Weekly Roundup, 6th September 2021

We begin today’s Weekly Roundup with Jackson Hole.

Jackson Hole

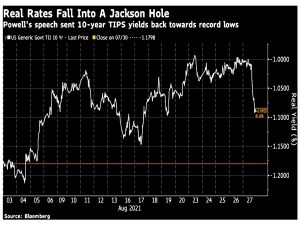

John Authers took a look at Jerome Powell’s speech at Jackson Hole.

- Some people have described it as hawkish – presumably because he said that tapering could begin in 2021.

But a tantrum like we had in 2013 has been avoided (markets went up) – so I’m planning to view it as dovish.

To John, this looked like the reaction to an interest rate cut.

The most important part of the speech was the separation of the QE taper from interest rate rises:

The timing and pace of the coming reduction in asset purchases will not be intended to carry a direct signal regarding the timing of interest rate liftoff, for which we have articulated a different and substantially more stringent test.

John finds this separation interesting:

Both are part of monetary policy, and both could be seen as tightening, but he managed to couple confirmation that a taper is imminent with reassurance that rake hikes aren’t.

Rate hikes won’t come until we have “maximum” employment, even if inflation runs hot for a while.

- So as well as avoiding a repeat of 2013, we should also avoid a re-run of 2015, when the Fed tried to raise rates even in the absence of inflation.

Powell restated that he thought inflation would be transitory, and there are plenty of commentators who think that the bigger risk is deflation.

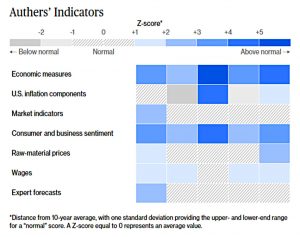

John’s own summary heat map of inflation indicators is little changed, but John notes that there is a lot of data to come in the near future.

Buy to Rent

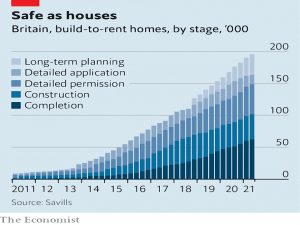

The Economist reported on the entry of large UK firms to the build-to-rent sector.

- Lloyds – via its private rental brand Citra – plans to own 50K properties by 2030, and John Lewis plans to build 10K new rentals.

- Aviva and L&G are already in the market, as are several private equity firms.

The private rental sector has grown from 10% of UK housing in 2001 to almost 50% today.

- But most of the owners are BTL amateurs, with Grainger the largest landlord at 9,000 units out of 4.5M (a 0.2% market share)

Build-to-rent has just 62K units (up from 1K in 2011), though another 133K are under construction.

- By 2030, 20% of new builds are predicted to be buy-to-rent.

The boom is driven in part by the relative lack of post-pandemic appeal of retail and office buildings.

- And the housebuilders are keen because Help to Buy is due to be phased out in 2023.

The fastest growth is now to be found in single-family homes, rather than flats, typically on the outskirts of big cities such as Birmingham, London and Manchester. Families with children are often unwilling to move, since changing schools would disrupt their children’s education. That makes them ideal tenants.

Share ownership and retirement flats are other niches that are expected to grow.

In the FT, Helen Thomas also wrote about the Lloyds plan, from the perspective of the bank needing new revenue streams.

- With interest rates at rock bottom, mortgage lending is not as profitable as it used to be.

She contrasts the UK market with foreign ones:

Other rental markets have a much bigger institutional component: the UK’s is about a 50th of the size of the US market, on a like-for-like basis.

But:

Retail banks are not actually big participants in more mature, overseas build-to-rent markets.

And Lloyds has no experience in tenant management.

Monetary and fiscal policy

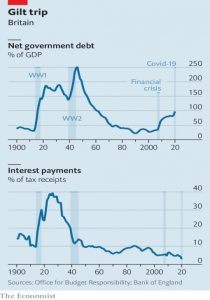

The Economist looked at the balance between monetary and fiscal policy.

The job of the Bank of England (BoE) is to maintain monetary stability (and the integrity of the financial system in general), which in practice means targeting inflation.

- For many years the BoE used to manage government debt – until the Debt Management Office (DMO) was created in 1997.

But a decade of QE means that the bank now holds more than a third of UK government debt.

- And Covid has driven the stock of debt from 80% of GDP to 100%.

The good news is that debt servicing costs have dropped, and not for the first time:

Despite a large increase in debt in the second world war, the burden on taxpayers of servicing that debt fell compared with the 1920s. In the latest financial year debt rose to its highest since the early 1960s but the ratio of interest costs to tax receipts dropped to new lows.

The concern now is that central banks might need to focus on enabling governments to pay their interest bills.

- Such a belief would quickly erode their hard-won credibility in fighting inflation.

Perhaps it is already too late:

A survey of the 18 largest gilt managers in January 2021 found that most believed that the main aim of QE was to lower government borrowing costs. Monthly asset purchases by the Bank of England between April and December last year almost exactly tracked DMO issuance.

This reinforces the point made in last week’s column, that central banks need to explain what QE is for and provide a plan for its removal.

Retail investors

Since there’s little news as we come to the end of the summer holidays, let’s catch up with Joachim Klement, who has written three articles this year on retail investors.

- His first post set out to refute the idea – popular in the wake of the GameStop episode – that retail investors are now the smart money.

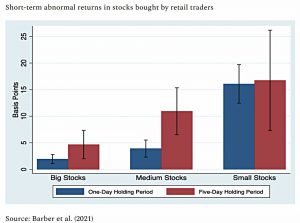

The “evidence” given in support of the power of retail traders is that stocks that are bought by retail traders experience high abnormal returns in the one to five trading days after they have been bought by retail traders.

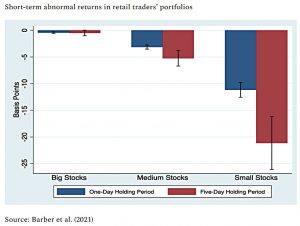

Unfortunately, the returns in retail traders portfolios are negative, particularly for smaller stocks and smaller trades.

The per-stock returns are calculated on an equal-weighted or value-weighted basis.

But that is not how retail traders invest. They buy more in shares that are attention-grabbing or hyped on social media and in the press and less in “boring” stocks. Retail investors experience negative returns simply by buying too much of the losers and not enough of the winners.

This also means that front-running retail flows should not be profitable, though shorting the flow might be.

The second article looked at why richer investors have better returns.

It’s not because they have access to better investment products.

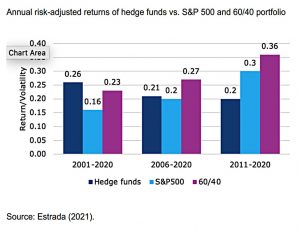

- Hedge funds have lower returns (both nominal and risk-adjusted) than a 60-40 portfolio over the last decade.

Even simply within stocks, richer investors have higher returns.

- The key factor seems to be more effort.

They use more professional advice and take more time to do their research and select the right stocks or funds. They tend to have more diversified and better performing investments.

Joachim speculates that richer investors have more time on their hands.

- They are older and more likely to be retired.

Also, many of the wealthier investment cohort will have a background in business and management. Plus, of course, more money may be at stake and as a result, they simply may choose to invest more time.

The third article contrasted the behaviour of retail investors with that of corporate insiders.

- Mansi et al used Google Trends to track retail investor interest in stocks.

As you might have expected, retail interest led to insider selling:

A one standard deviation increase in retail investor interest in a stock led on average to a 3.6% increase in insiders selling their shares and they on average sold 3,204 shares more than normal. The likelihood of corporate insiders buying shares declined by 4.3% and they bought c. 1,500 shares less than normal.

The study also found that following insider trades during heightened retail interest did make money (around 1% per month).

Joachim concludes:

So, can we please lay the argument that retail investors are a force to be reckoned with in markets to rest? Retail investors really are the patsies in the market.

Quick Links

I have ten for you this week, the first five from The Economist:

- The newspaper said that new 800v electric cars will recharge in half the time

- And reported on an electric vehicle startup aiming for a stellar valuation

- And asked whether big gaming might become the big tech of the metaverse

- And said that Databricks has momentum and big plans

- And wrote about the rise of 3D-printed houses.

- Musings On Markets looked at China’s tech crackdown

- Alpha Architect said that factor timing is tempting

- And that mutual funds have a negative $125 bn in value-add

- Disciplined Systematic Global Macro looked at the sobering world of future returns

- And Matthew Ball wrote about Netflix and video games.

Until next time.

Best [Freudian] slip I have seen in a while: “the bugger risk”!

Thanks for the catch – not one that the spell-check or grammar bot would spot.