Weekly Roundup, 15th December 2014

We start today’s weekly roundup with Jonathan Eley’s FT column.

Contents

UK savings rate

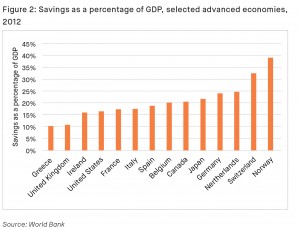

Jonathan was looking at a report from the Social Market foundation, a think-tank. They note that despite facing longer retirements, we haven’t adjusted our savings rates. Only the Greeks are saving as little as the British, and most of our savings are in cash, which although accessible has a dismal long-term record.

Their recommendations are:

- removal of stamp duty for retail investor share purchases

- creation of a £2K annual ISA allowance for bonds

- introduction of a window for access to pensions at age 35,

the time when people are most likely to quit their scheme (with a similar advice / education session as now proposed at age 55) - marketing materials to stress long-term returns rather than recent performance, and to educate savers that cash is eroded by inflation

- regular education and confidence building for saves at key life stages (NI number issues. student loan application, age 35 etc.)

I’m not sure that the £2K bond allowance will do much good – as Jonathan points out, few people fill their ISAs – or even that encouraging bond investment is wise just now, but most of the proposals sound promising. I particularly support the lifetime education recommendation , something that I asked for last week in my coverage of the FCA review on retirement income.

Access to pensions at 35 is slightly worrying. We really need to be convincing people that thinking long-term is key, not getting them to save for 10 years and then blow it on a new kitchen.

Jonathan would like to see wages raised to take low earners out of the benefits / credits system. It’s a nice sentiment, but I don’t think they would immediately save for retirement, and the looming automation of minimum wage jobs would only be accelerated.

He also points out the tendency of Britons to save via their home. This has been a fairly good idea over the past 20-30 years, and house prices look well supported by supply and demand for the near future. I’m all in favour of people owning their home, but they also need to diversify beyond housing.

Education remains the key factor for me. Most people just don’t know what’s coming when they get older.

Accounting scandals

The Economist had a briefing on accounting scandals. For UK investors, the Tesco fiasco is fresh in the memory. PWC signed off the 2013 accounts despite the dodgy supplier rebates which led to the profit warning this year.

Similar scandals have been reported in Spain (Bankia), Japan (Olympus) and the US (HP / Autonomy), and the role of auditors in the 2008 financial crisis is also suspect. Things in India (Satyam) and China (Sino-Forest) look even worse.

So are the Big Four (PWC, KPMG, EY and Deloitte) – who between them audit 98% of US firms by value – worth their $50 bn in annual fees? The worry is that as investors start to distrust accounts, they will raise the cost of capital to honest and crooked companies alike, which will reduce investment and slow growth.

US accounts follow GAAP (generally accepteed accounting principles), a 7,700 page document with many loopholes. Outside the US, IFRS (international financial reporting standards) are used. Auditors count inventories and match invoices to shipments and bank statements, but do not verify all transactions.

There is no incentive for companies to hire the “best” auditor over the cheapest, or for accountants to blow the whistle on irregularities rather than paper over them. Many finance directors have previously worked for the Big Four. With such a cosy market, reputational risk is not a major protection factor.

The report concludes that more regulation is the answer:

- the auditors’ report should include “value drivers” such as drug pipelines and energy reserves

- more competition is needed – industry specialisation means that many companies have only two or three of the Four to choose from; it’s not clear how to achieve this, since even KPMG is larger than the next four firms combined

- responsibility for appointing auditors could be given to the government, or the profession nationalised like the tax service, though there would be significant political opposition to this

- alternatively, financial statement insurance could be introduced, whereby firms protect their shareholders from the consequences of errors; the insurers would then appoint the auditors to ensure that the statements are correct, with incentives to uncover fraud

- a free-market solution would be to scrap the audit requirement; firms would then only hire auditors who could add value, and standards should rise

I am tempted by the last option, but the cynic in me prefers the insurance solution. Whether auditors could convert from poacher to gamekeeper in short order is another matter.

UK state pension

The letters section of the Economist carried no fewer than four angry responses to the extremist proposal from last week that high income pensioners should not receive the state pension. The letters focused on the moral issue of removing a benefit that some people will have contributed towards for 50 years (I had also raised the difficulties of implementation).

One correspondent (Jennifer Robinson) compared the system to the NHS, where fitter younger workers support the old and sick, in the hope that they will be treated when they in turn require it. An intergenerational transfer in the opposite direction is the support from older taxpayers with no dependent children for the education system.

We should beware pulling at these stray threads lest the whole ball of string should unravel.

British Assets Trust

I noticed in Jeremy Beckwith’s review of the Investment Trust sector for Investment Week that the British Assets Trust is proposing to widen its mandate. This is being interpreted as a response to the pension reforms that will come into force from April 2015.

In the future, more pensioners are likely to choose drawdown over annuities (I have written elsewhere of my dislike for annuities, other than for the very old) and low-volatility assets which produce a sustainable and rising income should prove popular.

The investment trust sector as a whole has been responding to these reforms, and to the introduction of lower-cost “clean” active funds as a result of RDR:

- most new money has been raised in less liquid asset classes (infrastructure, distressed debt, and property)

- many trusts have cut their fees

- others have adopted zero-discount policies, since the volatility of discounts has been a negative factor with advisors and their clients

- funds have also been stressing their long-term dividend record

British Assets is the clearest example of this trend. Subject to a shareholder vote in January, the trust will convert from equity-only into a multi-asset income fund targeting capital preservation and income growth.

No-Fee ETF

From one multi-asset fund to another, with the news that Cambria is launching the first ETF with no management fee. At least, that’s the sizzle; the steak is that it’s a fund-of-funds, with underlying charges of 0.29%.

The fund holds ETFs on equities, bonds (including index-linked), commodities and real-estate, so that’s not a bad charge for such a diversified asset. It’s a one-stop shop with the potential to simplify investing for a lot of beginners. Too bad it’s only available in the US for now.

Pensioner bonds

The announcement of the interest rates on Pensioner Bonds has been fairly well received, though they seem fairly underwhelming to me. The headline rates (2.8% for 1-year and 4% for 3-year) are better than a very poor market, but the restrictions are numerous:

- you are only eligible at age 65, so those retiring at 55 must wait for a decade

- they are taxable, so even for 20%-rate pensioners, the real rates are 2.2% and 3.2%

- the income only turns up at the end of the bond

- most importantly, there’s a £10K limit per person per bond

With a maximum investment of £20K across both issues, they can’t play a significant part in the retirement portfolio of the 7C investors. If you qualify, and you can get hold of the 3-year bonds, they are worth having. But there will probably be a stampede, and it’s not life-changing if you miss out.

Until next week.