Weekly Roundup, 24th September 2019

We begin today’s Weekly Roundup in the FT with Tim Harford, who was talking about climate change.

Contents

Climate Change

In theory, today’s Weekly Roundup is a bumper double edition, since I was on holiday last week.

- In practice, that might not mean that it’s any longer than usual.

Time was writing about economics professor Martin Weitzman, who committed suicide in August.

- Weitzman suggested that massive spending today on “fixing” climate change was wrong.

It’s most worrying impacts — including floods, crop failures and diseases — are unlikely to manifest at full strength for decades or even centuries [and] because the world has been getting dramatically richer, future generations are likely to be much wealthier than we are.

Weizman was writing in response to the Stern Review on the Economics of Climate Change.

Stern’s case for action depended on arguing that our super-rich descendants living in the far future should weigh very heavily in our calculations.

It is hard to square that with how we behave in respect to any other issue, personal or social. We simply do not set aside nine-tenths of our income to benefit future generations.

Makes sense to me.

Tim notes that tail effects are harder to predict than central estimates, and it’s possible that climate change will turn out to be more dangerous than we think.

- He makes an analogy with buying insurance for the worst-case scenario.

But buying insurance is a mug’s game (the money is in selling it) and a life lived constantly in anticipation of disaster is not worth living.

- Nevertheless, that’s the one the climate change protesters have in mind for us.

Negative yields

In his regular update on the ETF portfolio that he runs for the FT, John Redwood said that he could not bring himself to buy sovereign bonds with negative yields.

- I couldn’t agree more – the only justification is that you think that a “greater fool” will come along to buy them off you at a later date (and a higher price).

He notes the current reversal of the normal approach to investing – people now buy bonds for capital appreciation and stocks for income.

John says that inflation remains stubbornly low due to technology and globalisation.

The fund is up 12% for the year.

- John thinks that sterling looks cheap, so he is increasing the currency hedging on his US holdings.

Controlling risk

Jason Butler argued that avoiding investment risk is pointless and that we should control it instead.

He had a few tips:

- Price volatility is the wrong measure of risk, so don’t focus on the ups and downs of the market.

- I agree in theory, but people find price drops so hard to ignore that volatility ends up being a surprisingly useful measure.

- In my coaching, I never meet people with too much equity exp[osure – everyone is afraid of crashes.

- The relationship between risk and return is not linear

- Jason’s right to point out that higher risk leads to higher variability of returns (indeed, that’s how it’s defined), but high return assets are high risk.

- Diversify, unless you are as good as Buffett and Howard Marks, who don’t need to bother.

- I would argue that everyone should diversify with their first £1M or two.

- Control the risks to your human capital – your ability to earn a living.

- I’m afraid that ship has sailed for me.

- Jason seems to be a fan of income protection insurance (as well as training).

- Control your lifestyle spending so that you can save enough to fund your retirement.

- I think we can all get behind this one.

ESG investing

This is a bumper article in one sense – because of the two-week gap between Roundups, we have four articles by Merryn Somerset Webb to look at.

In her first for the FT, she looked at ESG investing.

- At the recent FT Weekend Festival, one of the speakers pointed out that green investing has outperformed over the last five years.

The prompted Merryn to think about whether energy stocks might be a high-yield bargain.

- At 6% pa, the stocks only have to hang around for 17 years for you to get your money back.

This beats bonds and annuities and might suit older investors in particular.

- So what do you think the world will look like in 2036?

The second FT article looked at wealth manager fees, which are coming down, but not quickly enough.

- Merryn also squeezed in a plug for NetWealth, where she is a director and shareholder.

Unfortunately, NetWealth is like the rest of the Robo-advisors.

- It doesn’t do anything very clever and it charges too much.

Even at £500K it costs 0.85% pa (including some advice).

- The real competitor is DIY investing, which is much cheaper.

But the industry (and the financial media) have no interest in making that clear.

Merryn’s two MoneyWeek columns covered a lot of ground, including St James’ Place (see section below) and the WeWork IPO (see the articles in Quick Links below).

Corbyn watch

Jim Pickard reported on law firm Clifford Chance’s calculations of the impact of Labour’s plans to appropriate 10% of shares in UK firms with more than 250 staff.

- CC says that it will cost British pension funds £31 bn.

The transfer would involve about £300bn of shares, one of the biggest state expropriations of assets seen in a western democracy.

Labour says that only 3% of the UK market is held by pension funds.

- But 18% of DB pension assets are in the UK market.

CC says that pension funds hold £310 bn of UK stocks, hence the £31 bn impact.

Labour has dressed this up as a redistribution of dividends to workers, but these handouts are capped at £500 per person.

- CC says that by year 10 of the scheme, 88% of dividends would be retained by the government.

At last week’s Labour conference, the party voted for further asset appropriation.

- They intend to take over public (ie. private) schools.

I didn’t go to private school, and I have mixed feelings about them.

- But I know that governments seizing private assets is never a good thing.

Rent controls

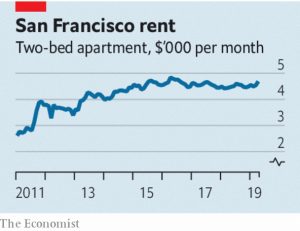

The Economist correctly points out that rent controls lead to worse housing shortages.

They deter the supply of good-quality rental housing. With rents capped, building new homes becomes less profitable.

Even maintaining existing properties is discouraged because landlords see no return for their investment.

Renters stay put in crumbling properties because controls often reset when tenants change.

The newspaper quotes evidence from Cambridge Mass (which scrapped controls) and San Francisco (which tightened them).

- The average waiting time for a long-term tenancy in rent-controlled Stockholm is now ten years.

On a related note, Elliott Kime in the FT wondered whether the St. Ives ban on sales of new builds to second homeowners has backfired.

- New homes only made up 5% of sales in St Ives last year, and local estate agents say the ban is hampering supply.

To quote one:

A lot of these measures brought in by politicians don’t work in the real world because developers aren’t going to develop and investors aren’t going to invest.

Disclosure: I intend to buy a second home in St Ives at some point in the future.

House prices are still going up, but slower than in the past (3% pa, cf. 10% pa at some points in the last decade.

- Purchases by second-homers are up from 25% in 2016 (when the ban was introduced) to 32% in 2018.

St James’ Place

In the Times, Ali Hussain wrote about the sales targets and rewards used by St James’ Place for its IFAs.

- £150K in new business gets you a place on a holiday cruise (described as a business trip).

- £300K gets you business-class flights.

The top tier of rewards kicks in at £1.95M of new credits.

- Then you can take your partner and twelve friends.

An anonymous former adviser chipped in with stories of Montblanc pens, commemorative pill-boxes and Mulberry bags.

- Plus a cult-like system of cufflinks and brooches which go from blue to green to gold to diamonds as you move up through the company.

Advisers basically run their own business, but they can only sell SJP funds and pensions. In exchange, SJP lets advisers use its brand, lends them money and provides insurance and help with regulatory red tape.

And everything is paid for by SJP’s ludicrously high fees.

Quick links

I have ten for you this week:

- The Economist wrote about Tim Cook’s plan to make Apple less dependent on expensive devices

- Alpha Architect looked at Factor Investing from Concept to Implementation

- And at Investor Focus on price returns

- Musings on Markets looked at VC Pricing via the planned IPOs of WeWork and Peleton

- He also had a second article on the WeWork float

- Flirting with Models wrote about Value-Driven Sector Rotation

- And about Factors and the Glide Path

- And about how to Build Your Own Long/Short

- David Stevenson suggested that Value Investing’s Comeback might never arrive

- And UK Value Investor wondered whether Mitie was a disappointment or had dividend potential.

Until next time.