperformed during 2020.

Robin quotes Inigo Fraser-Jenkins, head of quantitative strategy at Bernstein, who recently published a report entitled “why I am no longer a quant”:

Quant funds apply backtests to future investment decisions. But what if the rules have changed? If Covid doesn’t count as a regime change I don’t know what does.

It’s well understood by factor investors that no factor works all of the time, and you are well-advised to use multiple factors in a portfolio.

But perhaps Covid does signal a change, even after a vaccine:

Almost three-quarters of quants surveyed by Refinitiv in October said that their models had been hurt by Covid-19, and a small but eye-catching minority of 12 per cent declared that their models were obsolete.

The average mutual fund is up 8.3% YTD, whereas the average quant mutual fund is up only 3.3%.

- The average hedge fund is up 5.3% whereas the average quant hedge fund is down 5.7%.

Why own bonds?

In the Green Line newsletter from Ruffer, investment director Hermoine Davies wanted us to remind her why we own bonds.

Conventional bonds will provide neither acceptable returns in good times, nor much protection in a downturn. This will be a shocking contrast to the last 40 years.

Since 1981, inflation and interest rates have been falling, and when equities fell, central bands have cut rates, boosting bonds.

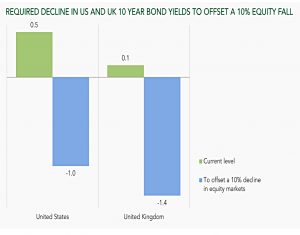

Bond yields are now historically low and would have to fall to unprecedented levels even to offset a 10% fall in equity prices (assuming the benchmark 60:40 stock/bonds portfolio.

- In the UK, the 10-year needs to fall to -1.3% and in the US it would need to go down to -0.8%.

Which seems a stretch.

And these are yields on conventional bonds, so represent the returns before taking inflation into account. If, as we expect, the scale and scope of government spending marks the beginning of a new more inflationary era, then these negative nominal returns could be even less appetising.

Using the average UK long-term inflation rate, real bond yields would need to get down to -6.6%.

That means bonds cannot effectively protect an equity portfolio. It also means they offer a lot more risk than potential reward.

Ruffer advocates paying for (credit and volatility) protection right now.

Quick links

I have ten for you this week, of which the first five are from The Economist:

- The newspaper looked at the recovery by McDonald’s

- And at Klarna’s plans to conquer America

- And at the success of Disney’s streaming platform.

- They also wrote about the tightening of UK law on foreign takeovers

- And about Rishi Sunak pitching the City to the world.

- Maynard Paton wrote about Jarvis Securities

- Richard Wiggins at Institutional Investor claimed that the Sharpe Ratio broke Investors Brains

- David Blitz at Robeco explained why he is more bullish than ever on quant

- Sam Dumitriu at Cap X looked at the worst policy idea of the pandemic – Deutsche Bank’s plan to tax home working

- And Alpha Architect looked at trend-following research.

Until next time.