Weekly Roundup, 16th March 2020

We begin today’s Weekly Roundup once again with the big story – the coronavirus and its impact on the markets.

Contents

Market outlook

There’s not much to talk about apart from the virus.

Another week on and things are no clearer.

- The news is getting worse in Europe (more cases, more deaths and many business closures and lockdowns).

- It’s getting works in the US (flight bans, lockdowns in NTC, LA and Vegas, famous people have tested positive).

- It’s getting better in China and South Korea.

We still don’t have a good idea of the death rate, because many people are asymptomatic and there aren’t enough test kits.

Here in the UK, we have shops stripped clean by panic buying and no football.

- We are a couple of weeks behind Italy and so lockdowns must be imminent.

We don’t seem to be at a market bottom yet, but I still remain optimistic that there will be bargains to be bought at some point in the next six months.

- More on that in a separate post, perhaps next week.

Hunting for value

In the FT, Merryn Somerset Webb pointed out that we have no real sense of how to value stocks in this environment.

- There are too many unknowns.

In a US recession, what happens when record levels of corporate debt are downgraded to junk and funds have to sell it? And what of the overvalued unlisted firms held by all fashionable asset management companies?

But apart from the US, most markets are now trading on less than their historical averages.

Merryn expects helicopter money (so do I) and advocates drip-feeding money in on the way down to the bottom.

- Given the way the last month has been, I think I might wait for a couple more weeks.

Redwood fund

John Redwood appears to have timed well a switch away from stocks in the ETF funds he manages for the FT.

- He now was a cautious allocation of 40% to stocks rather than a previously optimistic 60%.

What will it take to tempt me to buy shares again? The best trigger would be evidence that the virus is waning, perhaps when the weather warms up.

John also expects more helicopter money, as announced by Hong Kong.

Market closures

In his Bloomberg email, John Authers wondered whether the markets might be closed for a time.

- Circuit breakers were triggered twice last week in the US – both times they seemed to help with sharp sell-offs.

John notes that calls for a longer closure are new – there were no such suggestions in 2007-09.

- The argument is that since so little is known about the future progress of the pandemic, volatility is inevitable.

But he doesn’t expect it to happen, particularly in the US under Trump.

- The only previous closures have been 1997 (circuit breaker for one afternoon) and four days after 9/11 in 2001.

I would argue that markets were invented to set prices, and if you are in favour of a shutdown, you can achieve the same effect by not selling any of your holdings.

- Some investors may need to generate liquid funds through selling, or may simply need to move money in and out of tax shelters in order to take advantage of annual allowances.

And for that, they need the markets to stay open.

Paying for advice

Joachim Klement looked at why investors are reluctant to pay for advice:

- The advice was historically given away for free when advisers were able to take a cut of the fees on products or trades.

- This also led to advisors having the wrong incentives.

- And it led to problems when investors discovered low-cost products like ETFs.

- MiFID II, which separated research from institutional fees has led to less spending on research which is nevertheless regarded as more expensive and with reduced coverage.

- People find it hard to judge whether financial advice is good.

- It takes years for outcomes to arrive, and success is subjective.

- There is also a trade-off between risk and return, and between short-term and long-term outcomes.

- There are no immutable laws in financial markets.

- So the past need not be like the future, and good advice can fail.

Financial advice dispenses medicine that makes you vomit once a month for the next twenty years for the promise that you will have a better quality of life at old age.

Financial advisers are like dietitians. They force you to give up on all the nice things in life for the promise of being healthier once you get older.

Joachim thinks that the solution is to earn the trust of clients (in my experience, that’s what the industry thinks, too).

- But it’s not clear how to achieve that when the markets can go against you at any point.

Don’t waste the crisis

Joachim also implored the powers that be not to waste this crisis as they did 2008-09.

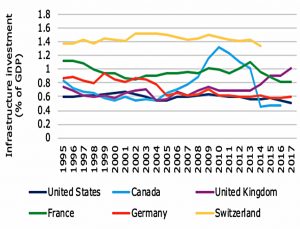

He wants more infrastructure spending like the UK announced in last week’s Budget.

Monetary policy will not be sufficient to fight the next recession and so fiscal policy has

to come to the rescue. And when it comes to fiscal stimulus, infrastructure investments are amongst the best thing you can spend money on.

Quick links

I have nine for you this week:

- The UK Value Investor was hunting for dividends in the Goldilocks zone

- And reflecting on the recent crash

- The Economist reported that Britain is ahead of most countries in technology startups

- And that no-one is likely to win the oil-price war

- And that corporate bonds are at the centre of the latest financial scare

- And that a spike in the dollar is a reliable sign of global panic

- Alpha Architect looked at whether insider trades provide insights into future returns

- In The Long Run looked at historical evidence on the impact of pandemics

- And Musings on Markets looked at the clues in the debris.

Until next time.