Weekly Roundup, 8th November 2016

We begin today’s Weekly Report in the FT, with the Chart That Tells a Story. This week the topic was UK personal debt.

Contents

UK personal debt

Gavin Jackson looked at consumer credit data from the Banker’s Association.

- The survey covered credit cards, overdrafts and personal loans at the major banks only (the challenger banks are not included).

After falling from 2009 to 2013 consumer credit has been rising since then and is now growing at 6.7% pa, the fastest rate since December 2006.

- Total debt is at a 5-year high, and credit card debt is close to the all-time high in nominal terms.

We are still 20% below the all-time debt peak, and the average borrowing per person is lower.

- So there’s nothing to worry about yet.

Many observers see robust household consumption (which makes up 65% of UK GDP) as a positive.

- Bank of England figures which also include car loans are flat, so it looks like credit card spending is holding up, but big ticket, longer-term spend is down.

The common interpretation is that consumers have paid down their debts to an acceptable level, and with interest rates at all-time lows, have little reason to save.

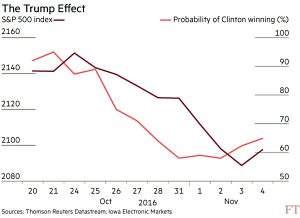

US election

John Authers tackled the big story of the week – what would happen to markets if Trump wins the US election.

- John had written Trump off a couple of weeks earlier, but then the FBI found more potentially dodgy Clinton emails.

- As I write, the FBI have cleared Clinton of wrongdoing in the latest batch of emails, and she looks to be on course to win again.

In case Trump can convince a majority to “vote against globalisation and the status quo”, John advises following the Brexit playbook.

- There would be an initial sell-off of US stocks and the dollar.

- US treasuries could gain as a safe-haven asset.

After that, stocks would likely rebound, supported by the devalued dollar.

- Trump would not take office until January, and the US constitution limits his actions.

So there might be a buying opportunity in large US stocks with international earnings.

- Healthcare should also do well if the threat of Clinton penalties is removed.

The stronger yen and euro would put pressure on those stock markets.

- The pound would also gain, which could cap the FTSE-100.

But emerging markets should do well from the weaker dollar (dollar debt servicing would become easier).

In the medium-term Trump should provide moderate fiscal stimulus and more rate rises from the Fed.

- This could be good for the US economy but would hurt bonds and bond substitutes.

- And it depends on him getting his spending plans through a hard-line Republican Congress.

Cyclical and inflation-proof stocks would do better than the rest.

- “Real” assets such as commodities should do well.

Crowd bonds in ISAs

Apart from the election it was a thin week for financial news.

- Aime Williams reported that the Innovative Finance ISA has expanded to include “crowd bonds“.

Up to now only P2P loans have been allowed, and the fact that none of the major loan platforms has been fully approved by the FCA means that take up has been low.

Now asset-backed debentures from crowdfunding websites can be included.

- These will be from small, unlisted companies, and will therefore be much riskier than even the much derided “mini bonds”.

- There’s no official secondary market, so you would probably need to hold bonds to maturity.

The one advantage over mini-bonds is that you remain a client of the crowdfunding platform after you have paid for the bonds, so you can report them to the ombudsman.

- But you aren’t covered by the FSCS unless fraud takes place.

Bonds on offer range from 4% pa to 7% pa, and from 5 to 19 years in maturity.

- They are backed by care homes, hydro electric schemes, solar and wind farms and pubs.

It sounds way too risky for me.

- I’ll stick to the P2P lending investment trusts for my slice of Innovative Finance.

John Lee on stop losses

John Lee, who we looked at last week as part of our Guru series, wrote his regular column in the FT on Saturday.

- This time he was discussing stop losses, in the context of his sale of Braemar Shipping.

This was a recent purchase, at the start of the year, for around 440p on a 6% yield.

- A negative trading statement in August triggered John’s 20% stop loss.

John is a recent convert to stop losses and uses a fairly wide one.

- Some people use 10% or 15%, but John invests mainly in quite volatile smaller stocks.

John sold at 350p and the shares are now at 318p.

The gig economy

The Economist looked at the implications of the ruling in London that Uber drivers are company employees rather than independent contractors.

- This means that they are entitled to the minimum wage and holiday and sickness pay (and potentially to a workplace pension).

McKinsey reckons that there are 162 million people in the “gig economy” of Europe and the US – more than 20% of the working age population.

Self-employment works best when the contractor can be judged on results, rather than effort.

- Uber drivers fit this pattern to an extent, but labour rules also exist to limit the risk borne by contractor / employees.

- The risk of earning less than the minimum wage because of traffic or a lack of hires is probably the kind of thing that they were supposed to catch.

Uber certainly has a lot of control over the drivers – their behaviour and vehicles, for a start, plus which passengers can be picked up, how much the fare is and what the route should be.

- But they don’t set working hours or locations, or force drivers to take a fare.

The problem is that new technology is throwing up a third type of worker – neither employee nor independent contractor.

- Re-classifying them as employees will increase fares, and hit demand.

- This in turn will probably lead to fewer drivers.

And the ease with which someone could (up to now) become an Uber driver gave them extra bargaining power with other employers.

- We’ll probably get to some half-way house in due course, but it could be a bumpy ride.

End of deflation

Buttonwood looked at the case for a turning point in markets, based on a change from deflationary to inflationary pressures.

Government bonds are the first market to provide evidence, after a bull market dating back to 1982:

- 10-year US Treasuries bottomed on July 7th at 1.37% yield.

- 10-yr bunds hit a low of -0.18% at the same time.

- And UK bonds yields have since risen from 0.61% to 1.17%.

Markets in risk assets (junk bonds, emerging market stocks, commodities, property funds and gold) have also turned.

- Worries from the start of 2016 over the Chinese economy have failed to materialise, and there have been no Fed rate hikes this year.

Fears of deflation have also receded.

- The ratio in prices of real assets (commodities, property and collectibles) to those of financial assets (stocks and bonds) is the lowest since 1926, largely because of QE.

If this is a turning point, there could be money to be made from buying property and gold, selling stocks, or both.

- But the odds are against another real boom – the last commodities boom was driven by a one-off burst of Chinese investment, and the demographics of ageing baby boomers will work against property.

And on top of that, we don’t know what the central banks will do when (if) bond and stock markets start to fall.

- So this may not be 1982 all over again.

Until next time.