Weekly Roundup, 26th May 2020

We begin today’s Weekly Roundup in the FT with the Chart That Tells A Story, which this week was about inflation.

Contents

Inflation

Madison Derbyshire reported that we once more have savings accounts that pay more than inflation.

- Don’t worry though, savings rates will catch up (ie. be cut) in a few weeks.

The pandemic has driven inflation down to 0.8% pa.

- This is down to collapsing commodity prices and reflects the increased tendency of consumers to save rather than spend.

I can’t say my personal experience over the past few weeks matches up to these figures.

- I’m really only buying food and drink, and they are definitely more expensive than at the start of the year.

Let’s hope that we don’t move from low inflation to full-on deflation.

- The expectation that prices will fall in the future can lead to consumers delaying purchases and become a self-fulfilling prophecy.

Active vs passive

Merryn Somerset Webb made the case for active fund management, saying that the average UK active fund has outperformed over the long run.

- Neil Woodford’s protege Mark Barnett was sacked by Invesco last week after 24 years at the firm.

Returns on the fund he inherited when Woodford set up on his own have been bad, and money has flowed elsewhere.

- Barnett’s fund was second-worst over one-year, and the worst over five.

Merryn sees the underperformance of Barnett and Woodford’s funds as reflecting the general underperformance of income and value investing in recent years.

- I think Woodford’s misadventures with unlisted biotech – where he had no edge – are also part of the picture.

Merryn is a fan of passive investing, but like me, she thinks that there’s no such thing as truly passive.

- Trackers and ETFs track an index, and that index i9s not the entire universe of assets or even the invisible universe.

And then we come to implementation – which sample of the stocks (or whatever) in an index should buy?

She also thinks that some active funds outperform, giving Scottish Mortgage as an example.

- UK, European and Japanese active funds have outperformed over the last 20 years, though I’m not sure how survivorship bias was accounted for in this analysis.

In the US, passive works better, so it seems that the extent to which the biggest firms are the best performing is a factor.

Unfortunately, we aren’t buying all the funds, but rather just a few of them.

- I have no doubt that some active funds will outperform, but the trick is being able to identify them in advance.

Merryn recommends buying five or six funds that are cheapish and have a large active share (deviation from the index).

- Closet trackers with high fees are the funds dragging down the active average.

I do use a small amount of active management – around 25% of my listed portfolio – for three reasons:

- To access markets and asset classes where passive funds are imperfect or unavailable (small-cap Japan, or real estate, private equity or hedge funds)

- To implement strategies that aren’t available as passive vehicles (eg. trend following)

- And to generally reduce my volatility (and improve my Sharpe ratio) by changing the pattern of my returns through time, relative to market-cap weighted indices.

Market levels

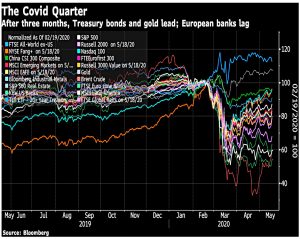

In his Bloomberg newsletter, John Authers did a three-month review of the markets’ slide and recovery from the Feb 19th peak.

Here’s a chart of asset classes, normalised to 100 on Feb 19th.

And here are the scores three months later.

- FAANGs, Tech, China and long bonds have done well.

- Latin America, Real Estate, oil and European banks, not so well.

John notes that the prospective PE on the S&P500 is as high as its been for 20 years, right back to the dot com bubble.

There are two possible justifications:

- The Fed will keep yields historically low, justifying a higher PE

- Prospective earnings are too low (or rather, the bounce back in 2021 will be significant)

John is not convinced:

Does it really make sense to have bid stocks up to this level already? No. To paraphrase [Howard] Marks, we should know what we don’t know, and not position ourselves for the best of all possible worlds.

In MoneyWeek, John Stepek had spotted a contrarian indicator which suggested that the market could have further to rise.

Probably my favourite measure of sentiment is the monthly Bank of America global fund manager survey. This looks at where fund managers around the world claim to be putting their money. If positioning gets extreme, then it often pays to do the opposite.

In the May survey, 70% of managers felt that this is a bear market rally, and only 10% expected a V-shaped recovery.

- They are also holding more cash (5.7%) than at the peak of the 2008 crisis pessimism.

It is useful to know that despite the solid rise in markets since late March, there is still a lot of bearishness about. That implies that we’re nowhere near the point where we have to brace for another big collapse.

Negative UK bond yields

In the Times, Patrick Hosking reported that for the first time in history, investors have lent money to the UK for the long-term, knowing that they would not be repaid in full.

- Or to put it another way, negative bond yields have hit the UK.

We sold £3.8 bn of three-year bonds at an effective rate of -0.003%.

- The nominal rate was 0.75% pa, but investors paid above face value for the bonds.

The UK had previously sold a three-month bill at negative rates in 2016 (following the Brexit referendum), but never before a bond (with a duration of more than a year).

- Negative bank rates are just around the corner.

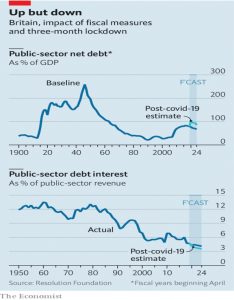

The Economist noted that as the size of the UK debt increases, the cost of servicing it goes down.

Interest costs will take up a smaller share of tax revenues by 2024 than was expected at the budget. Indeed, they will be lower than at any point in Britain’s post-war history. And as existing debt is refinanced the cost of servicing it will fall, too.

No dividends

In FT Adviser, Imogen Tew reported that large businesses borrowing more that £50M from the government thorough the Coronavirus Loan Scheme will not be allowed to pay dividends to shareholders.

- Share buy-backs are also limited, and senior management are banned from pay rises and bonuses.

Let’s hope we have a public list of recipients, so that we know which firms to avoid as investors.

Non-cash assets in pensions

Emma Agyemang reported on an Upper Tribunal ruling that non-cash assets are not eligible for income tax relief when they are transferred into a pension.

- Thousands of investors may now need to pay back millions of pounds of this relief.

These “in-specie” contributions are mostly shares and commercial property.

- These are completely legitimate pension assets, so it’s hard to see the logic in the new ruling.

Small business owners are often short of cash to make pension contributions (though of course, the in species assets could have been sold at a cost and transferred as cash, net of transaction fees).

Andy Bell, chief exec of AJ Bell, was not pleased:

For a decade HMRC’s guidance wrongly confirmed that it was possible for tax relief to be claimed through in-specie contributions. Anyone who followed that guidance may now face an unexpected tax bill. This will be difficult to accept because in-specie contributions were made in good faith.

MSE course

The MoneySavingExpert site has launched a financial education course – effectively a MOOC – in partnership with the Open University.

- It’s a self-paced course and can be found on the Open University’s OpenLearn platform.

This course is aimed at adults – previously MSE produced a financial education pamphlet aimed at 16-year-olds, which was mailed to all UK secondary schools.

The course has six two-hour sessions:

- Making good spending decisions

- Budgeting and taxation

- Borrowing money

- Mortgages

- Savings and investments

- Planning for retirement

I hope to find the time to take the new course over the next few weeks of lockdown, and I’ll report back if I do.

Quick Links

I have seven for you this week, the first four from the Economist:

- The newspaper said goodbye to a golden age of drinking

- And looked at Walmart’s groceries edge during a pandemic

- And wrote about how Softbank has been a big beneficiary of the Fed’s pandemic response

- And said that drug innovation is back in fashion

- Morgan Housel looked at the three sides of risk

- Alpha Architect looked at how prospect theory helps to explain return anomalies

- And gave some practical advice on how to use trend following on the S&P 500.

Until next time.

Official annual CPI inflation for: food & non-alcoholic drinks; and fags & booze were: 1.3%; and 2.5% respectively in April

Feels more like a 50% increase over two months to me …

Woh!

This might be because your habits have changed, for example:

a) more eating/drinking at home – e.g. no visits to restaurants/pubs;

b) buying things at the supermarket that you usually buy from other shops (as they are currently closed);

c) just at home more – ie no holidays/breaks away;

d) comfort eating/drinking – as it helps fill the day.

I have observed some of these factors in our spending during lockdown, and they explain most of our c. 30% uplift (in terms of £’s spent on groceries during lockdown) vs last year.

It’s mainly because:

– the shops have all increased their prices

– I can’t buy in bulk

– there is no public transport, so I have to buy more at local shops aimed at yummy mummies

I’ve been working from home for 8 years, so I’m not eating more, and I’m actually drinking less.

Interesting. WFH was not alien to me. I did it for a day or two a week before I pulled the plug on work some years ago.

I reckon your points 2 and 3 above may be the most influential in your scenario. In our scenario, the prices are remarkably stable – but we are still using exactly the same shops (bigger chains); albeit we are now doing 1 big shop / store/ week rather than 1 bigish shop / store / week plus frequent top-up visits in-between.

We have never been particular fans of regular bulk-buying/BOGOF, etc and generally buy what we need when we need it. Having said that, I do like a bargain when I find a real one.

The ONS data reflects relatively stable prices at the shops for food & drink – even for high demand goods, see Section 6 at:

https://www.ons.gov.uk/peoplepopulationandcommunity/healthandsocialcare/conditionsanddiseases/bulletins/coronavirustheukeconomyandsocietyfasterindicators/21may2020

We have also been shopping for others – which could confuse our picture – but I have been careful to back most of this out of my calculations.

For us, the single biggest difference was that we normally go away for a few weeks during the lock down period – and had to abandon those plans – but that is a whole other story!

As I am sure we have discussed before, inflation (CPI, RPI, or whatever other flavour) is an average [latent] parameter and absolutely no household is, by definition, average. So each of us experiences inflation in their own way.