Weekly Roundup, 5th September 2017

We begin today’s Weekly Roundup in the FT, where Merryn Somerset Webb was talking about dividends and diversification.

Contents

Dividends and diversification

She began by looking back to the 1950s, when dividends were all that investors cared about.

In 1952, Glaxo’s earnings yield was 45% (that’s a PE of just over 2) and its dividend was covered 12 times over.

- But the stock wasn’t seen as cheap because it’s yield of 4.35% was slightly below the market average.

Since then, we’ve been through a period where equities were seen as real assets which protect you from inflation, but Merryn worries that the cult of the dividend is returning.

- Annuities are poor value, interest rates are at historic lows, and equity income funds are the best sellers.

Investors in tech stocks (and Bitcoin) aside, people want to see a big dividend.

- The problem is that dividend cover of 12 times is long gone.

The FTSE-100 has average cover of 1.5 times, and the average for the top 10 dividend payers is just 1.17 times.

- And half the dividends from the FTSE-100 come from seven companies.

In the All-share index, 64% of dividends come from 20 stocks in three sectors (financials, consumer goods and oil & gas).

- Merryn’s advice is to steer clear, and to get out of the main UK equity income funds.

Accesso

John Lee’s column has a new format – he’s interviewing small cap investors about a stock from their portfolio.

- First up was David Stredder (known on twitter as carmensfella), a founder of ShareSoc and a well-known fan of AIM stocks.

The stock he chose was Accesso Technology (ACSO), which he first bought at 7p in 2003.

- It’s now some 225 times higher.

Accesso’s technology helps visitors to theme parks to avoid the queues for popular rides.

- It was originally called Lo-Q and changed its name after a US acquisition meant that most of its revenues were generated across the Atlantic (where the word “queue” isn’t used).

This is David’s best-performing share ever, and once made up 15% of his portfolio.

- It’s now down to 7% – David tries to keep individual positions below 8%.

Tax reforms

With the news that Trump has finally got around to trying to simplify the US tax code, John Kay looked at tax reforms over the last 40 years.

- He notes that reforms happen incrementally, with the 1986 US Tax Reform Act a notable exception.

The general trend has been for income tax to become less important (down from 30% of OECD tax in 1975 to 24% now) while consumption taxes (VAT and sales tax) have become more important (up from 13% in 1975 to 21% now).

- Payroll taxes are also up, from 23% in 1975 to 27% now.

- And the extension of savings vehicles (SIPPs and ISAs here in the UK) mean that income tax also functions more like a tax on (eventual) expenditure.

Income tax rates have also fallen and bands have been simplified:

- Britain moved from 10 bands peaking at an 83% rate to three bands with the highest at 45%.

- The US had 25 bands peaking at 70%, and now has seven, with the highest at 39.6%.

The other change has been self-assessment via new technology, which has to a shift away from taxes that are complicated to assess.

- Taxes on transactions are harder to avoid than assessed taxes.

Metals prices

John Authers looked at whether rising metals prices were indicating that a global recovery has begun.

- This would be at odds with conditions in the US, where the jobs growth rate is lower than in 2016, wage growth is only 2.5% and unemployment just ticked up.

But metals demand in recent years has been driven by China, and rising prices are often aligned with a broader global recovery.

- Stocks exposed to China have also started to rise.

- And emerging markets currencies have recovered.

John says that unless the US can agree on a fiscal stimulus, and a return to Trump’s protectionist agenda, non-US assets will outperform from here.

Ten years after

The FT magazine had a special feature on finance, ten years after the 2007-08 crisis.

The articles included:

-

What have we learnt? – Patrick Jenkins

-

From here to uncertainty – Alistair Darling

-

Nonprime has a nice ring to it – Ben McLannahan

Forecasting

Over in the Economist, Buttonwood looked at long-term forecasting.

- Returns from asset classes are highly variable, and dependent on the initial valuation.

- The higher the starting price, the lower the likely future returns.

Calculations are simple for bonds, but complicated for stocks.

- But in general, stocks selling on high multiples, or low dividend yields are likely to return less.

GMO (the firm that James Montier works for) approaches asset allocation by trying to predict the future returns on assets.

- The model is based on the idea that valuations will revert to the mean over seven years.

It has been a partial success:

- The assets predicted to do best have done best.

- But the numbers are off – for example, assets predicted to return -8% pa or worse have actually returned -2.8%.

US equities have been particularly problematic for GMO – they’ve underestimated returns by more than 4% pa.

- This is because there has been no mean reversion, and US stock prices have remained high.

This could be because stocks have moved to a new valuation level, but that sounds too close to the chatter around in 1929 for comfort.

- There does seem to be a return to monopoly power in some industries, and globalisation seems to have reduced labour’s share of profits.

But it’s more likely that the dismal returns on cash and bonds mean that stocks are the only way to a decent income.

- In which case they must run out of steam in the end.

- GMO is sticking to its predictions of mean reversion for now.

Floods

Another article in the newspaper looked at the tragic floods in Texas.

- Although fewer people nowadays die in floods and storms, the frequency of the extreme weather events is increasing, and is likely to continue to increase due to climate change.

But poor planning makes things worse.

- Houston has almost no land-use restrictions, and a lot of coastal prairie that used to absorb the rain has been concreted over.

- And since 2010, more than 8,600 buildings have been constructed on the floodplain.

While a lack of insurance is a problem in developing nations, the US has the opposite problem – insurance in vulnerable areas is subsidised by the federal government.

- This encourages building more houses, and dissuades existing owners from moving away.

- The worst 1% of the properties covered by the National Flood Insurance Programmme (NFIP) account for more than 25% of its claims.

There’s been a bit of a row on the internet about price gouging which the article doesn’t mention.

Price gouging (despite the name) has a legitimate role to play in the rationing of scarce resources.

- But Uber charging more for a cab when it’s raining is not the same as stores increasing the cost of drinking water by 20 times during a natural disaster.

I would say that the latter is a case of market failure where government intervention could be justified.

Cash ISAs

The Guardian (amongst others) reported that the popularity of Cash ISAs has collapsed in the space of a year.

- The amount invested in 2016/17 fell to £32.9bn, down from £58.7bn the previous year.

- Another £22.3 bn went into stocks and shares ISAs, up from £21.1 bn.

It’s partly down to the low interest rates on ISAs, compared to current accounts, but it’s also because of the introduction of the personal savings allowance, which means that the first £1,000 of interest is tax-free to a basic rate taxpayer.

The fall in inflows and the rising stock market means that for the first time, there is now more held in stocks and shares ISAs than in cash ISAs.

- There’s £315 bn in stocks, and £270 bn in cash.

Banks and Bitcoin

Citywire reported that six banks have teamed to launch a “Bitcoin rival“.

- The ‘utility settlement coin’ has been created by UBS in conjunction with Barclays, Credit Suisse, Canadian Imperial Bank of Commerce, HSBC, MUFG and State Street.

From next year USC will be used for clearing and settling transactions using over blockchain.

- It’s expected to make settlement quicker and cheaper.

Twitter pics

I have three for you this week.

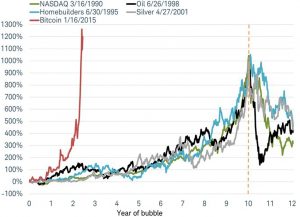

The first compares various bubbles from history:

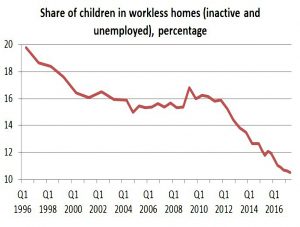

The second shows that the proportion of children living is workless homes is rapidly falling:

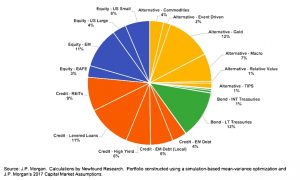

And the third shows what a strange place the markets have reached.

- It’s the “Weird” portfolio from Newfound Research, based on mean-variance optimisation.

- I doubt that many investors would feel comfortable holding this, even if the expected returns are optimal.

Until next time.