Weekly Roundup, 23rd August 2021

We begin today’s Weekly Roundup with a look at forestry.

Forestry

David Stevenson looked at ways to invest in forestry.

The biggest draw is that it is 100 per cent free of inheritance tax (IHT) after two years, provided the investment is still held on death. There is also no income tax liability on the sale of timber nor any capital gains tax on its growth in value.

The problem is the lack of vehicles with a low entry-level.

The Gresham House forestry fund might generate an internal rate of return of 6 per cent a year in the long term, with the potential upside from selling carbon credits via new forests. The minimum investment is £100,000.

Venture capital firm Par Equity works with Scottish Woodlands, a leading forestry management company with 200,000 hectares under management. The minimum investment is £50,000.

Given the small percentage of your portfolio that you might want to allocate to woodland, these funds are for millionaires only.

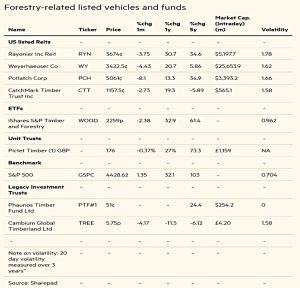

David also has a table of funds and trusts, though the best are US-listed:

Unlike the direct commercial funds mentioned above, there is no tax advantage from directly owning these business assets. I should add that the forestry-focused closed end funds, Cambium and Phaunos, have produced hugely underwhelming returns and are in winddown mode.

Redwood

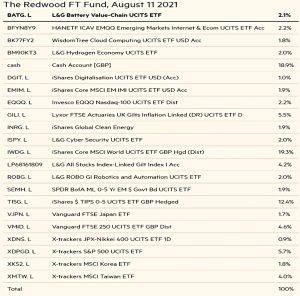

In his regular review of the ETF portfolio he runs for the FT, John Redwood warned investors against the growing impact of nationalism.

- Governments are moving to protect technology, food supplies and raw materials.

The relations between China and the US have become very strained. President Donald Trump’s Make America Great Again has morphed into President Joe Biden’s plans to make more in America.

China presses on with its 2025 Made in China and Belt and Road Initiatives, seeking to provide most of what it needs from domestic sources and to widen its economic influence from a strong home base.

Working out which sectors and countries will benefit from a world with more subsidies, tariffs and takeover protection, and less diversified supply chains is not easy.

- John’s biggest weighting (19%) is now to the World Index fund, and he’s also 19% in cash.

Family investment companies

In the FT, Emma Agyemang reported that HMRC has closed the unit that it set up to investigate Family Investment Companies (FICs).

- An FIC is a private company that holds and manages investments, and whose shareholders are family members.

FICs are typically used by wealthy families to efficiently pass down assets to younger generations.

- They have become more popular since 2006 when the tax treatment of trusts was tightened up. (( Assets moved into trusts are subject to an immediate 20% IHT charge and an extra 6% every 10 years, plus up to 6% when assets are transferred out of the trust ))

The unit had recently reported that there was no evidence that FICs were being abused.

- The FIC unit will be absorbed into the department which looks at general tax compliance amongst the wealthy.

HMRC said:

In the research we undertook there was no evidence to suggest that there was a correlation between those who establish a FIC structure and non-compliant behaviours.

As with any analysis of a taxpaying population, the same broad range of tax compliance behaviours were observed, with no evidence to suggest those using FICs were more inclined towards avoidance. [People use FICs as] a planning strategy, often with the primary objective of generational wealth transfer and mitigation of inheritance tax.

HMRC said FICs tended to be used by people aged over 50 with an average wealth of around £5M.

- We looked at FICs in detail back in 2019.

Family trusts and charitable trusts are interesting topics to which I will return in future articles.

Stock flows

The Economist reported on a new paper which says that day-to-day trading has lasting effects on stock markets.

- Traditionally, stocks (and bonds) are held to be valued – on average – with reference to their future cash flows.

To look at the new paper, we first need to define flows.

- Every stock market buy is also a sell, so there is no net flow.

The authors’ definition of inflows relies on the fact that investment funds often promise to maintain a fraction of their portfolio in equities. A flow into stocks is defined as an investor using fresh cash, or the proceeds of selling bonds, to buy funds that hold at least some equities. The higher the share devoted to equities, the larger the “flow”.

Which I guess amounts to a measure of external buying pressure.

Price is forced up until the value of the market is sufficient to satisfy each fund’s mandate to hold the target fraction of its portfolio in stocks.

The paper finds that markets magnify rather than dampen the effect of such flows.

A dollar of inflows into equities increases the aggregate value of the market by $3-8.

The authors call this the “inelastic markets hypothesis”.

- It suggests that front-running trades should be profitable, but flows are hard to predict.

Once the “flows” have moved the price, there is little further opportunity to profit.

There are implications for capital structure, however:

In inelastic markets, a firm that issues debt to buy back its stock will find that it drives up both its own share price and the broader market.

If the same holds for bonds, then QE will affect bond yields (as it seems to).

And the paper also speaks to the potential impact of passive funds:

In recent decades funds that passively allocate fixed percentages to indices have grown in popularity. The trend is a vote of confidence in markets’ efficiency, which should make the returns to active stock-picking low. Yet passivity may breed inelasticity—and therefore create opportunities for a canny investor who is ahead of the crowd.

Soccernomics

In the FT, Jamie Powell looked at a football transfer designed to be profitable for both teams involved.

Juve “sold” Bosnian midfielder Miralem Pjanic to Barça for a basic fee of €60m, while Barça sold Brazilian midfielder Arthur Melo to Juve for a basic €72m.

Most of this money would never change hands.

Each club could book its handsome supposed selling price as immediate income. The notional payments would be spread out over the years of the players’ contracts. Only €12m in actual money would end up changing hands, the difference between the two players’ fictional prices, paid by Juve to Barça.

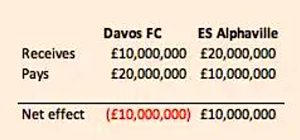

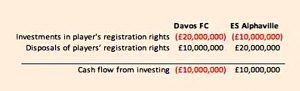

To explain how this works, Jamie concocted a similar fictional transfer

ES Alphaville buys a player from Davos FC for £10m who has climbed through the ranks from youth team football. At the same time ES Alphaville sells a player to Davos FC for £20m who has been at the club for 3-years, with 2-years remaining on her contract. She was originally bought for £10m.

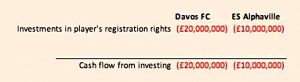

The buying club will capitalise the purchase and amortise the cost over the length of the contract.

Both clubs will record a cash outflow through the cash flow from investing statement, not the profit and loss statement.

Next, we add back the transfer fees:

This looks pretty reasonable to me.

For the profit and loss, we need to start with the book values of both players.

- The Alphaville player was worth £4M (£10M, minus three years of amortisation on a five-year contract).

- The Davos player had a zero book value, as he was from the youth academy.

So Alphaville books a £16M profit and Davos books £10M.

- Jamie estimates 10% in “expenses” on each transfer.

So sales over book value run through to the P&L whilst purchases are capitalised.

- This means that sales for inflated values can be useful in balancing the books.

Many will quibble with the fees paid in the case of the Pjanic/ Melo transfers. Particularly as Pjanic barely got a kick for Barcelona last season, and Melo has failed to prove a hit with the Old Lady. The timing of the Melo/Pjanic deals, a day before the end of both clubs’ financial year on June 30, also raises questions.

SPACs

The City has made a rule change designed to attract special-purpose acquisition companies (SPACs) – with questionable timing.

- SPACS are launched with no particular takeover target in mind but when they find a private firm to take public, the owners get a cut of the deal.

The vast majority of these have been listed in the US, but the few that came to Europe have ended up in Amsterdam, Frankfurt, Paris and Stockholm.

- That’s because UK rules used to require a prospectus before shareholders can dispose of their shares – which meant that they couldn’t sell if they didn’t like the look of the target firm.

The new rules are not great either – the SPAC sponsor must abstain from the merger vote.

- This is not a requirement in, say, Amsterdam.

And because the UK is not in the Euro, it’s not a natural choice for European acquisitions.

- Meanwhile, British firms seem keener on listing on NASDAQ.

The SPAC craze is probably already past its peak, so don’t expect a boom in London.

Exo

Fresh from its silly rebranding exercise, Abrdn (formerly Standard Life Aberdeen) (( Which should have gone for industry nickname Staberdeen )) has bought Rothschild-backed robo-advisor Exo Investing.

- Exo was/is one of the smarter offers in the robo-space, but way too expensive for me.

Abrdn CEO Stephen Bird said:

Exo was the first of its kind to offer a fully automated wealth management platform, leveraging machine learning to feed into portfolio decision-making. There is a downward pressure on fees, changing customer expectations and increasing regulatory requirements. It’s important to address these issues by providing a highlyscalable, next-generation service to investors.

It sounds like the big boys still believe in robos, but I can see much evidence that they are catching on.

Crypto

Crypto app Circle (which started life as a P2P payment network) has filed with the SEC to become a “full reserve national commercial bank”.

- It plans to back customer deposits with stablecoin USDC, which runs on the Ethereum blockchain (amongst others) and has a market cap of $28 bn.

Circle CEO Jeremy Allaire said:

We believe that full-reserve banking, built on digital currency technology, can lead to not just a radically more efficient, but also a safer, more resilient financial system.

Establishing national regulatory standards for dollar digital currencies is crucial to enabling the potential of digital currencies in the real economy, including standards for reserve management and composition.

Good luck with that.

- Getting a banking licence usually takes from 18 months to two years, so I won’t hold my breath.

Quick Links

I have four for you this week, the first three from The Economist:

- The newspaper reported on how US retailers have adapted to Amazon

- And looked at the water shortages in America

- And wondered whether neobanks would prosper.

- The UK Value Investor explained why he sold Burberry even though it is a quality company.

Until next time.