Dirty Portfolios – Mount Lucas

Today’s post looks at an article from last year on the Mount Lucas blog about adding Managed Futures to Lazy Portfolios, to form what Mount Lucas calls Dirty Portfolios.

Contents

Mount Lucas

I hadn’t come across Mount Lucas before, but it appears that they’ve been around since the 1980s.

ML targets institutional and high-net-worth investors (presumably in the US) with “actively managed strategies and proprietary passive indices”. They are committed to “diversification, liquidity, risk management, and transparency”.

The paper dates to December 2022 and is called “Dirty Portfolios – Managed Futures As A Portfolio Element”.

Dirty Portfolios

The starting point for the article is the recent change in fortune for the majority of Lazy Portfolios:

Almost all benefitted from the low rate, low inflation market environment. So far, 2022 has been difficult across the board for these models as stocks, US Treasuries, and credit have all fallen, and even short-dated bonds have not helped.

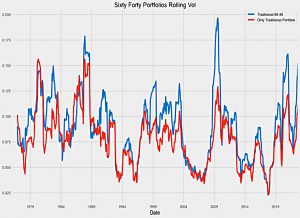

To try to fix this, ML add trend (long and short, in the form of Managed Futures) to the portfolios.

Managed Futures offers an uncorrelated, positively skewed portfolio element with a positive expected rate of return that can complement the broader portfolios of equities, credit, and real estate.

Or, more pithily:

Where the investor premium in equity and credit markets looks for cash flows, the investor premium in the futures markets looks for “crash” flows.

Inflation

For the last few decades of declining bond yields and low inflation, stocks and bonds have mostly been inversely correlated.

Markets began to price that, in the event of any serious economic slowdown or episode of poor market functioning, the Federal Reserve would come to the rescue and cut rates.

During the pandemic, this state of affairs hit two problems:

- bond yields became too low to move significantly lower, and

- inflation returned, making the Fed unwilling to cut rates if stocks fall

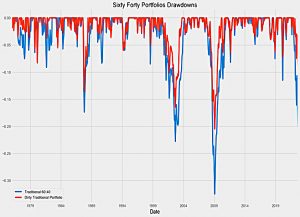

So in 2022, both stocks and bonds fell.

- Diversification didn’t work for most Lazy Portfolios and things were even worse for those that use leverage.

Managed Futures (MF) can be long or short in any market, and so they can sidestep this problem.

- MF provided similar benefits in the deflationary crashes of 2000 and 2008.

The analysis

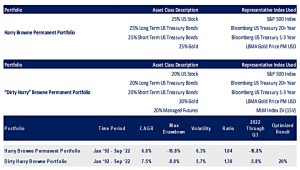

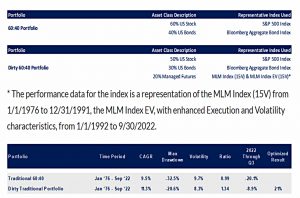

For Managed Futures, ML used the MLM Index EV (15V).

[It] doesn’t contain equity markets, it does not adjust position sizes for volatility, and it passively represents the beta to pure trend following.

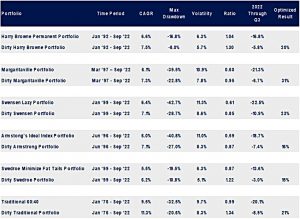

ML looked at six Lazy Portfolios and used monthly rebalancing.

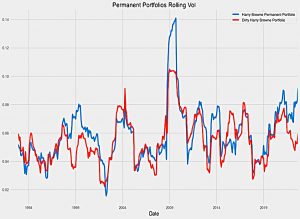

Harry Browne

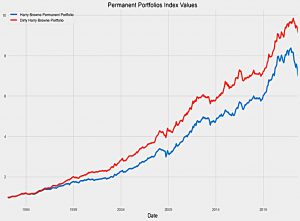

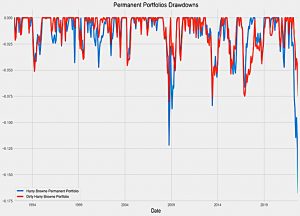

The Harry Browne Permanent Portfolio allocates equally across four assets.

- Adding MF modifies this to five allocations of 20%.

The Dirty PP shows a higher CAGR, lower volatility and lower max drawdown.

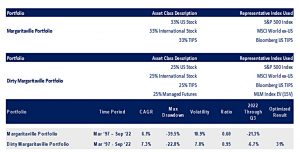

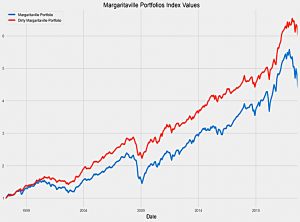

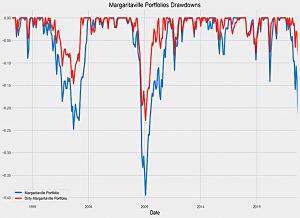

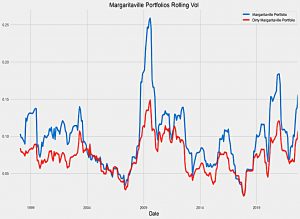

Margaritaville

The Margaritaville portfolio has an equal split between three assets – TIPS, US stocks and international stocks.

- So the Dirty Margarita has four allocations of 25% each.

As before everything improves – CAGR, volatility and drawdowns.

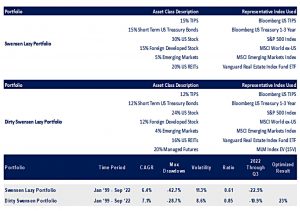

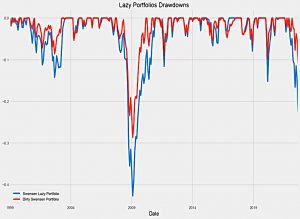

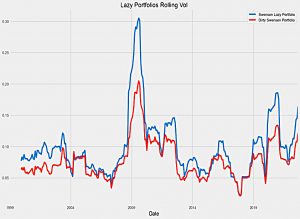

Swensen

The Swensen Yale endowment portfolio has six assets, including 20% in REITs.

- The Dirty Swensen adds a 20% allocation to MF.

Once again, everything improves.

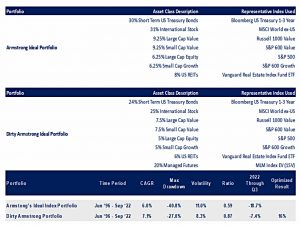

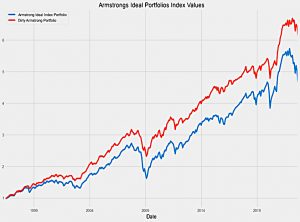

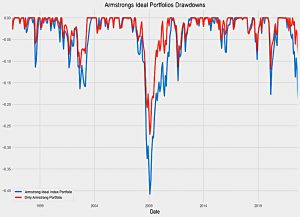

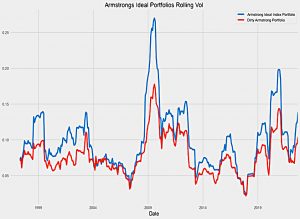

Armstrong

The Armstrong Ideal is a Lazy Portfolio that I haven’t come across before.

- It has seven asset classes and sums to 62% stocks, 30% bonds, 8% REITs

As usual, the Dirty Armstrong has a 20% allocation to MF squeezed in.

As ever, all the numbers improve.

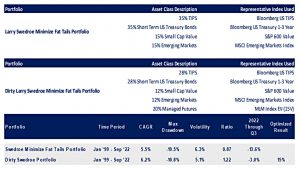

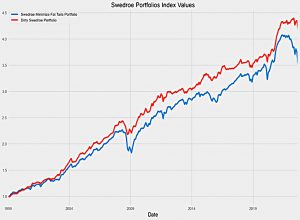

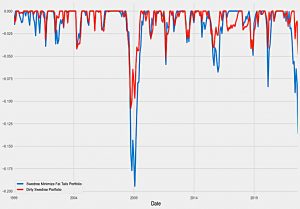

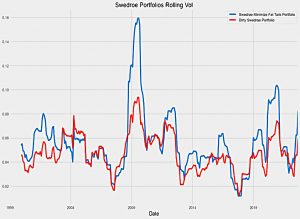

Swedroe

The Larry Swedroe Minimize Fat Tails Portfolio has 70% bonds (split between TIPS and US Treasuries) and 30% stocks (split between US small-cap value and emerging markets).

- The Dirty Larry adds 20% MF to the mix.

By now it will come as no surprise to you that all the numbers got better, despite the heavy bond bias.

60-40

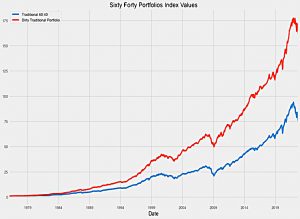

The final portfolio that ML looked at was the 60-40.

- The Dirty 60-40 becomes a 50-30 with 20% MF.

Of course, all the numbers get better.

That’s it for today.

- The message is simple – adding an allocation to MF improved all six of the Lazy Portfolios that ML looked at.

Or as ML put it:

For those looking to add Managed Futures strategies, there are many reasonable options. Build a good portfolio of strong diversified elements that each do their job, and then rebalance. The starting point is to take the portfolio constructs you like and make a “dirty” version with Managed Futures at 10-20% or so.

If only the implementation of this approach was straightforward for UK private investors.

- Until next time.