Weekly Roundup, 28th August 2018

We begin today’s Weekly Roundup in the FT, with the Chart That Tells A Story. This week it was about dividends.

Global dividends

The August break for financial journalists appears to still be in force, so this will be another short article.

Kate Beioley reported that global dividends (ex-UK) have been growing over the last ten years.

- They have increased by 110% over the period.

This is partly due to rising corporate profits, but the US tax breaks and some large one-off dividends in Hong Kong and Singapore have also helped.

The message from Kate is that UK investors need to diversify.

- The UK is the only place that dividends fell in 2Q2018, by 1.4%.

- And UK dividends are horribly concentrated in just a few countries.

I’m all for international diversification, but there are much better reasons than chasing dividends.

- For as we all know, dividends don’t matter.

As Kate notes, you also have to look out for FX movements when investing internationally, although these tend to average out over the long run.

EIS

Kate’s second article was about EIS, or as the FT’s sub-editor’s put it, in print and online respectively:

- The weird world of EIS, or

- The world of wacky investments.

Most of the EIS investments that I come across are far from wacky, though they are very risky and increasingly tech-dominated.

But Kate did indeed find some wacky ones:

- An algae farm (minimum investment £10K)

- Small-scale spacecraft (also £10K, though this is part of a fund that will invest in at least ten companies)

- Children’s television (not so wacky? – a recent funding round for Acamar films had a £20K minimum)

I’ll be looking at EIS funds in more detail in a couple of weeks.

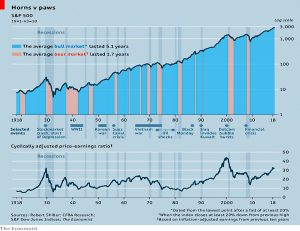

US bull

The Economist looked at the bull market in US stocks, which by some measures became the longest ever bull last week.

- The S&P is up more than fourfold since March 2009.

Some say that the bull to 200 is the record holder, since a fall in 1990 was a 19.9% correction, not a true bear.

- Others contend that a bull doesn’t begin until the previous peak is surpassed.

Whichever definition you use, it’s a long time since US stocks crashed.

The funny thing about this bull (which the Economist notes) is that it has never been loved.

- Apart from in crypto late last year, we haven’t seen the euphoria of previous bulls.

It hasn’t been the steepest in history (16.5% pa, cf. 19% pa to 2000) but it has been the calmest (low VIX).

The S&P 500 PE is now 26 (and even higher using the CAPE, which still includes data from 2008).

- But the warning signs of an immediate crash are not present.

Allocation by job

Buttonwood looked at asset allocation based on your occupation by asking – are you a stock or a bond?

- A risk-loving investment banker is a stock, and should therefore hold more bonds.

- A risk-avoiding civil servant is a bond, and should hold more stocks.

Under the traditional financial advice process, their risk tolerances would mean that the opposite happened.

- And many people compound the error by holding a lot of their savings in the shares of their employer.

I’m all for including human capital in the investment process, but the logic used by the Economist doesn’t translate well to the decumulation phase.

- With no human capital left, retirees would be risk-averse bonds.

Yet at the same time, with no income other than that from their portfolio, they are not well-placed to absorb the shock of a stock-market crash.

- The answer for me is as much allocation to stocks as you can stomach, and a four-year cash buffer with which to ride out the downturns.

Road pricing

The Economist also looked at road-pricing.

- New York has capped numbers of ride-hailing cars (Uber and Lyft) and London is looking to do the same.

With the high attrition rate on existing drivers, a cap on news ones should quickly lead to falling numbers.

- But that won’t fix congestion, and it will impact suburban ride-hailing customers.

Even in London, the Congestion Charge is a blunt instrument.

- It’s charged by the day (for a 12 hour peak window) and has a single chargeable zone.

Road-pricing could target the rush hour, and make off-peak driving cheaper.

- It would also move traffic away from the most congested (and therefore most expensive) roads.

- And ride-hailing cars could be charged more (rather than being exempt, as in London – the counter-argument is that many trips in private vehicles can be replaced by a single cab).

Singapore has a road-pricing system, but will it spread?

Road-pricing would also support the separation of congestion and pollution (emissions).

- Emissions need to be charged for separately, rather than through congestion charge exemptions for low emitters.

Immigration

The Economist also looked at immigration, which can be a touchy subject for some people.

- International law says that refugees are entitled to sanctuary, whereas economic migrants and no right to go anywhere that doesn’t want them.

And studies show that immigration leads to improved productivity (assuming a person moves from a poor country to a rich one).

There are four problems with this:

- The lines between the two groups become blurry to say the least in a war zone.

- Economic migrants have a clear incentive to pose as refugees.

- Many people feel that the countries which should offer sanctuary are limited to their immediate neighbours.

- Most of the economic benefits of immigration accrue to the immigrants themselves, rather than to the existing voters of the country that must decide to admit them.

- There is a limit to the number of immigrants that a country can accept without putting its own culture at risk and straining public services – at least at a local level.

- And this assumes that the immigrants want to assimilate – which has clearly not been the case in recent years – and don’t want to freeload on their new state.

In prose worthy of Candide, the newspaper naturally assumes that all the problems can be overcome.

- One point worthy of note is that they prefer the US’ tough immigrant welfare regime to the generous one operated by Sweden.

- And they are even prepared to consider a surtax on migrant earning during the first few years.

I look forward to any UK party adopting such measures.

AIM

In the Times, Mark Atherton looked at the AIM market.

- As we discussed recently, it’s five years since the IHT tax perk was added, during which time the AIM All-share index has risen from 750 to 1092.

That doesn’t sound like much to me, and in any case, the AIM All-share is a misleading index.

- Probably upwards of 75% of the market is rubbish, and a private investor only really needs to concern himself with the top 200 ir so companies.

The arguably more important IHT exemption was added many years before, though it recently grown in popularity.

- So much so that there is talk of the perk being removed.

It’s worth noting that the starting value of the AIM All-share when the market launched in 1995 was 1000.

- So the index is up 9.2% over 23 years!

AIM is a stockpicker’s market, so ignore the index.

- But don’t ignore the market, there are some good firms on there.

Quick links

I have just two for you this week:

- Alpha Architect looked at Accruals Momentum as an investment strategy, and

- The Adventurous Investor was planning for the worst case populist scenario.

Until next time.