Weekly Roundup, 21st September 2020

We begin today’s Weekly Roundup in the FT with Merryn Somerset Webb, who was talking about tax rises.

Tax

Merryn Somerset Webb advised Chancellor Rishi Sunak to avoid huge tax rises in the November budget.

- She thinks that inflation is building.

In the short term, supply shortages are biting just as demand is rising fast (all the cash dished out during the pandemic has to go somewhere). And in the medium term, social distancing is bumping up costs too.

Merryn wrote this column before the August inflation figures were published.

- The headline rate fell from 1% to 0.2% pa (a five-year low) as the Eat Out to Help Out restaurant promotion led to a 2.6% year-on-year fall in restaurants and cafes – the first-ever fall in this category since records began in 1989.

The temporary VAT cut helped, too.

Merryn outlined the four options for dealing with the UK public debt, which now stands at £2 trn / 100% of GDP:

- actual default (not a UK thing);

- default on promises to citizens (austerity);

- default via inflation (the state effectively pays back less in real terms);

- or sharp rises in taxation, which have the same effect as austerity on those who

take the new tax hit

Inflation is the least painful of these, but the hardest to create and control.

Merryn points out that the proposed new and higher taxes on wealth and the rich can only be cosmetic – they can’t raise nearly enough money.

- Even 1% on all income tax rates, NIC rates and VAT would only raise £20bn – 1% of the debt/GDP.

And such rises would kill any remaining hope of a V-shaped recovery.

Merryn wants the tax system to move in the opposite direction:

Lower, flatter, simpler – to make it into one that gives us a better chance of constant real economic growth in the future. Making the debt look small relative to GDP by enlarging GDP would be a lot better for us than making it look small by shrinking it in absolute terms.

I agree with her, but I’m not optimistic that it will happen.

Cities

James Altucher kicked off a debate (ie. attracted a lot of hate mail) when he declared on LinkedIn and Medium that New York City is Dead Forever.

James was born there, but he identifies three reasons to move to NYC – or any big city (my detail in brackets):

- Business opportunities (jobs, careers, good pay)

- Culture (including a better pool of potential mates, and friends)

- Food

Because of the pandemic:

- The business districts are dead

- Social order is fragmenting to an extent (though we haven’t had looting in London)

- People are moving away

- Cultural venues are closed or limited (masks to view art, anyone?)

- Bars and restaurants have lost their vibe (and pre-booking kills spontaneity)

- Rents are falling

- College students are absent (learning remotely) or more sequestered than previously

- Tourists have stayed at home

- And nobody knows what can survive with limited capacities and social distancing – lots of restaurants have closed already

The difference from previous crises is, of course, bandwidth.

- Now we can all Zoom into meetings from anywhere.

James points out that cities thrive on density and clustering (the original network effect) and that less competition is bad for everyone.

- But cities are hard work – without the benefits, making the effort doesn’t make sense.

He fears a deflationary spiral:

People wait. Prices go down. Nobody really wins. Because the landlords or owners go broke. Less money gets spent on the city. Nobody moves in so there is no motion in the markets.

The counter-arguments are:

- remote work won’t stick (because either employers or workers decide that they don’t like it)

- we just don’t know whether the current productivity boost will last

- lower rents will lead to a cultural renaissance

- though even this might come at the cost of a loss of personal safety

- and the death spiral towards Detroit and Baltimore looks just as likely

- we could get a vaccine or a treatment that means that social distancing can end

To survive, James thinks that cities have to do quite a lot of things:

- Encourage innovation

- Incentivise people to come

- Privatise key services (in the US, hospitals, education and roads)

- Literally sell off the relevant infrastructure

- Start a local currency that encourages spending to stay within the city

- James suggests a cryptocurrency, but there are other ways to implement this

- Encourage a greater central bank focus on stoking inflation (by buying municipal bonds of cities)

- The end of licencing for non-professional jobs

- This is a much bigger problem in the states than in the UK, but we have our own red tape to get rid of

- TFL’s ludicrous traffic control designed to encourage walking and cycling should be the first thing to go

- Remove zoning and rent control

- We’re moving in the opposite direction here, with the Tories introducing housebuilding zones and Labour in favour of rent controls

- Have an eviction holiday

- We already have that, though for me it merely delays the inevitable

- To be fair, James wants to pair it with a bailout for landlords (via their lenders)

I think it’s pretty unlikely he’ll get his wish.

- I fear for my city, and for his.

Combining factors

Last month, Joachim Klement looked at the decline in the performance of factors one they are identified and funds are created to track them.

- Combining multiple factors was the suggested response.

He was back this month with a look at how many factors you need, and how to deal with the potentially high transaction costs that implementing such portfolios can generate.

He notes that many firms don’t use portfolios optimised for risk-adjusted returns:

It is easier to sell a portfolio that looks nice than one that works.

A recent study (de Miguel et al, 2017) finds that you only need six factors (absent of transaction costs):

- earnings surprises

- return volatility (low vol)

- asset growth

- one-month price momentum

- profitability

- market beta

Value, size and 12-month momentum are excluded because their higher volatilities more than cancel out their higher returns.

Working out how many factors to in the real world involves a trade-off of transaction costs:

A stock may drop out of one factor portfolio but may be introduced into another factor portfolio at the same time. Hence, the portfolio manager can net out these two trades and avoid transaction costs on these altogether. The more factors a portfolio contains, the more likely it is that such netting is possible.

But the more factors a portfolio contains, the more expensive transactions will become because the trades become smaller and smaller since each factor has a lower allocation in the overall portfolio.

The ideal portfolio for a dollar investor includes 15 factors, including the traditional winners excluded in the absence of costs.

Value investing

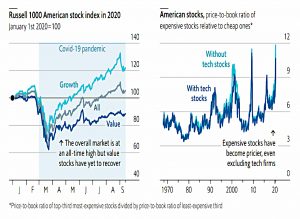

The Economists’s Graphic Detail featured provided more data on the underperformance of value investing since 2010.

The pandemic has only widened the gap between the most and least expensive stocks. While shares in fast-growing companies with high price-to-book ratios have risen by around 20% since early January, shares in value firms are down by over 10%.

Analysis by AQR shows that the rise of tech firms with low book values (lots of intangible assets like IP and brands) is not the explanation.

Pricey stocks have outperformed, even when excluding tech firms or the biggest 5% of companies by market capitalisation.

And the rise in the price of high PE stocks means that it’s not just an issue with book value.

- Growth is just valued more than normal (and more than value) under the present circumstances.

Big Mac index

Buttonwood looked at whether you can make money from the Big Mac Index, which uses the price of burgers to examine purchasing power parity (PPP) and hence FX imbalances.

PPP [is] the notion that the fair value of a currency should reflect its power to buy goods and services.

Deviations from fair value should on average halve over 1 to three years.

- But trading the Big Mac index on a two-year cycle would not make money.

Adding in the excess interest (over dollars) from buying weaker currencies would boost returns to around 2.5% pa.

Part of the problem is that PPP gaps can close through price rises as well as (or instead of) currency strengthening.

- And rich countries tend to stay more expensive because wages are high even in unproductive sectors of their economy.

The Big Mac index which adjusts for this was profitable since 2011, but only just.

- Results from the Economist’s simple one-bet-at-a-time strategy are skewed by the consistent undervaluation of the Hong Kong dollar.

A more sophisticated multi-best strategy might do better.

This is all reminiscent of the Schiller CAPE, which is useless over the short-term, but a pretty good long-term predictor.

Magazine covers

John Authers reminded us of the use of magazine covers as contrarian indicators.

- The Economist is the go-to magazine here.

John mentions the oil covers, but they have also made some spectacularly bad calls on stocks and commodities, as has BusinessWeek.

Up this week is clean energy.

The Economist may just have given the go-ahead to start buying fossil fuels. The market has never been less impressed by the prospects of the oil majors, compared to other companies. Sentiment does look extreme.

Quick links

I have seven for you this week, the first four from The Economist:

- The newspaper looked at how Snowflake raised $3 bn for its IPO

- And at how Nvidia’s purchase of ARM could open up new markets

- And at who will rule the Teslaverse?

- And wondered whether Nikola could become the next Tesla

- The BBC noted that (as discussed above) the Eat Out To Help Out scheme has driven UK inflation to a five-year low

- Alpha Architect looked at Accruals and Momentum and what they mean for factor investors

- And also at whether the best stock pickers can beat the market.

Until next time.