Weekly Roundup, 21st February 2017

We begin today’s Weekly Roundup in the FT, with the Chart That Tells A Story. This week it was about missing the best days in the market.

Contents

Caught with my pants up

I’m always fully invested. It’s a great feeling to be caught with my pants up. – Peter Lynch

Hugo Greenhalgh looked at data from Psigma on the downside of trying to time the market.

- Missing the best few days in a 20 year period has a massive impact on returns.

The FTSE All-Share returned more than 250% over the last 20 years, but missing just the 20 best days reduced that return to only 30%.

- Miss the 40 best days and you lost 30%.

This is a concept I first came across in Peter Lynch’s 1989 book “One up on Wall Street”.

- But apparently, more than a quarter of a century later, there are some people who haven’t heard.

[amazon template=thumbnail&asin=0743200403]

Emerging Market ETFs

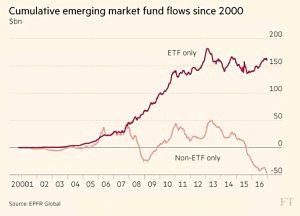

Terry Smith (who runs an emerging market investment trust) looked at the recent cash flows into emerging market ETFs.

- Terry claims to be in favour of passive investing, but he doesn’t hesitate to point out the “drawback” to trackers – that “they deprive investors of the opportunity to focus their investment only in good companies and/or shares which offer reasonable value or better.”

- He also says that many active funds are really closet trackers, but with higher fees which guarantee their underperformance.

Another problem with trackers is that they route new money towards the stocks that make up an index, based on market cap rather than the attractiveness of the stock.

In recent years a lot of money has flowed into emerging market ETFs, while active emerging market funds have seen modest outflows.

Terry’s concern is that the companies in the MSCI emerging markets index are not good ones.

- The return on capital (ROCE) of the top ten stocks is “just” 12%.

- The PE of the top ten stocks in the index is 28, compared to 23 for the index as a whole.

Moreover, ROCE has been falling for a decade.

- Terry puts this down to the availability of almost free debt to the big Chinese firms.

- He draws parallels to the dot-com boom and to the Japanese boom of the late 1980s.

Although the money flows will push up the prices of these “bad” companies in the short term, Terry sees this as an opportunity for active managers (such as himself) to buy the shares that are better than the index.

- Thus active management can exploit inefficiencies driven by the rise of passive management.

Not a bad article, but I’m not sure that the FT should be in the business of providing Terry with a marketing platform like this.

- I’d like to see more features from people with nothing to sell.

National Insurance

Paul Lewis was arguing for harmonisation of the national insurance system.

- He thinks that it’s unfair that the self-employed pay a lower rate of NICs than the employed.

I’m generally in favour of tax simplification, but I’m not sure that this is unfair.

- Perhaps the government wants to encourage (riskier) self-employment and is creating an incentive.

Paul explains that when the rates were set in 1978, the difference reflected the extra contributions by the employed to the second state pension (SERPS, since abolished).

- Since the self-employed weren’t eligible for SERPS they paid power NICs.

That’s evidence for the thinking behind the rates in 1978, but it doesn’t mean that the present government might not want to encourage the self-employed.

Harmonising the rates would raise close to £1 bn a year, but wouldn’t really harmonise contributions, since the employed also drive contributions by their employer.

- Paul isn’t suggesting that the self-employed also make up this shortfall.

- He’d like businesses who use the self-employed to pay extra instead.

Paul also hints that he would like the 2% rate on salaries above £43K harmonised with the 12% below £43K.

- Effectively, this raises higher rate tax from 42% to 52%, and additional rate tax from 47% to 57%.

- I’m pretty sure that rates this high would be counter-productive.

Paul has two further wishes:

- that “unearned” income (buy to let rentals, but also interest on savings, and dividends) should be taxed as heavily as earned income (ie. effectively have NI charged on it), and

- that pensioners who work past the state pension age should also pay NICs

This is equality gone mad.

The national insurance system is based around the idea that you make 35 years of contributions in order to qualify for the state pension.

- Once you’ve made these 35 years of contributions, there’s no moral argument that you should make more.

- Once you reach state pension age, and start drawing out, there’s no legal compunction to make further contributions, either.

The government is free to set NIC rates as it pleases, and they don’t have to be the same for everyone.

- An unearned income has nothing to do with earned income.

Work is for the young(-ish) and unearned income is for those too old to work.

- As we pass through life, we convert human capital to actual capital, hopefully in large enough amount that we can live off it in retirement.

- That capital has already been taxed, and doesn’t need to be taxed again, let alone at punitive rates.

- The income isn’t unearned, it was likely earned decades previously.

Let’s give thanks that Paul doesn’t have the ear of the chancellor, but merely the ear of Radio 4 listeners.

Tax and marriage

Merryn this week introduced me to the Kakuhido, the Japanese “Revolutionary Alliance of Men that Women Find Unattractive”.

- Apparently they organise protests against Valentine’s Day.

Merryn was arguing that the UK tax system is stacked against the unmarried, but I can’t say that I’m totally convinced.

Let’s look at the breaks for the married:

- if one spouse earns below £11K and the other below £43K, £1.1K of allowance can be transferred, saving a massive £220 a year in income tax

- assets can also be moved around between spouses to use up income allowances and CGT allowances

- and when the first spouse dies, their assets and IHT allowance can be passed to the survivor

But there are no breaks for the married on SIPPs and ISAs, or on property, which are the main three ways to build wealth in the UK.

It seems to me that the advantages that being married provides depends on the amount of assets that two people have.

- Couples with assets significantly above the £650K IHT limit for a couple won’t gain much from the shuffling around of ownership (they will likely each be above the income and CGT limits already)

- They might do better by owning a property each, avoiding CGT on the sale of one of them.

That said, getting married before you die looks like a no-brainer, apart from the difficulty of timing this particular market.

Bond downgrades

Over in the Economist, Buttonwood looked at the credit ratings of sovereign bond issuers.

- Britain lost its AAA rating in 2013, and there are now only 11 countries left with one (down from 16 in 2009).

- Just 40% by value of global sovereign debt is now AAA, down from 48% ten years ago.

Corporate bonds have been downgraded even more.

- there were 99 AAA US companies in 1992

- now there are two

Buttonwood links this to the tax deductibility of debt interest.

- This makes it efficient to increase debt levels.

- More debt means more risk, which means lower ratings.

At the sovereign level, the downgrades haven’t made much impact.

- Central banks are willing buyers of government bonds, and commercial banks, pension funds and insurance companies also need to own government bonds for liquidity or regulatory reasons.

- Buyers are relatively indifferent to yield, and yields have stayed low despite the continued deficits and soaring debts.

The bond vigilantes that spooked politicians in the 1990s have lost their menace.

If growth does not pick up, a future crisis looms.

- Another two or three percentage points on yields will make these debts difficult to service in a developed world strained by adverse demographics.

Market euphoria

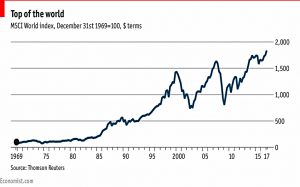

A second Buttonwood article look at the return of euphoria to the markets.

- There are signs of global recovery, and hopes of tax cuts in the US.

- Commodity prices are up and the Chinese economy is not slowing as much as was feared.

- Global growth is forecast at 3.4% for 2017, up from 3.1% in 2016.

The markets – including the World Index – have been hitting new highs once more.

Of course, politics – a Le Pen victory in France, for example – might yet derail things.

- Congress might not approve all of Trump’s tax cuts and infrastructure spending.

- And there could yet be trade wars.

Watch this space.

Copper

The Economist also reported on increasing optimism about the copper price.

Unlike the commodity supercycle, where the driver of prices was the level of demand from China, there is now a focus is on supply as well.

- Strikes and other disruptions are building a story of shortages.

- Labour contracts on 14% of production are up for renewal during 2017.

McKinsey has also forecast increasing demand for the next 20 years, driven by China, electric vehicles and alternative energy plants.

Short-termism

Schumpeter looked at the “slippery idea” of corporate short-termism.

- The idea dates back to Keynes in the 1930s, but it is now a widely held view that investors and company executives are myopic, constraining long-term investment.

- For every dollar of operating cash flow made by S&P 500 companies, 56 cents goes on dividends and share buybacks.

A new study from McKinsey used five measures to identify short-term companies:

- investing little

- cutting costs to boost margins

- share buy-backs

- booking sales before customers pay

- making their quarterly profits forecasts

This meant that 73% of companies qualified as short-termist

- And the 27% of long-termist firms performed better.

- Their profits grew by an average of 36% more than short-termist firms, between 2001 and 2014.

But the Economist is not convinced that short-termism exists.

- S&P 500 CEOs now serve 11 years on average, the longest for 13 years.

- Activist hedge funds have little role in the stock market, owning less than 1% of shares.

- Although holding periods for stocks are down, this is largely down to high-frequency trading.

- In parallel there has been a significant rise in the use of passive funds, which own 13% of the market and hold shares indefinitely.

- Bond investors lend to governments over a period of 30 years.

- Equity investors attach huge valuations to firms that won’t be significantly profitable for years (Amazon is a good example).

- Investment by S&P 500 firms is 9% of sales, in line with the 25-year average.

- Private sector capital spending is 12% of GDP, in line with the post-war average.

- High levels of share-buy backs reflect abnormally high profits (and possibly increasing concentration in many industries).

- Investing all of surplus funds would increase investment to 17% of sales, a level the newspaper calls “reckless”.

Nor is it clear whether McKinsey’s short-termist companies became weak, or whether weak firms adopt strategies which identify them as short-termist.

- Shrinking firms are supposed to cut costs and return cash to investors.

The Economist feels that the way forward is not to prod profitable incumbents into investing their vast profits.

- Instead, competition policy should be used to weaken the position of established firms and encourage new entrants.

- This in turn would shrink the profits of incumbents, boost wages and make the economy more dynamic.

Links

Finally, a few links that I tweeted out this week:

[contentcards url=”http://simple-living-in-suffolk.co.uk/2012/02/i-was-too-poor-to-live-in-london-so-i-moved-out-whats-so-hard-to-understand/” target=”_blank”]

[contentcards url=”http://aswathdamodaran.blogspot.co.uk/2017/02/a-snap-story-valuing-snap-ahead-of-its.html” target=”_blank”]

[contentcards url=”http://blog.alphaarchitect.com/2017/02/16/tactical-asset-allocation-insights-with-the-brains-from-thinknewfound/” target=”_blank”]

[contentcards url=”https://www.theguardian.com/money/2017/feb/17/one-in-four-uk-retirees-burdened-by-unpaid-mortgage-or-other-debts” target=”_blank”]

[contentcards url=”https://www.ftadviser.com/Articles/2017/02/13/Pru-s-exit-shows-annuities-are-now-a-specialist-product” target=”_blank”]

You can find more like these at our link archives.

Until next time.