Weekly Roundup, 13th January 2020

We begin today’s Weekly Roundup in the FT with Lucy Warwick Ching, who was writing about forthcoming changes to the savings market.

Single rates

Lucy reported that the Financial Conduct Authority is proposing that banks can only offer multiple introductory rates for up to 12 months.

- After that, they would be forced to provide a single rate across all their easy access accounts and another rate for Cash Isas.

Christopher Woolard, FCA executive director of strategy and competition, said:

Competition is not working well for many of the 40m consumers with easy access savings accounts and we want that to change.

The FCA said it hoped that the measures would:

Prevent firms from gradually reducing interest rates over time and make them compete for all their customers.

They estimate that consumers will benefit from £260M in extra interest each year.

Not much to argue with here, but you would still need to manually switch away from an uncompetitive account, and that process is unchanged:

- Check your own interest rate

- Check the market-leading rate

- Switch accounts if you are far away enough from the leading rate.

I’m not sure how this welcome simplification will help those who are too apathetic to switch.

- And of course, it could even lead to lower rates overall, albeit they are simpler.

Tandem

Sticking with the cash end of the investing spectrum, Tandem has announced that its cashback Mastercard (which pays 0.5% and is accepted everywhere – and of which I have been an enthusiastic customer) will attract a £5.99 per month fee from March.

- In return for this, we’ll get interest-free borrowing and a market-leading savings account paying 1.50% pa (I can’t find out if this is easy access or fixed-term).

The change has not gone down well on the internet forums I frequent, but finding a better replacement product is not straightforward.

It’s possible to earn more cashback than the new £72 annual fee, but it’s not simple.

- Tandem don’t offer credit limit increases, which means that half-way through the month, your account can fill up as you wait for the previous month’s statement to be paid.

- You can make advance payments, but it’s a little fiddly.

My £6K limit effectively caps my spend at around £48K, or £240 in cashback.

- I’m actually spending a bit less than that, but still getting close to triple the new monthly fee.

The boost in savings rate 0.15% pa over Marcus could also be worth £75 on a £50K deposit – enough to pay for the new fee on its own.

The alternative cashback cards come with fees or limitations:

- Aqua is capped at £100 cashback per year, paid annually, and starts you off with a low credit limit (it’s aimed at people trying to repair their credit scores.

- Amex Cashback is not accepted everywhere.

- John Lewis offers vouchers rather than cash.

- Amazon does the same and only pays 0.25% when not on Amazon (but 0.75% there).

- Santander All-in-One has a £3 a month fee.

I think I’ll apply for the Santander card and see if they offer me a large enough credit limit.

- But I wish that Tandem would reconsider.

Mini bonds

In FT Adviser, Imogen Tew reported that the Financial Services Compensation Scheme (FSCS) has decided to refund 159 minibond holders who lost money when London Capital and Finance collapsed.

- LCF went into administration at the end of January 2019, risking £237m invested by around 11,600 people.

The FSCE decision is obviously great news for those 159 individuals, but it’s also an interesting precedent.

- Mini-bonds were/are a pretty obviously dud product, offering very high returns from lending to small and very risky companies.

They present as bonds but come with equity levels of risk (but no upside).

- Sometimes they have a “guarantee” from the company itself, which is obviously worthless.

The LCF bonds were unregulated investments (and so outside the compensation scheme), but LCF itself was a regulated firm for part of its life.

- The FSCS has confirmed that 283 bondholders who dealt with the firm before it was authorised would not be covered by the scheme.

So it boils down to whether the firm gave bad advice, even though it was not regulated to provide this advice at all.

The FSCS said:

While we acknowledge that many customers were given incorrect information about investing in LCF bonds, being given incorrect information on its own does not constitute misleading advice. For that reason we believe many LCF customers are unlikely to be eligible for compensation.

I would be surprised if the majority of investors were advised at all.

The FCA has banned the marketing of mini-bonds to retail investors until the end of 2020.

- It’s probably best that the ban becomes permanent – it’s hard to think of an investor for whom these products are suitable.

Redwood fund

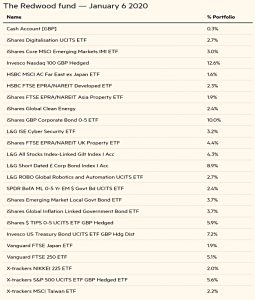

John Redwood provided his regular update on the ETF fund he operates for the FT.

The Democrats are struggling to find a candidate to beat Trump, with three moderates and two leftists leading the battle as we head towards the first primaries in February.

- Trump has to get through his impeachment, but that looks very likely.

Trump will do all in his power to stimulate the economy, promote faster growth and claim credit for anything that looks good economically. The support of both the Fed and the administration for more growth is a positive for the markets.

The other big issue is the climate change summit in Glasgow in November.

Will the Europeans and their allies press ahead without the US, India and China joining in? Will there be some compromise to claim that India and China are doing their bit?

As the EU advances with its own green deal, what kind of inroads will it make into the profitable business models of traditional carmakers, airlines, oil companies, sea freight and the rest?

Technology will benefit, while those [sectors] such as industrial, coal and mineral extraction and oil will suffer some discount as funds screen out certain types of share and sentiment turns against them.

Monetary policy

The Economist accused former Fed chief Ben Bernanke of being complacent in thinking that monetary policy will be enough to fight the next recession.

Next time we’ll be starting with rates already low, but Ben thinks that QE and FG are worth around 3% in interest rate cuts.

- Which means that we might only need two or three per cent of real interest rate cuts.

That leaves the US in a relatively comfortable position, but the Euro zone, Japan and the UK in trouble.

- The Economist thinks that helicopter money might be needed, and I tend to agree.

Oil stocks

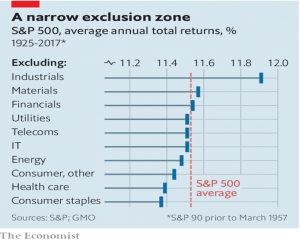

Buttonwood wrote about Jeremy Grantham’s (the G in GMO) thoughts on the hazards of owning fossil-fuel stocks.

- Grantham is a value investor who has turned against oil stocks.

He has looked at how omitting a sector would impact long-term returns (from the S&P 500).

- Between 1989 and 2017 the range across all 11 portfolios was just 0.5% pa.

Leaving out energy boosted returns from 9.71% pa to 9.74% pa.

- The long-term story from 1925 is similar, though this time energy stocks boost returns be around 0.05% pa.

The market, it seems, has done rather a good job over time of pricing stocks so that no broad industry group yields abnormal returns.

Grantham thinks that oil might prove to be an exception, as climate change scepticism in the US means that all the risk is not yet in the price.

- Grantham thinks that oil firms need to be made into pariahs so that politicians will take the necessary action, but that sounds like guilt talking to me.

I think that a lot of greenery is simply re-badged anti-capitalism, and that tech optimism (over things like batteries) might lead to prices overshooting in the opposite direction in the near future.

- We live in interesting times.

Quick Links

I have eleven for you this week.

The first two are from Alpha Architect, there are three from the Economist and there are also three annual portfolio reviews from UK Private Investors (my own was published last week).

- Alpha Architect looked at forecasting US Equity Market returns using machine learning.

- And at the Low Volatility Puzzle

- The Economist looked at why price controls are hard to get rid of

- And at new research that says that interest rates have been falling for centuries

- And noted that gold is at a seven-year high

- Human Progress explained why Anti-Capitalism is Trendy but Wrong

- Richard Beddard reported on his Best Year Ever

- Maynard Paton had an end-of-year portfolio review

- And so did the UK Value Investor

- Meanwhile, Flirting with Models were Pursuing Factor Purity

- And the FT wondered whether Vanguard’s role in the US financial system was too big to be healthy.

Until next time.

Re TANDEM:

Out of interest, since you stopped working have you experienced any difficulties when applying for credit?

I ask as other bloggers report major issues, see, for example, the comments about mortgages and credit at this post at Simple Living in Somerset https://simplelivingsomerset.wordpress.com/2019/09/12/__trashed-2/

No problem with credit cards or new bank accounts, but I don’t have any real debt at the moment.

Not planning on having any, though I do have one more house move in me and if asset prices moved against me it’s possible I might need to borrow. I’ve earmarked the cash lump sum from our DC pensions to bridge the gap. My partner is still working so it’s possible she could borrow, though I expect her to have stopped if/when we need the money.

I think one big problem is that you can’t borrow against tax-sheltered accounts. If I had all my investments in a taxable account with IB, they would lend me money against the portfolio. But you can’t do that with ISAs and SIPPs, which is where most of my money is (other than property and DB pensions).

Thanks for this prompt and very interesting reply.

If I understand what you have said in your last paragraph correctly this could entirely explain the discrepancy between Ermine and Boltt’s bad (re-)mortgage experiences versus FIRE v London’s “dream house” buying experience.

Thanks again.

FvL definitely borrows against his IB portfolio – he’s mentioned it several times.