Weekly Roundup, 1st November 2018

We begin today’s Weekly Roundup in the FT, with Merryn Somerset Webb. Like many commentators, Merryn was writing about the recent stock market volatility.

Contents

Markets

Merryn talked about the end of “market illusions”, by when she chiefly meant central bank liquidity.

When money is constantly cheap and available everything seems straightforward. Markets go up whatever happens, leaving investors free to tell any story they like about why.

One fund manager told me last mont, that traditional equity valuation methods are no longer the point — all we need to think about is how the company in question can respond to digitalisation.

In fact, she says:

Investors have to start focusing properly on cash and valuations.

Merryn still thinks that US corporate profits look fine, and that there is scope for digitalisation to improve productivity in developing countries.

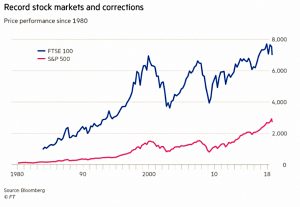

Other than the US, stock markets are no longer expensive.

- So active managers will have another chance to demonstrate the value of their stock-picking skills.

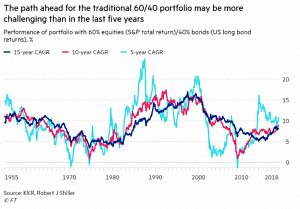

Michael Mackenzie thought that this was the start of regime change in global markets.

- He blames the stock market falls on higher bond yields, Sino-US trade friction, a strong dollar and weak global growth.

US corporate earnings have peaked and the tailwind from tax cuts will duly fade. Valuations are unsustainable as earnings are seen falling next year, triggering a messy adjustment on Wall Street that affects global investor sentiment.

The Fed is reducing its balance sheet at the maximum pace of $50bn a month. It will take a much bigger market shock — one with the power to seriously hurt the US economy — to make the Fed pause.

Sticking with the herd via passive investment strategies looks in trouble.

The downside of higher deficits is a more volatile environment for equities, but that should be good for active managers and stock pickers.

Michael thinks that we are still some distance from a true bear market.

- But generating strong equity returns will be more difficult from here.

For a more optimistic reading, we turn to Ken Fisher, who thinks that UK stocks at least will recover once the “Brexit fog” clears.

Markets need the uncertainty to end. What delays risk-taking isn’t the looming prospect of a no-deal Brexit. Rather, the stumbling block is not knowing what the rules will be after March 29.

The much-discussed negatives are basically unchanged, and surely priced. Global leading growth indicators are relatively robust. We’re entering the most consistently positive phenomenon in global stock market history — the aftermath of American midterm elections.

Stocks move on surprises. Anything short of an all-out Brexit disaster will help.

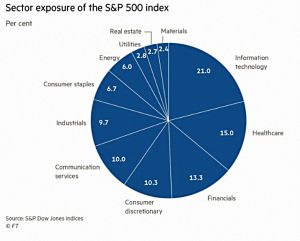

Kate Beioley looked at whether the market turmoil should affect your investment strategy.

The recommendations were:

- Stay diversified

- Stocks, bonds, property, cash, infrastructure and gold were mentioned as asset classes

- Also take a look at low-volatility ETFs, which exploit this proven outperformance factor

- It should be noted that such funds are untested through a sustained period of rising interest rates,

- Choose fund managers with different styles – growth value, defensive, dividends.

- Don’t expect bonds to protect you this time.

- Have a cash buffer – six months expenses seemed to be the upper limit.

- Use dollar cost averaging at the moment.

- The is certainly a help psychologically, but the maths doesn’t stack up.

- Rebalance regularly

Partial transfers

Josephine Cumbo reported that Ford will give its pension scheme members the option of a partial transfer.

- They will be able to take half their pot as a cash sum (presumably as a transfer to a DC scheme) and the other half as the traditional DB pension.

This flexibility is likely to be welcomed by many.

Sir Steve Webb, of Royal London and the former pensions minister, said the decision was “brilliant”:

There are probably plenty of people for whom a state pension plus part of their defined benefit pension provides a secure floor, while the balance of their defined benefit pot could give flexibility. Let’s hope more schemes follow suit.

Over at Pension Playpen, Henry Tapper had reservations.

His first point is that in effect, everyone already has a partial transfer option.

- DB pensioners can take a “tax-free cash commutation.”

This is calculated via a difficult formula, but should be close to the 25% tax-free cash commencement lump sum in a DC pension.

- The variability comes from the impact of this commutation on the remaining pension income.

But despite no-one knowing whether they are getting good value from taking a partial transfer from DB to cash, almost everyone takes the money.

Interestingly, though DB scheme CETV multiples are now in the high thirties or even more than 40, commutation factors are often in the 10 to 20 range.

- Which makes them much worse value.

Most schemes are still in deficit, and so the trustees and actuaries who decide on the commutation factor are being “prudent” (ie. acting in the interests of remaining members).

- Henry’s point is that under current rules, partial transfers offer much worse value than full transfers.

Australia

The Economist held up Australia as a model rich economy:

- Rising incomes

- Low public debt

- An affordable welfare state

- Popular support for mass immigration

- Broad support for government policies supporting these things

They forgot to mention no trade deal with the EU (Australia uses WTO rules).

- And Australia has a nifty compulsory pensions scheme (the “Super”).

And yet the country doesn’t feature on my list of places I could retire to, because:

- It’s small (25M people), and

- It’s a long way away from the part of the world I consider most important (Western Europe)

- It’s a hot desert (and I expect water to become a big issue globally)

- It has a high dependency on low tech (resources)

- It has a lack of high culture

- Increasingly it has an Asian rather than a European focus – it looks to China, Japan and Singapore rather than the UK.

Value investing

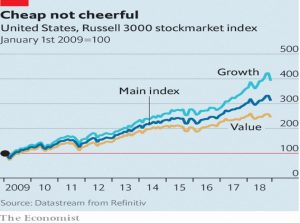

Buttonwood looked at the agony of the value investor.

- Buy shares that are cheap (relative to say, book value) should pay off in the long-term, but it hasn’t over the past decade.

Growth – which generally doesn’t outperform over the long-term – has done much better.

- But for how much longer?

The one per cent

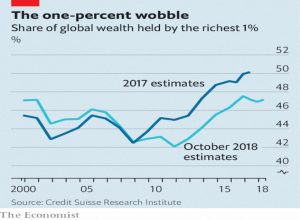

The Economist also reported that new calculations suggest that the share of global wealth now owned by the top one percent may have levelled off.

- It’s still pretty high, though, at 47%.

You “only” need $870K (£683K) in net assets to qualify, so a lot of people in the UK will make it.

- The US has 40% of the top 1%.

China has moved past Japan into second place, with 8.8% (including Hong Kong).

Ethical investing

The newspaper also looked at the suggestion that ESG (environmental, social and governance) investing is just “an excuse for investors to put all of their money in Scandinavia.”

In contrast:

Emerging economies are often dirty and corrupt—at least compared with Sweden.

Their most liquid companies tend to be national champions or sprawling conglomerates that neglect minority shareholders and jump into bed with the government.

Often emerging-market sovereigns default on their duty to protect human rights.

Regular global stock indices have an 11% weight to EMs, but ESG indices have only 9% (remember, this is an 18% money shortfall, not 2%).

Charlie Robertson of Renaissance Capital argues that ethical investors should judge countries relative to their GDP per person.

- Chile, Indonesia and Poland do well on this measure.

An alternative would be to invest in the most improved countries rather than the best.

- A simpler approach already used by some ESG investors is to have separate funds for developed and emerging markets.

Another argument is than EMs only benefit from foreign cash once their institutions pass a minimum quality level.

- Until then it is best not to invest, for fear of loading them up with foreign debts.

Quick links

I have nine for you this week:

- The Wall Street Journal asked why, when The Stock Market Held A Sale, No-One Turned Up.

- FT Adviser reckons that Digital Currencies could be hit by FCA Regulation.

- Flirting with Models looked the relationship between Simplicity and Fragility.

- It turns out that Seattle’s minimum wage increases didn’t have the effects that people had hoped for.

- AltFi reported that Wise Alpha (the corporate bond note platform) has launched a robo-advisor.

- Mainly Macro explained why even those who are anti-austerity should care about debt.

- A Bundesbank economist wants to bail-in Italy’s middle classes and force them to buy “Solidarity Debt”.

- The Economist looked at Amazon’s move into digital advertising.

- Money Observer said that the old rules on diversification no longer apply.

Until next time.