Weekly Roundup, 22nd June 2020

We begin today’s Weekly Roundup in the FT, where Eric Platt reported on mounting criticism of Warren Buffett.

Is Buffett washed up?

Eric Platt asked whether the tech-light, banks-heavy Buffett has lost his touch.

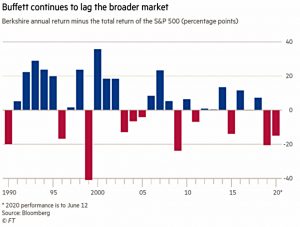

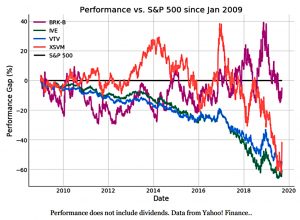

- Berkshire Hathaway (BRK) has been barely tracking the S&P 500 for a decade and had a particularly bad year of underperformance in 2019, including an embarrassing write-down of Kraft Heinz and a poor investment in Occidental Petroleum.

Although we’re only halfway through 2020, many observers think things won’t look any better for BRK if things stay the same as now.

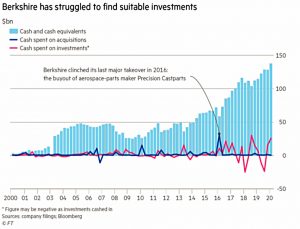

- Buffett was a net seller in April (just after the current bottom, including his ill-timed airlines purchases) and has kept his powder dry since then, waiting for new bottoms and better bargains – and missing out on the rally.

We haven’t seen anything attractive. The Federal Reserve did the right thing and they did it very promptly and I salute them for it. But a lot of companies that

needed money . . . got to finance in huge ways.

But then who really knows?

- I’ve taken a similar route through the year, and I’m far closer to break-even than the indices are.

The likely difference is sector weightings – I’m overweight in tech and biotech and ESG (which means more tech and health) and Buffett isn’t.

- He also has a lot more cash than me.

The recovery from 2008 was much slower, and Buffett did good deals in 2008, 2009 and even as late as 2011.

- But BRK is three times bigger today and needs much bigger deals.

Over on his blog (thefinaser.com), Chris Skinner ran with the idea that Buffett has lost his touch.

- Chris is apparently a big cheese in FinTech, but I’ve never come across him before.

He says of Buffett:

He doesn’t get today’s world of value. [For Buffett] the business must be easy to analyse, the management trusted to do right, the financial metrics sit well and the future earning value is high.

He has little faith in Amazon and Facebook. And this is where the business [BRK] is failing.

Dave Portnoy – who has switched his Barstool Sports Twitter fanbase from sports betting (no longer available) to betting on tech stocks – goes further:

Death of Value

On Medium, Christian Hubbs tried to explain the death of value investing, which has contributed to Buffett’s problems.

- He has beaten the main value funds, though.

Christian pins the blame on falling interest rates and four ways that they impact value investing:

- valuation models

- In DCF (discounted cash flow) models, the lower the interest rate, the less the future nominal cash flows are discounted back to the present

- This makes growth companies look more attractive

- The 10-year Treasury is Buffett’s choice for the discount rate, and that’s currently at close to 1.5% pa

- cost of capital

- The ability to roll over debt cheaply keeps zombie companies alive, impeding progress for true value stocks

- yield starvation

- Institutional investors chasing yield have pushed up the price of riskier and sexier growth companies

- and central bank intervention

- Money pumping leads to asset price inflation focused around the leading (growth) stocks.

Despite all this, Christian expect value investing to have a comeback – eventually.

- I wouldn’t rule it out, but the tricky part is figuring out exactly when.

Redwood update

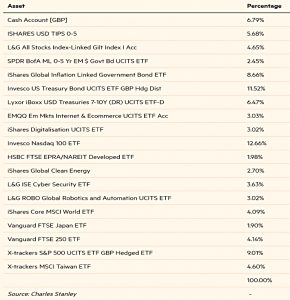

In his regular update on the ETF portfolio that he runs for the FT, John Redwood said that a torrent of new money is keeping investments afloat – for now.

It has been the oddest time I have ever witnessed in financial markets. Country after country announces falls in output larger than anything since 1945, so the market goes up. The US adds race protests and criminal damage in many cities, so the market goes up.

Company after company reports poor prospects for the year ahead and often cuts or stops their dividends, so the market goes up. Economists coalesce around a tick- or W-shaped recovery, instead of the simple sharp V some had hoped for, so the market goes up.

The “QE infinity” message from the Fed seems to be working.

The issue in the months ahead is to decide at what point the recovery is well enough assured to throttle back on this degree of support or stimulus. End it too soon and a deep recession gets worse. Leave it too late and there will be inflationary consequences.

John has managed to get the FT portfolio back to where it was at the start of the year.

- That’s pretty good – I’m still down 2.3% as I write (somewhat better than the -17.6% of the FTSE All-Share).

He’s upped the stock allocation from the previous minimum permitted levels (now at 50% rather than 40%) and moved more bonds into inflation-linked instruments (20% across the UK and US).

- He’s also overweight tech and green themes (as am I).

Family Firms

Merryn Somerset Webb reminded us that family firms outperform.

Around 20 per cent of the MSCI All Country World Index (ACWI) is made up of companies that have family involvement, in the sense that a family holds 30 per cent or more of the voting rights.

A new report from Pictet backs up earlier claims from Credit Suisse, UBS and Hargreaves Lansdowne.

- Pictet found that family firms outperformed by 46% from 2007 to 2019.

Merryn puts this down to “skin in the game” and the way that the owner’s reputation is tied to the firm.

- Families also tend to have more of a long-term view, reflected in lots of R&D, low leverage and often modest dividends.

So family firms reflect quality and growth factors, with a bit of ESG (mostly G) thrown in.

- At the same time, you need to watch out for nepotism, a blurring of ownership lines between the company and the family property, and possibly high valuations.

Our own list of family firms can be found here.

- Please let me know of any omissions.

Global or local?

Joachim Klement asked whether stock markets are global or local – or both?

- The test would be whether stocks in a sector are more correlated with each other globally, or whether stocks from that sector in each country are more correlated with the stock market of that country.

So there are three forces acting on the companies:

- The global economy

- The local (country) economy, and

- The sector economy.

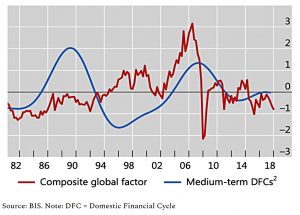

The local economy is driven mostly the housing market and the associated lending standards.

- The global economy is driven by global capital flows which create asset bubbles and collapses.

- The state of play in the US (and nowadays also in China) is also a big factor.

Global and local cycles are not correlated – global cycles are much faster.

- And until recently, the peaks and troughs were out of sync.

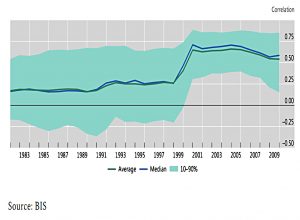

Since 2000, this has changed, perhaps because of increasing globalisation.

- GDP correlations between developed countries have increased from around 0.25 to around 0.5.

Thus companies within the same sector are likely to be more correlated with their global peers than with other companies in their home country.

Which suggests to me that sector diversification (and perhaps, sector trend-following) are worthy of further investigation.

- Of course, we might already be too late – Covid-19 might throw globalisation into reverse and GDP (and intra-sector company) correlations could fall once again.

Quick Links

I have three for you this week:

- Disciplined Systematic Global Macro Views looked at Macro risks and equity risk factors – Building unconditional portfolios is risky

- And The Economist had a couple of articles on Amazon – the first one saying that the pandemic has shown that the firm is essential but vulnerable

- And the second one asking whether the company can continue to grow like a startup.

Until next time.