Warren Buffett’s Annual Letters – 2020

As part of our series on Warren Buffett’s Annual Letters, we look at the letter for 2018, which was released over the weekend.

Contents

Warren Buffett’s Annual Letters – 2020

We’ve previously looked at Warren Buffett’s letters that cover:

2019, 2018, 2017, 2016, 2015, 2014, 2013, 2012, 2011, 2010, 2009 and 2008.

Today we’ll examine the 2020 letter, which was published at the end of February.

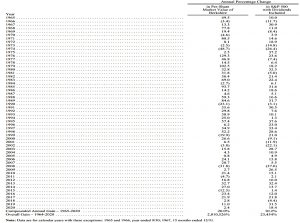

Performance

Over the 56 years to 2020, BRK has compounded its share price by 20.0% pa.

- During the same period, the S&P 500 has compounded at 10.2% pa (dividends included).

Total gains are 2.8M% for BRK and 23.4K% for the S&P – more than a thousandfold difference.

- But in 2019, BRK was up only 2.4% whilst the S&P went up 10.2%, despite Covid.

Under GAAP rules, BRK earned $42 bn in 2020 (down from 81.0 bn in 2019):

- $22 bn in operating earnings (down 9% from $24 bn)

- $4.9 bn capital gains on sales of investments ($3.7 bn)

- $26.7 bn in gains from unrealised capital gains on investments (“mark to market” – last year was $53.7 bn), and

- $11 bn loss from write-downs

The write-down is from the 2016 acquisition of Precision Castparts (PCC).

I paid too much for the company. No one misled me in any way – I was simply too optimistic about PCC’s normalized profit potential. Last year, my miscalculation was laid bare by adverse developments throughout the aerospace industry, PCC’s most

important source of customers.

There were no significant acquisitions in 2020.

Bonds

This year’s report contains a blast against bonds:

Bonds are not the place to be these days. Can you believe that the income recently available from a 10-year U.S. Treasury bond – the yield was 0.93% at yearend – had fallen 94% from the 15.8% yield available in September 1981?

In certain large and important countries, such as Germany and Japan, investors earn a negative return on trillions of dollars of sovereign debt. Fixed-income investors worldwide – whether pension funds, insurance companies or retirees – face a bleak future.

Through it could identify no decent acquisitions, BRK has been buying in its own shares:

Last year we demonstrated our enthusiasm for Berkshire’s spread of properties by repurchasing the equivalent of 80,998 “A” shares, spending $24.7 billion in the process. That action increased your ownership in all of Berkshire’s businesses by 5.2% without requiring you to so much as touch your wallet.

Following criteria Charlie and I have long recommended, we made those purchases because we believed they would both enhance the intrinsic value per share for continuing shareholders and would leave Berkshire with more than ample funds for any opportunities or problems it might encounter.

Warren notes the compounding effect of both BRK and Apple – BRK’s largest non-controlled holding – regularly buying in their shares.

Investments

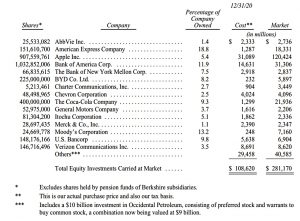

The table lists the largest 15 positions held by BRK, excluding Kraft Heinz.

- BRK is part of a control group there and accounts for the holding using the equity method.

The table doesn’t tell the story of BRK’s investments and divestments through the year:

- He dumped a lot of bank stocks, including completely selling out of JPM.

- He bought and then quickly sold airline stocks

- He bought up pharma and drug stocks.

- He also bought Verizon and Chevron and even a recent IPO (Snowflake).

- He made a rare move outside the US by investing $6 bn for 5% of five Japanese general trading companies (which have since underperformed).

America

Warren includes his usual support for the USA:

In its brief 232 years of existence, there has been no incubator for unleashing human

potential like America. Despite some severe interruptions, our country’s economic progress has been breathtaking.Beyond that, we retain our constitutional aspiration of becoming “a more perfect union.” Progress on that front has been slow, uneven and often discouraging. We have, however, moved forward and will continue to do so.

Our unwavering conclusion: Never bet against America.

Diversification

For once, Warren was relatively positive about diversification:

Ownership of stocks is very much a “positive-sum” game. Indeed, a patient and level-headed monkey, who constructs a portfolio by throwing 50 darts at a board listing all of the S&P 500, will – over time – enjoy dividends and capital gains, just as long as it never gets tempted to make changes in its original “selections.”

Patience and fees

But investors should also be patient, and keep their costs down:

Productive assets such as farms, real estate and, yes, business ownership produce wealth – lots of it. Most owners of such properties will be rewarded.

All that’s required is the passage of time, an inner calm, ample diversification and minimization of transactions and fees.

Investors must never forget that their expenses are Wall Street’s income. And, unlike my monkey, Wall Streeters do not work for peanuts.

Conclusions

It’s a fairly short and quiet letter again this year.

There were no big deals and no mention of fashionable topics like Reddit (r/wallstreetbets), Gamestop, Bitcoin or potential market bubbles.

- Nor did Warren comment on the presidential election, the widespread political protests, or even the Corona pandemic.

He resisted the temptation to reduce BRK’s massive cash pile by paying a dividend.

- And there was nothing about succession planning.

Maybe we’ll have better luck next year.

- Until next time.