Weekly Roundup, 7th September 2020

We begin today’s Weekly Roundup in the FT with John Redwood, who was wondering whether the markets would miss Trump.

Contents

Trump

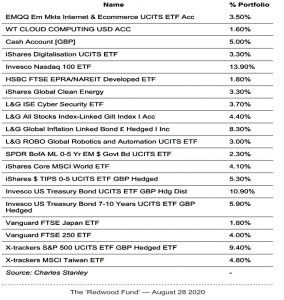

In his regular update on the ETF portfolio he runs for the FT, John Redwood wondered whether the markets are going to miss Trump.

- His tax cuts and promotion of jobs and growth have been popular with investors.

And last week’s crash notwithstanding, the US market has done well since he took charge.

- But it looks like Biden will win the election, barring a vaccine and/or an economic recovery by November.

Biden will raise corporate and personal taxes, which will be bad for shares.

- He also supports the green revolution, which will hurt oil and gas.

John has made no adjustments to the portfolio as yet but is monitoring developments.

- He remains out of Europe because of slow growth, virus policies which have damaged local economies and a lack of tech firms to exploit the new normal.

But John does expect a recovery in traditional sectors eventually:

There will be some fast rates of profits growth with the return of some dividends in those sectors and geographical areas most damaged by the virus recession. The companies that survive in badly damaged sectors may emerge in a stronger position in due course.

And a Biden presidency could help Europe, with taxes on the digital giants and common cause in ESG.

Monetary policy

Joachim Klement provided some evidence that monetary policy has become completely ineffective.

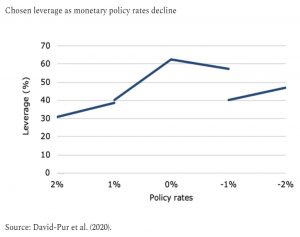

- A new study looked at investors’ willingness to borrow (and increase their risk) in a negative rate environment.

Participants were randomly assigned to groups with different starting rates.

- They allocated their borrowings to either risk-free cash savings, a medium-risk bond or a high-risk stock.

Before a second round, they were told that the central bank had lowered interest rates by 1%.

In a world of positive interest rates, lower rates increase the demand for loans. In a world of zero and negative interest rates, they don’t.

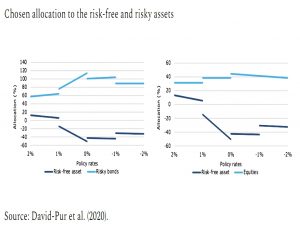

The interest rate regime also affected asset allocation.

In positive territory, lower rates mean a higher allocation to stocks and bonds.

- In negative territory, the allocation to bonds goes down and cash stays flat.

Joachim draws a parallel with Japan:

Despite zero interest rates, Japanese households and businesses have an extremely high cash quota in their savings and have been reluctant to take out loans. Could it be that we are heading down the same road?

Private equity

Buttonwood wondered whether private equity’s numbers can be trusted.

- The SEC in the US has just widened the qualifications for “accredited investors” who can invest in the asset class to include some retail investors.

Here in the UK, there are many listed PE investment trusts which allow retail investors access (though perhaps not to the very best deals).

- Even in the states, many of the largest PE firms are individually listed.

There are three problems with the data:

- The amount of money raised by the industry each year is not precisely disclosed, and estimates vary by as much as 25%

- Returns are measure using IRR on the capital used to buy corporate assets, ignoring the “cash drag” before the money is committed.

- IRR also assumes that disbursements from PE funds can be reinvested at the same rate, but this is common to most methods of calculating return.

- There is no widely accepted benchmark, and no common measure of risk (the equivalent of the Sharpe ratio for listed markets).

We’ve previously looked at analysis which shows that PE mimics returns from small-cap value, but with lower apparent volatility because of a lack of mark-to-market during downturns.

- These characteristics are useful to certain long-term investors (endowments and pension funds).

And the tendency for firms to IPO at a later stage in their development – when more value has already been extracted by insiders – has created a FOMO which PE (and VC even more so) can partially calm.

- So even if an increased focus on transparency reveals that the Emporer has no clothes, I would expect PE to remain popular.

In the FT, Merryn Somerset Webb picked up on the theme of later IPOs, contrasting Amazon and the Hut Group.

- Amazon raised $50M in 1997 when the company was three years old.

The Hut Group is fourteen years old and is raising $1 bn.

- More importantly, it doesn’t need the cash – the listing is an exit event for early backers, including PE firm KKR, which owns 19% of the company.

The average age of an IPO firm in the US is now 11 years, up from 8 in the 1990s.

Merryn worries about inequality and support for capitalism if the main gains are hoovered up by a few early investors.

- But the cost of a listing has increased, and so has the public scrutiny of listed company executives.

Merryn also notes increased demand for PE from pension funds looking for higher returns to close the gap between assets and liabilities.

- Historic PE returns have been good, but they will be harder to sustain as the industry continues to grow.

Hell is other bondholders

Buttonwood also looked at the ways in which bondholders have much to fear from other, less predictable investors.

He explained the “Pac-Man” strategy used by defaulting governments, under which the lender offers new bonds with gentler terms.

- Since “collective-action” clauses usually allow it to combine several bonds under one offer, the government might hope that a majority of holders from less penalised issues will outvote the diehards who have most to lose.

If offers were made separately, the diehards might expect a better deal from the savings made when paying off the easy touches.

- NML Capital held out for 15 years from 2001 on an Argentinian bond without collective action features.

The government can improve its chances by making an offer to the weaker bondholders which is just good enough to secure a majority.

- A slightly better offer to a wider group will now attract the votes of all who voted no to the first offer since it is better than an offer they are bound to.

So only a few holders of the diehard bond need to come across to produce the two-thirds majority usually needed for approval.

Argentina additionally threatened to use “redesignation”, where bonds which vote against the deal are excluded from it after the fact.

- In the end, they didn’t have to, as the offer was approved.

Stock splits

On his Musings on Markets blog, Professor Aswath Damodaran looked at the impact of stock splits and index inclusions.

- We have recently seen Tesla and Apple surge (and then fall back) after supposedly neutral stock splits.

- Tesla was also slated for inclusion in the S&P500 index but wasn’t added in the end.

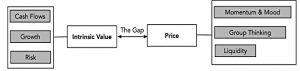

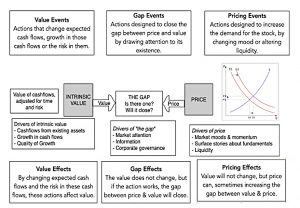

Damodoran suggests that different investors care about different things.

- In particular, traders follow price, whereas value investors look to buy when the price is below (intrinsic) value.

- Efficient market advocates believe that price and value are always the same thing.

He also identifies three kinds of stock events:

- Value events (eg. new shops, factories and channels) change future cash flows (and hence value)

- Gap events (eg. spin-offs and activist investor actions) draw attention to gaps between value and price (and hence narrow them)

- Pricing events (eg. the listing of foreign companies on mainstream exchanges) change the price of the company (and hence the gap to value)

Stock buybacks can fall into any of the categories, depending on the motivation.

Stock splits are pricing events, just as renaming a stock or ticker to something memorable is a pricing event.

- A stock split attracts new investors (including those put off by the old high price) and creates confusion.

Value investors would continue to view Apple and Tesla as over-valued after the split.

- And they could not expect the split to close the gap to value, since these stocks are already two of the most widely followed globally.

But for traders, the split could keep recent price momentum going for a while, and so you might want to buy more (supporting the price, a self-fulfilling prophecy).

- As it happened, momentum fell away within a couple of days, even more so for these two stocks than for tech stocks in general.

SIPP access age

The government has confirmed that it plans to increase the age at which an individual can access their private (non-workplace) pensions (ie. SIPPs) from 55 to 57.

- The change is slated to happen in 2028, but there is as yet no timetable for the introduction of legislation.

There has long been an aspiration that SIPPs should be accessible ten years before state pension age (which will increase to 67), but nothing has been said about this since the pension freedoms were introduced in 2015.

- It’s an annoying change for those in their forties, though slightly less annoying than the previous increase in the access age from 50 to 55 (I missed out by six months on that one).

Anyone wanting to quit work before 57 should ensure they have enough in their ISA pots to bridge the gap.

Quick Links

I have seven for you this week, the first three from the Economist:

- The newspaper wondered what Warren Buffett wants with Japanese trading houses

- And asked if Abenomics worked

- And considered whether Wizz Air might soar amid the pandemic

- Mauldin Economics reported that an inflation virus had struck the Fed

- Alpha Architect looked at the effects of portfolio construction on the performance of style factor ETFs

- Pragmatic Capitalism examing the COVID price compression in technology

- And Finimus explained why you shouldn’t currency hedge your equity portfolio.

Until next time.