Irregular Roundup, 11th September 2023

We begin today’s Weekly Roundup with US growth.

US growth

The Economist looked at what might derail US GDP growth.

Recent data suggest [the US economy] may even be on track for annualised growth of nearly 6% in the third quarter, a pace it has hit only a few times since 2000. New orders for manufacturing firms reached their highest in nine months in July. Retail sales were perky last month, too.

Construction is also doing well, and the labour market remains hot, with unemployment at 3.5%, close to a 50-year low.

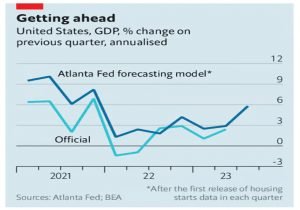

- The Atlanta Fed’s “nowcasting” model suggests a remarkable growth rate of 5.8% for 3Q23, unexpected after a year of rate hikes.

The nowcast almost certainly exaggerates the economy’s vigour. It is normally off by about two percentage points at this point in the quarterly cycle.

One reason will be the drawdown of existing inventories, suggested by a gap between retail and wholesale trades.

Of course, too much growth runs the risk of overheating and prolonged inflation.

Andrew Hollenhorst of Citigroup warns that shortages of both workers and housing risk a significant reacceleration of prices next year.

The strength of the economy means that investors sell Treasuries, pushing up yields.

- Some think that the short-term neutral rate (designed to neither throttle growth nor stimulate it) is therefore higher than before.

So markets now believe there will be no rate cuts before May 2024.

The drag on growth

Joachim Klement looked at the drag on (earnings) growth from higher interest rates.

- Joachim has been writing a series of notes arguing against the doomy predictions of Cassandras, which we’ll look at in a later post.

I have argued that because of the massive debt load of businesses, higher interest rates cannot be sustained for long because they reduce investment activity too much and thus lead to a rapid decline in GDP growth.

In the latest article, Joachim turns the logic around to look at how much of past corporate earnings growth comes from falling interest rates.

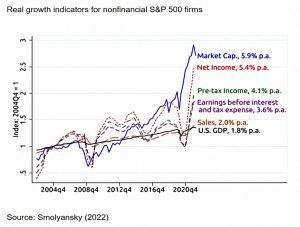

The red line is profit growth and the blue one above it shows growth in market cap (each adjusted for inflation).

- The gap between the twp reflects changes in PE ratios (valuations).

Below these come pre-tax income and operating income (EBIT).

- These are much lower than the growth in net profits. for two reasons:

This means that companies can use more capital, but pay less to use it.

Smolyansky estimates that about one-third of the profit growth of non-financial companies in the S&P 500 was a result of these two effects. That is what the difference between 3.6% EBIT Growth and 5.4% net profit growth says (1.8 / 5.4 = 1/3).

Of course, now that debt is more expensive, the opposite applies:

And corporate taxes are unlikely to fall further, so whichever choice they make, the growth in profits should slow.

With lower earnings growth comes a falling stock market and this, in turn, means fewer investments by businesses and less consumption by households – both of which translate to lower GDP growth.

Joachim says there are two ways to boost growth once more:

- reduce interest rates or

- boost productivity growth

The former is relatively straightforward to do and can be done by one central institution, the latter is highly uncertain and needs a coordinated effort by many participants in the economy. Which one do you think is more likely to happen?

So Joachim at least is sure that lower interest rates are heading our way.

- The question is how soon will that happen?

Pensions vs pay

On his AgeWage blog, Henry Tapper followed up on an idea from John Ralfe:

The Government can get people back to work – and also reduce taxpayer costs – by allowing all public sector workers to choose higher pay today, in exchange for a lower DB pension in retirement.

Given that the employer’s (ie. taxpayer’s) contribution to the NHS scheme is now 21% of pay, this sounds like a good idea.

- The default/minimum private sector EE contribution is just 3%.

Nurses pay a sliding scale of employee contributions, from the regular 5% for those on less than £15.5K pa up to £14.5% for those on more than £111.4K pa.

- The basic pay for newly qualified nurses is £27K, which attracts EE contributions of 9.3%.

The problem with John and Henry’s idea is that the benefit to the nurses is immediate ( a larger net pay packet) whilst the benefit to the Treasury is long deferred (a smaller pension pot).

Wealth tax

Labour appears to have ruled out introducing any of the most obvious versions of a wealth tax after the next general election (assuming they hang on to some of their current 20-point lead in the polls and actually win it).

- There will be no tax on expensive houses or increases to CGT or the top income tax rate (which leaves the base rate, VAT and NIC as potential targets).

Labour’s proposed restoration of the LTA is also a wealth tax of sorts.

- Labour have also said they will end non-dom status, and stop private schools from claiming a charitable exemption on profits.

Shadow Chancellor Rachel Reeves said that extra money for public services (they haven’t changed their minds about big spending, then) would instead have to come from growth:

I don’t see the way to prosperity as being through taxation.

Reeves also said that Labour would do “whatever it taxes” to attract investment into the UK.

- But would that include a corporation tax cut?

LightYear

I opened a LightYear account a couple of years ago because they had no FX charges and allowed you to hold the account balance in dollars.

- They have since introduced an FX charge, so I have stopped adding money to the account, but I haven’t taken out the cash I added in Year 1.

Lightyear has now introduced a Business Investment Account.

- Their chief competition in this department would be InvestEngine (who basically offer a free ETF account) and HL (who are more expensive but make things easy and flexible).

I currently have company money with InvestEngine but have used HL in the past.

LightYear has teamed up with BlackRock to add Money Market Funds (MMFs) to the account, which might well be attractive to those who don’t want to put their company funds into the stock market.

- But this comes at a price – 0.3% for the fund plus 0.15% for BlackRock, for a total of 0.45%

The yield on the BlackRock MMF is 5.1% at the moment, and uninvested cash in LightYear attracts 4.5% interest (in £, and also my personal dollar balance with LightYear).

- This compares well with the 3% on my regular business cash savings account, but I’m not sure that the gap is large enough to get me interested in switching.

Lightyear CEO Martin Sokk said:

We’re helping businesses actually benefit from the increasing interest rates – something which they just can’t do with banks. We’re first focusing on the largest, but most underserved part of the market – sole owner businesses – then we’ll open this out to multi-user and larger businesses in the next few months.

Taavet Hinrikus, an investor in Lightyear, said:

Businesses in the UK need to make sure their cash is not draining its value against inflation. With today’s high interest rate climate, Lightyear’s launch of both business investment accounts and MMFs is a timely step towards helping entrepreneurs put their cash to work.

Their new business accounts enable freelancers to earn interest and invest their otherwise stagnant cash, and their BlackRock MMFs partnership introduces these entrepreneurs to a whole new area of investing, previously reserved for larger corporates.

Binance

Another week, another problem in crypto land.

- This week we have two, each affecting Binance.

Last month the exchange suspended euro withdrawals and deposits, citing issues with the Single Euro Payments Area (SEPA) system.

- A deleted tweet from Binance customer support said that their payment provider “can no longer support these transactions” and that “we don’t have a specific time frame for the restoration”.

A disgruntled EUR customer was quoted on Cointelegraph:

According to customer support there is nothing I can do about it except waiting for Binance to find a new payment provider. Letting users buy EUR, just to block them from accessing it right afterwards is what you would expect from scam exchanges.

The SEPA service was planned to end on 25th September, as the payment provider (Paysafe) had already decided not to support Binance going forward.

And there was more bad news from Binance:

[As Sept 25 approaches] some users may occasionally be asked for more information as part ofroutine compliance checks, which could lead to early closure of their accounts. [We] will have alternatives for our users in place before the end of the SEPA service.

The following week, Mastercard and Binance announced that they were ending their crypto card partnership (which only operated in Argentina, Brazil, Colombia and Bahrain), again in late September.

- Neither company has commented on the reasons behind the decision.

Quick Links

I have four for you this week, the first three from Alpha Architect:

- Alpha Architect asked Do Short-Term Factor Strategies Survive Transaction Costs?

- And looked at the Implications of Regime-Shifting Stock-Bond Correlation

- And got stuck into Dissecting the Investment Factor.

- The Economist said that Argentina needs to default, not dollarise.

Until next time.

Labour will say anything to get elected – so IMO rule nothing out. They will be no more trustworthy than the current lot!