Weekly Roundup, 9th March 2020

We begin today’s Weekly Roundup once again with the big story – the coronavirus and its impact on the markets.

Market outlook

The trouble with writing a weekly report is that sometimes events in financial markets move more quickly than that.

- As I write, the FTSE-100 is down more than 6% this morning, having started out close to 9% down when I woke up.

As such, the coronavirus articles from the past seven days that I had planned to review are largely outdated (in terms of detail, at least).

- The news from Italy continues to be bad, whist that from South Korea and China (if it can be trusted) appears to be a little better.

The UK is around two weeks behind Italy in terms of cases, so we should know a lot more by the end of March.

Oil shock

To go with the general market panic, we now have an oil shock, which both John Authers and Joachim Klement wrote about (we’ll have more from Joachim later).

- The price is down by around a third today, at close to $30 a barrel.

Unusually, the dollar isn’t spiking, other than against petro-currencies.

It should be noted that a lower oil price is usually good for the global economy and that a supply shock like the current crisis should not have lasting implications unless it goes on for a year or so.

- In which case, there would be a boost to GDP of around 0.3% – not enough to offset the effects of the virus.

The last time this happened was 1991, at the start of the first Gulf War.

- That time the collapse was because the US flooded the market with its oil reserves.

This time the crash is because the cooperation between OPEC and Russia to limit supplies has broken down.

- More production cuts had been expected to offset the impact from the virus on the global economy, but instead, Russia and Saudi Arabia had a row and have both increased production.

There’s speculation that as well as hoping to steal market share, both sides would like to kill off US shale production and delay the move towards electric cars.

- Shale operators are largely unprofitable below $50 per barrel.

Russia can reportedly produce at less than $20 per barrel and producers would be profitable at $40 per barrel.

- So the Saudi move is designed to hurt them too, and Joachim expects Russia to backtrack at some point.

Shale operators are also often heavily leveraged and this will put further pressure on the Fed to cut rates.

- The market is now pricing in another 0.75% of cuts at the March meeting.

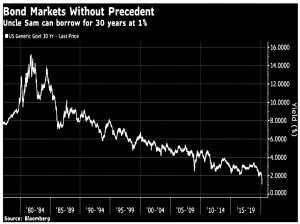

The 10-year Treasury yield has fallen below 0.5% pa, just a week after hitting 1% for the first time ever.

- The 30-year is now below 1%.

John notes that the fall in fuel prices will make it harder for central banks to stoke inflation.

- He expects banks and energy stocks to suffer, as well as cyclicals and emerging markets.

Joachim expects consumer stocks to be the main beneficiaries of the fall in the oil price, and in particular producers of energy-consuming goods and services (cars and airlines).

John also suspects that this could be the end of both the trust in central banks to control deflation and of the belief that the US can stand alone as Europe and Japan sink into negative rates.

Higher-rate pension tax relief.

In MoneyWeek, Merryn Somerset Webb and Max King debated the merits of higher-rate tax relief on pensions.

Merryn’s argument is that private pensions savings are designed to keep people off state benefits.

- She thinks that people need around £17K pa to live on and that £9k pa of that could come from the state pension.

Which means that people “only” need to save a pot of around £300K (£10K pa @ 3% SWR) at the most – implying that the current LTA of more than one million is very generous.

I agree in principle, but I would be more generous.

- Let’s assume that people would like to retire on £25K pa and that we are prepared to allow them to generate the entire amount from their private pension.

Then with current annuity rates and the prevailing drawdown age of 55, a pot of £1M sounds about right.

- And that’s without looking at the problem the LTA is causing for high earners like NHS doctors.

In my opinion, we just need an input cap (the £40K pa) and not an output cap as well.

Merryn’s argument doesn’t seem to have much to do with the higher rate relief, but she thinks that it just encourages people to save the rest of the pot between £300K and £1M.

- Since I think that target is fine, I have no issue with the relief.

The other problem is that without 40% relief upfront (or at least 30%, assuming we switched to a flat-rate system for all taxpayers), pensions would look unattractive in comparison to ISAs, which don’ lock your money away for decades.

Max goes further and thinks that without 40% relief, there would be less retirement saving overall, into any vehicle.

- Since the relief is really deferral (pensions are taxable) and higher-rate taxpayers pay most of the tax, it’s not surprising that they also attract most of the “relief”.

Max even argues that scrapping the relief would amount to double taxation (on the way in and the way out) but I can’t see that – I think people would simply avoid pensions.

CAPM

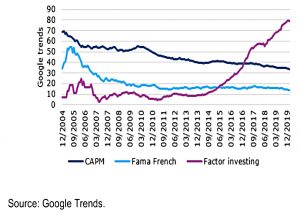

Joachim Klement also wrote about CAPM, which he called one of the models that won’t die.

The model predicts that financial assets should follow a simple linear model and returns should merely be a reflection of the systematic risk of the asset relative to the market.

The existence of outperformance factors like (small) size, value, momentum and low vol clearly violate the model.

Joachim points out that the assumptions behind the model are famously unrealistic:

- Investors are rational, risk-averse and aim to maximise their utility function (if they know what that is).

- There are no transaction costs or taxes.

- You can borrow (and lend) unlimited amounts at the risk-free rate.

- All information is available to all investors at the same time.

Some observers rely on the wisdom of crowds to defend these assumptions:

Individual investors may not be rational, may be taxable or face other frictions like transactions costs, but if you average them out, the market overall acts as if the assumptions were true.

The problem with this is that some of the requirements for crowd wisdom (independent opinions, specialised knowledge and trust in fairness) do not apply here.

Joachim notes that Google searches for CAPM and for Fama and French (popularisers of the model) are falling, while those for factor investing are increasing:

So perhaps investors are getting the message at last.

P2P aggregators

It was reported last week that Orca had shut down its P2P aggregator platform (to retail customers, at least).

- BondMason and Goji closed their aggregators in 2019 (and LendingWell closed in 2017).

InvestUp is now the last remaining aggregator with its CrowdISA, to be launched in 2Q20.

When they were launched, aggregators seemed to solve one of the problems with P2P – the lack of diversification other than at large size.

- Generally, each IF-ISA provider allows access to their own platform, so you would need five years (and £100K) to build up a suitable level of diversification.

But in practice, the aggregators failed to sign up the leading platforms.

- And aggregation doesn’t solve the issue that the IF-ISA is a substitute for the superior tax shelter of an S&S ISA, rather than there being a separate allowance for P2P.

In addition, the returns on offer don’t compensate for the associated risks (which have increased in recent years).

The final straw appears to have been regulatory changes which require investors to self-identify as high net worth, sophisticated or “restricted” investors.

- There are similar arrangements in place for most VCT and EIS investments (other than crowdfunding), but these target a very different investor base.

All in all, P2P has been one of those financial innovations which sound like a good idea but have failed to deliver a “must-have” asset (over fifteen years now).

Quick links

I have four for you this week:

- Joachim Klement looked at Bubbles and Negative Rates

- ERN pointed out that it’s not even a bear market yet (that was last week, of course – as I write we have a bear in the UK)

- Alpha Architect provided a rebuttal on their Smart Money Indicator,

- And Flirting With Models explained Why Trend Models Diverge.

Until next time.