Weekly Roundup, 4th April 2017

We begin today’s Weekly Roundup in the FT, with the Undercover Economist. This week Tim was talking about ostriches.

Contents

Brexit

There was a lot in the papers last week about Theresa May signing the Article 50 letter to officially begin the Brexit negotiations, and it was people’s reactions to Brexit that brought ostriches to Tim’s mind.

- Lots of his “sensitive liberal friends” have stopped watching the news because they find Brexit too depressing.

I plan to largely ignore Brexit, but not because I am depressed or could be considered too sensitive (though I would argue that I am liberal in the original sense of the word).

- Nothing has happened apart from a letter being signed and I prefer to report on events and data rather than self-serving media speculation.

Tim believes that there is valuable information within bad news, but the “ostrich effect” of hiding behind the sofa from the Daleks is well established in economics.

Tim quotes Lowenstein and Seppi’s study of retail investment accounts:

- when markets are rising, investors check the value of their accounts frequently

- when markets are falling, investors ignore their accounts

- there are a few people who go the other way, checking their accounts (or the news) every few minutes – this is known as the “meerkat effect”

And even when people overcome (or are forced to overcome) their ostrich tendencies, hearing the counter-arguments may paradoxically reinforce entrenched views.

- This cherry-picking of evidence – confirmation bias – was the finding of Taber and Lodge, who studied views on the contentious subjects of gun control and affirmative action.

As a Remainer, Tim doesn’t think that the Brexit negotiations will proceed well.

- I’m not sure we have the same definition of “well”, but I prefer to wait and see.

Worse than Brexit

Meanwhile, Merryn was arguing that consumer debt, overvalued markets and inflation are all better things to worry about than Brexit.

- She thinks the negotiations will be “nitty gritty, pernickety and insanely boring”.

We will lose rights to EU benefits, as will EU citizens in Britain to UK benefits, and “London will remain the financial centre of the universe”.

- And we will have to pay a couple of years of contributions (a parachute payment) so that Germany, France and Holland don’t have to stump up instead.

The key point is that none of this should affect your financial planning:

- fill up your ISA and get your pension right, just as now

- if you need to, look at the impact of tax changes on your buy-to-let(s)

Meanwhile, public sector debt remains at peace-time historic highs, and is now paired with a private sector credit bubble (mostly credit card debt and car loans).

- The overall Debt to GDP ratio in “the west” is at a record high.

Merryn thinks that that this kind of debt can only be dealt with by inflation.

- She recommends multi-asset funds, cheap equity markets (Japan), cash, and gold.

Savings rate

In related news, Gavin Jackson reported on a record low in the UK savings rate since records began in 1963.

- We hit 3.3% in 4Q2016.

Excluding changes in pension fund equity, the ratio fell to its lowest level since 2008, at just above zero.

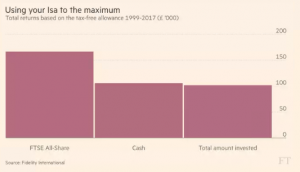

In the Chart That Tells A Story, Aime WIlliams reported that shares have delivered 60% more returns than cash over the past 18 years.

- So not a very surprising story being told this week.

The focus was on ISAs, which continue to make up 80% of ISA accounts, despite the low returns.

- The comparator for cash was the FTSE All-Share

- But fund and platform fees weren’t included, so 5% to 10% of the outperformance would have been eaten up by charges.

Compounding

Channelling all the baby-boomer guilt that he could muster, Paul Killik looked at how compounding could be the “saviour of the younger generation”.

He laid out a number of helpful scenarios, but his starting point was that since families nowadays often include four generations alive at the same time, passing down money to the next generation is not tax-efficient.

- By the time it reaches the youngest generation, three bites of IHT could have been taken out of it.

- But he was also aware of the risks of pensioners giving away too much money too soon.

He recommended using the AIM market to shelter spare funds from IHT, as we have discussed several times previously.

- You would then name the grandchildren / great-grandchildren as the beneficiaries of these investments in your will.

Paul’s table below outlines seven options.

- Each assumes investment at birth and holding the investment to age 70.

- Real returns of 5% pa have been assumed, which is slightly lower than the historical average for the UK. (( Of course, this might still be too high for future returns ))

The options, with their final values, are:

- Single JISA payment = £126K

- 10 years of JISA payments = £1M

- 10 years of JISA with transfers to LISA from age 18 = £1.23M

- Single SIPP payment = £109K

- Single payment to each of JISA and SIPP = £235K

- 10 years of JISA and SIPP payments = £1.9M

There would be some income tax due on withdrawals from the SIPP, but as we’ve seen previously, this works out at only 11.2%.

China

John Authers looked at the recovery in China.

- Things look a lot better than a year ago, and last month China had its first net inflows of capital for three years.

- Emerging stock markets generally are rebounding, as are their currencies.

But John worries that China’s resurgence is credit-fuelled and may be about to reverse.

John also wonders whether China can escape the “middle income trap”, where many countries develop to around China’s current level of wealth and then stall.

- Of countries with more than 20M in population, only Poland and South Korea have made it through.

China has unfavourable demographics, and would need to convert its economy from one based on exports to one based on domestic consumption.

- John worries that property inflation of more than 20%, and a proliferation of “wealth management” products suggest that China is heading to the pre-2008 state in the West.

On the plus side, Chinese debt is largely funded domestically, and it retains a current account surplus.

- But debt is estimated at 260% to 300% of GDP, and has grown rapidly.

Time will tell, but unlike other emerging markets, the fate of China is not something we can watch from the sidelines.

Trump bump

Over in the Economist, Buttonwood looked at the markets’ failing confidence in the Trump bump.

- After a 12% rise in the S&P 500 between election day and 1st March, the honeymoon seems to be over.

- The S&P has flattened out, but the dollar has lost half of its post-election gains, and bond yields have fallen back.

The cause appeared to be the failure of Trump’s health reforms, but it was really the read-across to his chances of pushing through significant tax reforms.

- In this sense, the bump reflected undue optimism, and the pullback corresponds to realism.

- Trump’s stimulus package was always more likely to boost the US economy in 2018 than during this year.

This is bad news for US markets, but a sustained Chinese recovery should support international stocks.

- Unless, of course, Trump starts a trade war.

Luxury goods

Elsewhere in the newspaper there were claims that luxury goods firms could no longer rely on China for their growth.

- Apparently there has been a crackdown on ostentatious displays of wealth in China (often associated with corruption) and higher duties on personal imports by holidaymakers.

- There also appears to have been a change in tastes, with fewer luxury pieces now mixed with more “fast fashion”.

The next challenge for the industry is to go digital.

- Only 8% of luxury sales are online, compared with 16% for the rest of retail (excluding groceries and petrol).

The Economist suggests that Ermenegildo Zegna’s current motto of “from sheep to shop” could soon be replaced with “from sheep to screen”.

Poverty

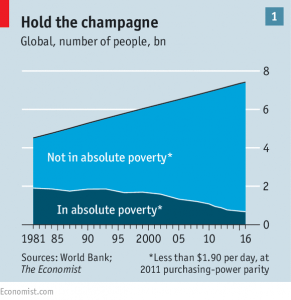

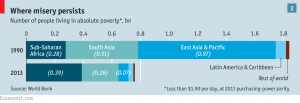

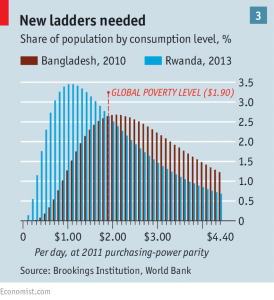

We end with a good news story about the decline in global poverty:

- In 1981, 42% of the global population lived in absolute poverty

- The World Bank says that by 2013, this proportion had fallen to 10.7%

- The estimate for 2016 is 9.1%

In Britain, this transformation from 40% poverty to 10% took a century, from 1820 to 1920.

The less good news is that the recent rapid pace of change is unlikely to continue.

- The concentration of the poor into “China, India and the rest” meant that is was relatively easy for improvements in the first two countries to produce big effects.

The big problems now are in sub-Saharan Africa.

Until next time.