Weekly Roundup, 28th September 2020

We begin today’s Weekly Roundup with a look at the impact of demographics on the prospects for stocks.

Contents

Demographics

Over on the Enterprising Investor blog from the CFA Institute, Nicholas Rabener looked at the impact of ageing on equities.

- He starts with Japan, where the BoJ has been buying stocks, bonds and ETFs to counter unfavourable demographics.

From 2020 to 2100, Japan’s population will shrink by 40% – from 126M to 75M.

- Japan is in the lead, but most of the developed world could follow.

The replacement fertility ratio (number of children per woman) is 2.1.

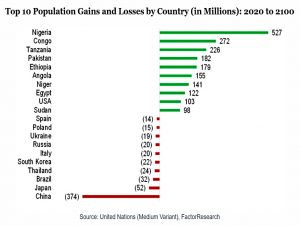

- Overall, the global population is predicted to grow by 40% by 2100, from 7.8 bn to 10.9 bn.

But the population of developed countries will only increase on the UN’s most “optimistic” scenarios.

- Most of the growth is in Africa.

- Italy and Spain are expected to lose 34% and 29% of their population respectively.

It’s possible that African countries will evolve into developed ones, but the experience of the last 100 years is not supportive.

Japan and South Korea moved from poor to rich and Argentina went from rich to poor, but otherwise the ranks of the developing and developed remained largely static.

Declining and ageing populations have three effects, two of them bad:

- there is less wear and tear on the environment

- old people do less damage, as do fewer people

- economic growth will slow

- growth depends on rising productivity and a rising working-age population

- fewer people will be buying stocks

- old people are net sellers as they de-risk and spend their portfolios

- in contrast working-age people are accumulating assets and have a higher risk capacity

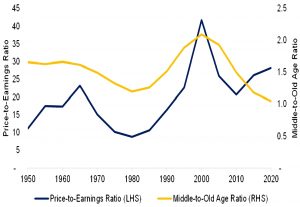

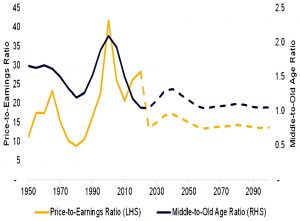

Nicolas replicates the work of Liu and Spiegel in comparing the middle- to old-age ratio with the PE ratio (he uses the Shiller CAPE):

The valuation of US stocks between 1950 and 2020 was largely driven by population changes. This would also help explain the tech bubble at the turn of the millennium, as the middle-aged grew faster than the elderly cohort and demand for stocks outpaced supply.

The US population is expected to grow by 2020, but it will also age.

- So Nicolas expects the PE ratio to decline.

These forecasts make a strong case for not only selling stocks for the long-term, but also selling all asset classes that are bets on economic growth. That means bonds, real estate, and private equity.

Nicolas suggests using anti-fragile portfolio strategies (as popularised by Taleb) and assets that benefit from volatility.

Fortunately, most of the dramatic population declines are expected after 2050.

Freetrade and Trading 212

Regular readers will remember that I have small accounts – less than 1% of net worth between them – with each of the UK’s commission-free brokers (Freetrade and Trading 212).

- T212 has an FX advantage, so I use that for a trend-following portfolio of US stocks.

- With Freetrade I have a multi-asset trend-following portfolio of global (but UK-listed) ETFs.

The question most people ask is how do these platforms make their money?

- The most common answer up to now has been that T212 cross-sell to their more profitable CFD business, but Freetrade’s only source of income was their £36 a year ISA account.

In recent months, Freetrade has announced a Plus account which will cost £120 pa, and recent statements are clarifying how they will entice people to use it.

Features of the Plus account include:

Limit orders, stop losses, and a much longer list of stocks, with specially curated collections to help you discover them easier [sic].

With collections such as ‘Fighting Covid-19’ and ‘Fighting climate change’ you can find the companies involved in the most important issues affecting the planet, while others like ‘Cloud computing’ allow you to uncover stocks that meet your investment needs.

The ISA fee is included in the Plus fee and Plus customers also get priority customer support.

Last week Freetrade explained how the stocks lists will differ between the Basic account (now renamed as a GIA) and Plus.

For plus:

Our long-term vision is to make all listed companies globally, from Hong Kong to Latin America, available in Plus. Starting this week, we will begin to add new UK and US stocks available exclusively to Plus members.

Which means:

- FTSE All-Share

- FTSE AIM All-Share

- S&P SmallCap 600

- Plus any other highly requested small and micro-cap stocks not included in these indices

The “Free Universe” will be:

- FTSE 350

- FTSE AIM 100

- MSCI US Prime Market (the 750 largest companies listed on major US exchanges)

- IPOs, SPACs, and other highly-requested large cap companies

More significantly for current users:

A small number – specifically 84 London-listed and 52 New York-listed stocks – currently available to all Freetrade users will become part of the Plus universe.

If you hold one of those stocks and decide not to become a Plus member, you will be able to continue holding or sell the stock, but you will no longer be able to buy more of this stock.

I had a quick look at the list movers and as expected, it’s:

- AIM stocks not in the AIM 100

- FTSE stocks not in the FTSE-350

- US stocks not in the MSCI Prime Market

This won’t affect me directly as there are no ETFs on the list, but it will impact a lot of users.

Meanwhile, T212 seems to be heading in the opposite direction:

- They’ve added a new feature called Pies, which amounts to designing your own portfolio to which you can add through a regular monthly subscription.

This feature is underpinned by the use of fractional shares (which Freetrade also supports).

Pies have two goals:

To have a diversified portfolio and easily maintain diversification balance in the long term, as markets move up and down.

To be able to make contributions to your portfolio without having to make complex calculations in order to allocate the right amount of money to each company/ETF you own.

In other words, they act like a home-made fund with a very low minimum contribution, which is great for those with smaller portfolios.

Pies can hold both stocks and ETFs, up to a maximum of 100 securities.

- And you can have multiple pies, though you can’t nest one pie within another (yet).

You can also manually contribute funds to a pie at any time, and top-ups can by according to your original splits, or self-balancing (more funds added to underweight instruments.

I think this is a very useful feature.

Freetrade had first-mover advantage in the UK zero-commission broker space, but it seems clear that T212 have overtaken them for the time being.

Size effect

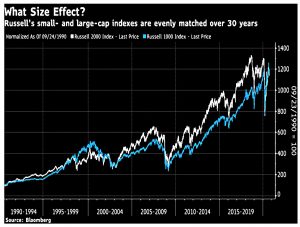

John Authers looked at the size factor – the idea that small companies outperform large ones.

- Size is one of the original three outperformance factors, along with momentum (winners keep winning) and value (cheap stocks beat expensive ones).

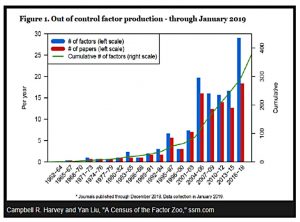

Since then, academics have identified more than 400 factors, though most of these stop working once they have appeared in the literature.

One of the factors now under pressure is the size factor.

- The recent outperformance of the large FANG stocks is a contributing factor to its disappearance.

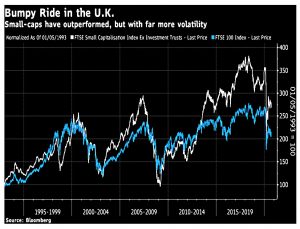

Here in the UK, small stocks have done better, perhaps because the FTSE-100 is stuffed with unpopular sectors.

John concludes:

Smaller companies tend to do a little better during good times, only to give back all of their advantage in market breaks.

Which is another way of saying that the small-company effect can be explained by market sensitivity or beta.

Cliff Assness of AQR – in a new paper called There Is No Size Effect – agrees:

The original work on the size effect back in the early 1980s [found] that small beats large by more than market beta could explain. But a series of cumulative challenges … have reduced the historic “net of market beta” return, ultimately leaving nothing.

In essence, the early work underestimated the beta of small stocks because of their illiquidity.

Often, thanks to the difficulty trading, they don’t show their full market reaction straight away, but only with a lag, once traders have been able to make a trade.

Which means that small-caps will still work well in a rising market, but won’t outperform overall.

- Small-caps are under-researched, and more likely to be mis-priced, but they are as likely to be over-valued as under-valued.

Another paper from Robeco finds that small-cap works when linked to “quality” – a strong balance sheet and reliable growth.

- But even here, it’s shorting the poor-quality small caps that delivers the outperformance, not holding the good ones.

Stakeholder capitalism

In the Economist, Schumpeter looked at the near-impossible trade-offs of stakeholder capitalism.

In a landmark essay published 50 years ago, Milton Friedman declared that the sold responsibility of a company manager was to the firm’s owners (in the case of listed companies, the shareholders).

The owners’ desires would generally be:

To make as much money as possible while conforming to the basic rules of the society.

Nowadays, even Walmart champions green energy, gay rights and gun control.

- Its CEO chairs the Business Roundtable group who want to replace shareholder primacy by adding customers, employees and other stakeholders to the list.

But the Chicago Business School has hit back:

Some stakeholders will always object to what is done on behalf of others.

The problem [is] the near-impossibility of balancing the competing interests of stakeholders in any way that does not give God-like powers to executives.

I have long seen the agency problem as one of the biggest in capitalism, so I am against anything that makes it worse.

- I stand with Friedman.

Triple Lock

The government seems to be committed to retaining the State Pension triple lock.

- They’ve introduced a bill to avoid freezing pensions when earnings growth is negative (as it likely will be for this tax year).

This clears the way for a 2.5% increase in 2021/22, but the real problem will arrive the following year when any earnings rebound would translate into a much higher increase.

- As previously discussed, I think this debate is a read herring as the UK state pension is the lowest in the OECD (relative to average earnings).

Even a massive increase wouldn’t put us half-way up the league table.

Winter Economic Plan

The government has cancelled the Autumn Budget scheduled for November in favour of an emergency Winter Economic Plan to combat the effects of Covid-19 and social distancing.

- The centrepiece is a German-style wage subsidy – called the Jobs Support Scheme – to replace the furlough scheme which ends next month.

Pushing back potential tax rises to the spring makes sense, as we’ll be through Brexit and have a clearer idea of how far away we are from a vaccine.

The new scheme pays 22% of wages for anyone working at least 33% of their normal hours for a small- or medium-sized company – so no more support for those who can’t work. (( Technically, the government and employer each pay for a third of the unworked hours, but for simplicity, we’ll assume the minimum 33% are worked ))

- There is nothing for those excluded from the previous schemes and nothing targeted at the most badly-affected sectors, other than the extension of the VAT cut to the end of March.

Employers must top-up another 22% of wages (plus all of the required employer’s NIC and pension contributions – more details are to follow).

- Which means that workers earn 77% of their wages for 33% of the work.

- The government grant is capped at £700 a month, which corresponds to a salary of £38K (at 33% hours worked).

Looked at from the other direction, employers pay 55% of wages for 33% of output, a deal which is more attractive when applied to highly-skilled staff than to typical retail and hospitality workers.

- The scheme runs for six months from November.

Because tax and NI are still payable, the plan costs the Treasury just £125 per week – rather than the nominal £463 – for a worker on £25K pa.

- And for higher earners, the government will get back more than they pay out.

Quick Links

I have six for you this week. Five are from The Economist and the first three of those are about zombie firms.

- The newspaper asked what to do about zombies

- And explained how Covid-19 will make killing off zombie firms harder

- And asked whether Japan will have a new generation of zombie firms

- The Economist also explained what Warren Buffett sees in Japan Inc

- And wondered whether Tik-Tok can help Oracle stay relevant

- Alpha Architect looked at Intangible Capital and the Value Factor.

Until next time.