Weekly Roundup, 19th July 2021

We begin today’s Weekly Roundup with a look at the stock-bond correlation.

Contents

Stock bond correlation

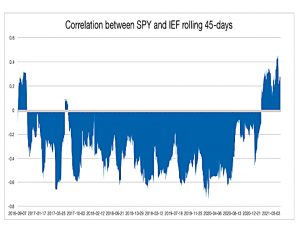

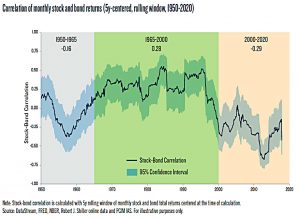

Disciplined Systematic Global Macro Views noted that the stock-bond correlation has turned positive.

We have been in a 20-year period of negative correlation after a 35-year period of positive correlation.

There are three drivers of the relationship:

- the change in interest rates

- a rise in rates reduces the discounted cash flows of all investments

- the relationship between cash flows and rates

- this depends on economic policy and growth

- the relationship of the stock and bond risk premia

- this changes with volatility and risk aversion – a flight to safety will turn the correlation (temporarily) negative

The interesting factor is the relationship between fiscal and monetary policy:

If monetary policy is used to combat inflation, then rates will rise with economic activity to stop inflation which will lead to a negative correlation between equity and bond returns. If monetary and fiscal policy are coordinated and used to enhance growth over inflation there will be a positive stock/bond correlation.

So the jury is still out.

UK Pension pots

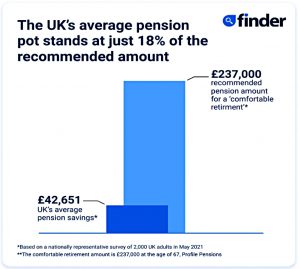

Research from personal finance comparison site Finder has found that the average UK pension pot is just £43K (or £34K for those who have not yet retired).

- Finder claims that the headline figure represents just 18% of a target pot size of £273K.

My own target would be rather higher.

- £25K pa of income at an SWR of 3% works out at £833K.

And you need a house on top of that, which currently averages £256K.

- This brings your total target for financial independence to £1.09M.

The headline pension pot figure is just 4% of my target.

A few other stats from the survey:

- 19% of the population have no pension

- Men average £62K whilst women average just £23K

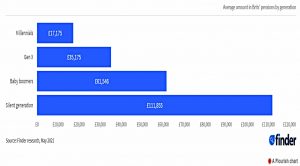

As you might expect (since pension pots build over time from both contributions and investment growth), there’s also a generational gap:

Probably because of auto-enrolment, the proportion of people with no pensions rises across the generations:

A staggering 22% of Baby Boomers and 30% of the Silent Generation said they did not have a workplace or private pension. These figures drop to 15% for Millennials and 19% for Gen X.

Art and sneakers

In the FT, Merryn Somerset Webb explained why collectables usually fail to make the grade as investments.

- She begins with a recent purchase of her own, a Vernon Ward painting from the 1940s that cost just £250.

The point here is that if you had bought into Vernon as a long-term art investment,

based on his fame and momentum, it will not have worked.

Blue-chip art has a decent record in recent decades, and as we mentioned some weeks ago, Masterworks now allows fractional ownership of this asset class.

- Apparently, Rares will let you the same thing with “investment grade sneakers”.

Merryn takes issue with art indices, which have to include stuff that has been publicly traded, which probably means stuff that is going up.

We are more likely to sell assets that have gone up in value than those that have gone down. Art indices, then, are less overall price indices than momentum measurers — and the majority of art purchases end up being, at best, Vernons and at worst, actual rubbish.

There’s also the problem that art has no residual value.

The value of an equity is the sum of the dividends it will eventually pay you. The value of a sovereign bond is about the coupon it pays and that of a house its potential rental income.

Art, sneakers, crypto and NFTs have no income stream or residual value.

- Nor, it should be said, does gold.

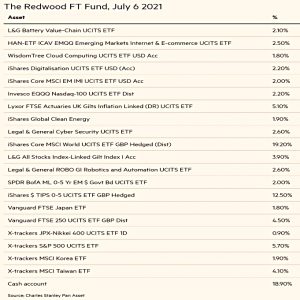

Redwood Fund

Also in the FT, John Redwood gave his regular update on the ETF portfolio he manages for the newspaper.

- The fund has done well recently as some of its tech and green holdings have recovered.

- Recovery shares in the general global index have also done well.

John notes that his preference for Taiwan (up 19% YTD) over China (up only 2.5% YTD) has also worked out.

Beijing does not seem unduly worried about its stock market as it engages in its struggle with a more aggressive US. As it celebrates 100 years since its formation, the Chinese Communist party is considering how it can promote more prosperity and economic success. Investors ask if any of this will produce good returns for them.

John notes that economic growth doesn’t always translate into stock returns:

The world’s second-largest economy has been recording increases in gross domestic

product of about 6 per cent a year for much of the last decade, well above growth in

the world and or the US.Yet the main Chinese stock index rests well below its 2007 high. In contrast, the S&P 500, the main US index, hit new highs in 2007, 2015 and this year, and is 170 per cent higher than in 2007.

The big difference is of course the tech weighting in the US, but monetary policy also matters:

Over the past year, the US has generated inflation in domestic asset prices by creating huge amounts of money, while China has decided to be more prudent.

Future Earnings

David Stevenson reported on a fintech innovation for funding student tuition.

- Here in the UK, we have what is nominally a loan system backed by the state.

But since the loans are eventually written off and most students won’t earn enough during the payback period to clear the loan, it amounts to a graduate tax.

- I’m old enough to have received free education, but I also grew up poor, and a tax on my future earnings might have been enough to put me off from going to university.

This makes me interested in student financing innovations, even if (like today’s) they wouldn’t fix my objection to handing over more of my future earnings than a non-graduate.

UK FInTech StepEx has raised money in a seed round to develop its Future Earning Agreements (FEAs):

[FEAs] present students with the opportunity to pay a percentage of their earnings for a fixed period of time, once they cross an agreed salary threshold, with payment terms calculated using StepEx’s proprietary machine learning model.

StepEx is already working with two of the top three business schools in the world – London Business School and INSEAD – as well as several providers of courses focused on in-demand technical skills such as coding and AI.

The ML model creates a forecast of expected earnings to work out the terms for each student. As well as a commission on the monthly repayments, there’s also a per-student charge to course providers.

StepEx is keen to expand the approach to vocational studies:

The FEA model works just as well for an Amazon warehouse worker who wants to earn more money as a truck driver, but can’t afford the training, as it does for a freelance designer wanting to develop coding skills or an entrepreneur currently priced out of an MBA.

It’s an interesting idea, and one I would like to see turned into a product accessible by private investors.

Crypto

The UK’s war on crypto continues, with the local advertising watchdog announcing a clampdown on “misleading marketing” for crypto investments.

Miles Lockwood, director of complaints and investigations at the ASA, said:

We see this as an absolutely crucial and priority area for us. Where we do find problems we will crack down hard and fast.

The ASA is in focus because most crypto investments fall outside the scope of the FCA. Back in May, the ASA criticised Luno’s ads on London transport, which read:

If you’re seeing Bitcoin on the Underground, it’s time to buy.

The ASA decided that this was misleading and underplayed the risks involved.

The ASA used to rely on consumer complaints to flag up problem ads but is now using web scraping and AI to scan proactively.

- They also plan to look at social media influencers.

Meanwhile, the FCA is working with the Treasury (and the BoE as part of the “CryptoAsset Taskforce”) to extend its powers.

It seems that only a minority of crypto purchasers are influence by ads, but, according to the FCA:

Consumers who are persuaded by adverts are much more likely to regret their purchase.

They are also more likely to believe (incorrectly) that their crypto holdings are government-protected (like cash savings).

In Pensions Expert, Benjamin Mercer reported on research from CoreData which shows that 40% of millennials (aged between 25 and 40) would like to invest some of their pension in crypto.

- Only 7% of boomers (aged 57 to 75) were interested in crypto

Gold and silver were the most popular alternatives with 45% liking them.

- 33% were interested in BTL, and 24% in frontier markets

- 23% liked rare earth metals and 19% wanted farmland and/or timber

- 18% liked medicinal cannabis and 17% wanted vegan products

Quick Links

I have just three for you this week:

- Alpha Architect looked at the Misery Index and future equity returns

- Musings on Markets wrote about disclosure, and when more data means less information

- And Validea Guru Investors told us to Put Down The Dividends.

Until next time.