Weekly Roundup, 21st December 2021

We begin today’s Weekly Roundup with public sector pensions.

Public Pensions

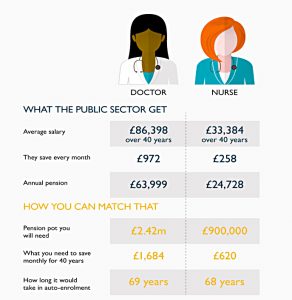

In the Times, Imogen Tew looked at public sector pensions.

- State workers often maker larger payments into their workplace schemes, but the rewards are even greater.

Most public sector workers still get defined benefit (DB) pensions – 6.6M, com[pared to 1M in the private sector.

- These provide a guaranteed index-linked income, along with death benefits (a partial pension to their surviving spouse).

But the schemes have been made less generous in recent years, with average salaries replacing final salaries as the basis of the income calculation.

Worker contributions have also increased, but the taxpayer bill for all public sector pensions now stands at £2.4 trillion.

- On average, the pensions cost 63% of salary each year.

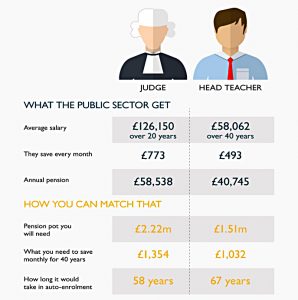

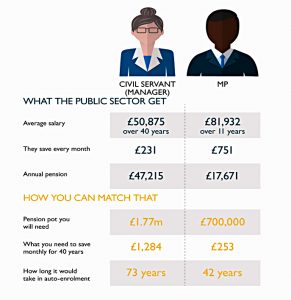

Imogen found that public sector pensions are a lot more generous than private pensions.

Judges and civil servants have the best deal. Judges have a relatively short tenure, but civil servants have an astonishingly good deal. They pay in less than teachers and doctors. Their employers (taxpayers) pay in more — up to 30 per cent of their salary. And they build up their benefits faster.

The average civil service manager would receive a pension of £47K, which is taxed as a pot of £944K (under the LTA limit).

- To buy that income privately would cost £1.77M, way over the LTA.

If you were auto-enrolled in a private sector pension and earning the same as the

civil service manager you would need to save for 73 years to match their deal.

Similar – though less extreme – results were found for doctors, MPs and teachers.

John Lee

In the FT, John Lee reviewed his best performers for 2021.

- John is 80 next year and will have been investing for 60 years.

Over the years his style has changed from taking small profits to hanging on for the long run.

Patience is the number one prerequisite for successful investing — buying into a growing business and staying with it — and better still, adding more if my belief in the business holds firm.

This year his five largest holdings (bought between 1999 and 2019) are up 35% this year.

- He’s up 22% in his overall portfolio.

One thing I find extraordinary about John’s style is the way that he builds up positions.

- His first purchase of Vitec was in 2019 but he’s since bought it on another 21 occasions.

- He also admits to 26 purchases of Treatt.

His portfolio is also horribly concentrated, with 40% of his ISA in Treatt.

Stock market history shows that in most successful portfolios, performance comes from just a small number of stocks that deliver.

There’s some truth in the idea that concentration can lead to more rapid gains (and also to more rapid losses) but at the age of 79, I would have thought that more diversification might be sensible.

The capital cycle

Also in the FT, Merryn Somerset Webb was looking forward to 2022.

- She’s been reading through the outlook reports from various financial institutions.

There is more good news than bad, apparently:

Economies are still growing nicely. Household savings are high, unemployment is low and both those things bode well for consumption in 2022, as does the shift in favour of fiscal policy by governments (they are all big spenders now). Supply chain bottlenecks are also likely to ease in 2022, something that will ease inflation — which markets aren’t much worried about anyway.

They also predict that Covid has reduced competition and large firms will increase their earnings.

- Which all sounds fine – and the Covid situation is likely to improve as well – but what about tapering, the end of QE and potential interest rate rises?

Merryn also notes that high prices (expensive markets) lead to fragility:

If global markets were cheap and resilient, the fact that we don’t know if the new variant [Omicron] is a bad one (more infectious and more lethal) or a good one (more infectious but milder) would have had no effect on markets.

And she recommends that we consider the capital cycle:

Look at how much capital is flooding into a sector. The more there is, the more likely it is that sector will see oversupply and price collapse.

Renewable energy looks vulnerable, and fossil fuels and mining look more promising.

Competition

On CapX, Sam Dumitriu looked at the decision by the UK’s Competitions and Markets Authority (CMA) to retrospectively block the purchase of Giphy by Facebook (now Meta).

They had two issues:

- that Facebook might restrict access by competitors to GIF libraries

- that competition in the Display Advertising business might be reduced

The first concern could have been addressed by forcing Facebook to maintain open access to the libraries (for as long as it takes to create competitors).

The second concern must relate to future hypothetical competition since Giphy’s ad business is too small at the moment.

- In which case, Google is already supplying competition in the ad space, and lots of other social services ( Tiktok, Twitch, Youtube, Twitter and Snapchat) are supplying a different form of competition.

The CMA also wants to lower its standard of proof in cases involving strategic tech firms like Google and Facebook.

- Currently, there needs to be a greater than 50% chance that competition would be reduced; this would become merely a “realistic prospect”.

Given that deals like the Giphy takeover can already be blocked, it’s not clear why this change is needed.

The problem with all this is exits for VC.

- Most VC investments fail, and only a few reach the stage where they can IPO.

In between comes the trade sale or merger.

If exits are blocked, the result will be less investment, less entrepreneurship, and less innovation.

David Stevenson made similar points about the takeover of equity crowdfunded Seedrs by US platform Republic.

- This comes on the back of the CMA blocking the merger of Seedrs with its UK rival Crowdcube.

Crowdcube has also since done a deal by rating money from the US owner of SeedInvest, another US crowdfunding platform.

David is not happy:

Anyone with more than passing knowledge of UK economic history after the second world war will spot a pattern. The UK innovates, gets to first base with a product but then doesn’t quite have the scale to move something into a global market.

Said innovators then get together and try and build a stronger strategic entity but the regulators cry wolf, stop the deal and then the Europeans/Americans swoop in and grab our innovation crown jewels.

I struggle to see equity crowdfunding as a crown jewel (or even as much of a net benefit at all, at least as currently implemented in the UK) but I do agree with David about the implications for entrepreneurship.

You work your guts off to build a new product category, you are just about to get scale in your home market, aware that other international players are merging. You suggest a market rationalization and the regulators stop you dead in your tracks because it is ‘anti-competitive.

You throw your hands up in the air and then accept the best offer from a player in a much deeper capital pool which is usually the US. And yet again the UK loses a possible strategic player. Shame on the regulators.

Dodl

AJ Bell has announced that it will launch a phone-based trading app called Dodl in 1H2022.

Andy Bell, AJ Bell CEO, said:

Dodl by AJ Bell is for anyone looking for a low-cost, easy-to-use investment app to help them meet their investment goals such as saving for a house deposit, holidays or retirement. The intuitive investment journey and streamlined investment range will appeal particularly to those that are new to investing

and want a simple way to manage their investments.

It’s received a lot of press as a “free trading app” because there will be no transaction charges.

- But it’s not free, as there will be a custody charge of 0.15% pa.

This is the same as the Vanguard fee, but Dodl won’t restrict you to Vanguard funds only – though it will have “a simplified investment range which AJ Bell believes

will meet the needs of most investors “.

What we know at this stage is:

- at launch, Dodl will offer a restricted range of 30 funds and 50 UK shares

- the app will just have UK equities at launch – and won’t include investment trusts – but there are plans for global stocks to follow

- there will be themed investments, including technology, robotics, healthcare and responsible investing

- AJ Bell’s “low-cost” multi-asset funds, which cover six different risk levels, will be included

There will apparently be ISA and SIPP options as well as a GIA.

On the downside, Dodl has no fee cap (it has a minimum of £1 per month), so it’s for small accounts only.

- More evidence that this is a “down with the kids” play comes from Apple and Google pay integrations.

Apparently, the app will feature “friendly monster” characters (Clippy, anyone?) as guides.

- I have a feeling this could attract ridicule.

I can see why AJ Bell wants to do this – their average account size is £200K whereas Freetrade attracts customers with an average balance of just £1K.

- The custody fee and restricted investment ranges are deal-breakers for me, but I also have some doubts that the kids will be interested once they find out that AJ Bell is behind the app.

Tillit

New platform Tillit has a different twist on “low cost”, but once again, I don’t buy it.

- Tillit charges a 0.4% pa custody fee on 95 OIECs, investment trusts and ETFs but the fee drops by 0.01% per year until it reaches a floor of 0.25% pa.

Felicia Hjertman, Tillit CEO (and formerly of Baillie Gifford) said:

Tillit is all about leveraging deep expertise from asset management and building an outstanding platform that fundamentally helps people make better and more informed long-term investment decisions.

The cost angle isn’t convincing – after 15 years you’ll have a portfolio that has cost you an average of 0.325% pa (ignoring portfolio growth and fund fees) and an ongoing charge of 0.25% pa.

- Those are not low numbers.

CGT and IHT

The government plans to largely ignore the Office of Tax Simplification’s recommendations on CGT and IHT.

- In particular, there probably won’t be cuts to the CGT allowance or increases to the CGT rate (to align it with income tax rates).

The Treasury has accepted five of the OTS’ 14 recommendations on CGT and has agreed to consider another five, but they are all minor technical issues.

The news came in a letter to the OTS from Lucy Frazer, financial secretary to the Treasury:

As you rightly highlight in your first report, these reforms would involve a number of wider policy trade-offs and so careful thought must be given to the impact that they would have on taxpayers, as well as any additional administrative burden on HMRC.

The government will continue to keep the tax system under constant review to ensure it is simple and efficient. Your report is a valuable contribution to that process.

The Treasury rejected all eleven recommendations on IHT.

Frazer wrote:

The Budget in March announced that the nil-rate band and residence nil-rate band will be maintained at their 2020-21 levels up to and including 2025-26. Any potential changes to reliefs and the regime for lifetime gifts must be considered in this wider context.

The government has decided not to proceed with any changes at the moment, but will bear your very valuable work in mind if the government considers reform of IHT in the future.

Quick Links

I have just two for you this week, both from Alpha Architect:

- They looked at the relationship between interest rates and the value factor

- And they dissected the green returns from ESG investing.

Until next time.