QuBe Portfolios – NewFound

Today’s post looks at a paper from NewFound on portfolio construction.

Contents

QuBe portfolios

I found this paper, which dates back to December 2016, while researching the QuBe portfolios from NewFound Research.

- I haven’t been able to access the portfolios themselves as yet (the links in the emails from NewFound don’t work for me), so I will have to make do with the underlying framework.

The title of the paper is “A Modern, Behavior-Aware Approach to Asset Allocation and Portfolio Construction” and the authors are:

- Corey Hoffstein

- Nathan Faber and

- Justin Sibears (who I don’t think I’ve come across before).

MPT

The paper begins with a critique of Modern Portfolio Theory (MPT):

The assumptions that asset class returns are normally distributed and that expected returns, volatilities, and correlations are both known to investors and are static over time fail to hold up to empirical evidence.

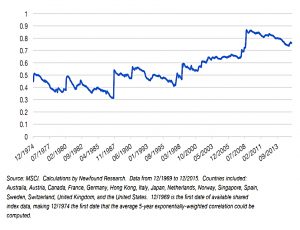

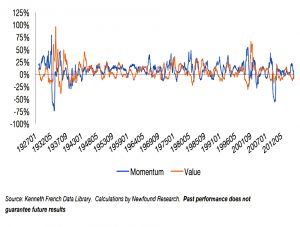

I practice, returns have fat tails (extreme events are more likely than in a normal distribution) and relationships between assets are regime driven.

- The stock/bond correlation is the most obvious of these.

Unfortunately, these assumptions appear to fail spectacularly during market crises: the very times that investors rely on diversification the most.

Behaviour

Even more importantly, MPT fails to incorporate the role of investor behaviour in long-term investment results.

- Investors show loss aversion and also tracking error aversion to both indices and their peers.

This paper highlights the steps that can be taken within asset allocation to address the behavioral shortcomings of investors. The optimal investment plan is, first and foremost, the one the investor can stick with.

Leverage

Investors also have leverage aversion, which gets in the way of the MPT/Risk Parity approach of holding the ideal (low-return) asset allocation and using leverage to achieve their desired return/level of risk.

- Most investors try to hold more high volatility assets (stocks) instead of using leverage. (( I would do this myself, but my unlisted holdings – property and DB pensions – make it hard for me to get my stock allocation above 40% ))

The problem here is that most of the portfolio risk is now equity risk.

Correlations

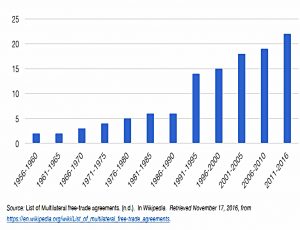

Rising globalisation (perhaps now reversed by Covid and by Russia’s invasion of Ukraine) has led to rising asset correlations, impacting diversification benefits.

- As noted above, correlations also spike during crises.

Bond yields

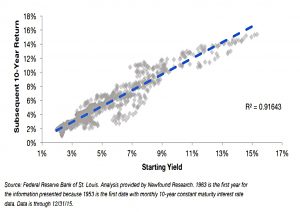

Bond yields – the best predictor of bond returns – are now at record lows, making fixed income a very expensive diversified for stocks.

Low starting yields also impact the crisis alpha of bonds:

From peak-to-trough during the dot-com sell-off (March 10, 2000 to October 9, 2002), the 10-year U.S. Treasury rate fell from 6.39% to 3.61%, a 2.78 percentage point move. During the peak-to-trough sell-off of the Great Recession (October 9, 2007 to March 10, 2009), the 10-year U.S. Treasury rate fell from 4.67% to 2.89%, a 1.78 percentage point move.

If bond yields are already low, they can’t gain so much in the next crisis.

Growth decomposition

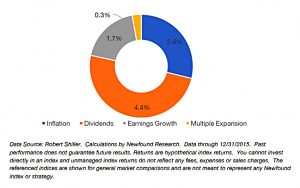

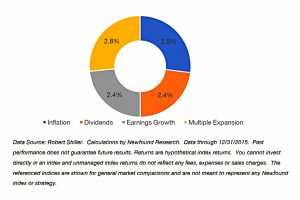

Nominal equity returns can be decomposed into four sources: inflation, dividend yield, real earnings growth, and valuation changes.

Historically, (reinvested) dividends and earnings growth account for 95% of real returns, but in the 30 years prior to the writing of the paper, valuation expansion was more prominent, taking annualised returns above 10%.

The S&P 500 was yielding approximately 2.1% as of June 30, 2016, and its cyclically adjusted price-to-earnings (CAPE) ratio was in the 91st percentile.

The authors felt that multiple expansion was unlikely to continue, though it has so far.

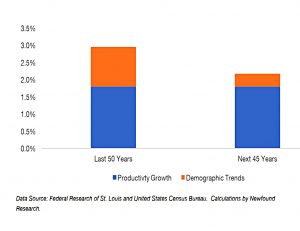

They also expect demographic headwinds (primarily boomer retirement) will depress GDP growth and hence corporate earnings growth.

Declining productivity growth should also have an impact.

Asset allocation

Assets

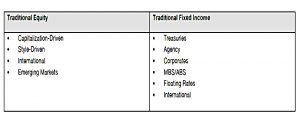

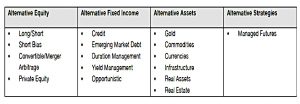

Portfolios now use more assets, sub-asset class style and alternative approaches.

You could also add crypto to this list today.

Some of these asset classes used to be available only to institutions and HNW/sophisticated investors, but now there is usually an ETF that anyone can access.

Approaches

New allocation approaches include risk parity, the endowment (Yale) model and tactical asset allocation.

Tactical asset allocation strategies dynamically adjust the asset profile over time in order to take advantage of short-to-mid term opportunities stemming from attractive valuations, momentum shifts, or macroeconomic conditions.

Behavioural finance

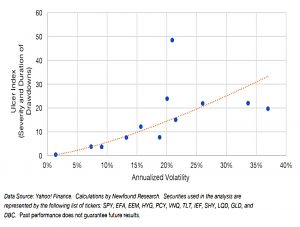

One of the key behavioural findings is that investors are not risk (volatility) averse, they are loss averse.

- The average “coefficient of loss aversion” is 2.25 – losses are 2.25 times more painful than equivalent gains are pleasurable.

Investors actually have a preference for high risk, “lottery” style investments. By using volatility as the primary measure, MPT punishes both bad, downside risk and preferable, upside risk.

Investors also benchmark to peers and to indices, rather than using absolute performance.

- And since they check portfolios at (too) frequent intervals, they prefer a smooth ride.

MPT in contrast optimises for the end result.

The NewFound Approach

We believe a modern asset allocation process should:

- be strategic, but not static

- address the flawed assumptions of MPT (e.g. volatility as a risk measure, normality of returns, and a constant correlation structure)

- include new and diversifying asset classes and strategies and

- address the role investor behavior plays in long-term investment results

This translates into three steps:

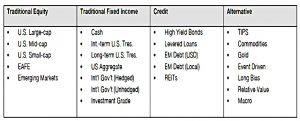

- traditional allocation using 7-15 forward assumptions to maximise returns for a given risk level

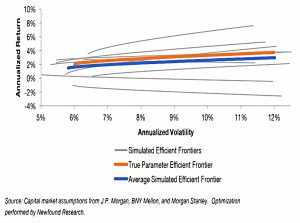

- NewFound use Monte Carlo simulation here, averaging thousands of runs to incorporate non-linear trade-offs and the sensitivity of returns to (diverse) capital market assumptions (from multiple institutions)

- They also use factor-based “shocks” to simulate the impact of fat-tail events

- addition of non-traditional assets and strategies where they are highly likely to increase return or reduce risk

- risk budgeting ( a version of risk parity)

Their simulated efficient frontiers lead to different allocations than under MPT (eg. 29/71 stock bonds vs 25/75 under MPT).

Portfolios

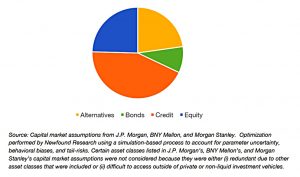

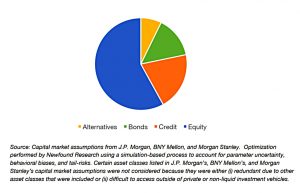

Current projections of low economic growth and low yields lead to an optimized result that relies heavily on credit-based asset classes (e.g. high yield, senior loans, emerging market debt, and REITs) for return generation and alternative asset classes and strategies for risk mitigation.

This is a 25% stocks and 20% alternatives portfolio that I can’t see many private investors adopting.

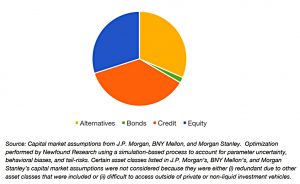

- NewFound acknowledges this, and their second optimisation process is designed to maximise returns relative to the traditional 60/040 stock-bond portfolio, using a coefficient of loss aversion of 2.

This reference-point portfolio is much closer to the traditional 60/40.

Traditional fixed income is supplemented with credit-based and alternative assets, which can diversify equity exposure without the expected return drag inherent with large core fixed income allocations in a low yield environment.

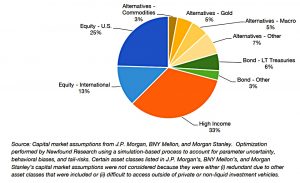

Step three is to maximise “internal diversification” through risk parity.

Specifically, we implement hierarchical risk parity, which seeks to first balance the risk contributed by each broad asset class category (e.g. equity) and then balance the asset class contributions within each category (e.g. U.S. large-cap).

This is another strange portfolio, which looks like 30% stocks, 30% alternatives and 40% bonds.

Together, the three methods cover several important categories:

- Absolute return, relative return, and return agnostic

- The destination and the quality of the journey

- Investor rationality and irrationality

- Holistic risk management

The final portfolio is simply a blend of the other three:

The allocation is 38% stocks, 42% bonds and 20% alternatives.

- This is a fairly low return portfolio that would require leverage to hit most investors’ return targets.

Implementation

NewFound implements this portfolio using mutual funds and ETFs from three groups:

- Active strategies ( downside risk management, income management, duration management, or diversification enhancement)

- Smart-beta (factor) funds

- Low-cost index funds

Conclusions

It’s been a reasonably interesting journey through this fairly long paper, but the destination is a little disappointing.

- The final portfolio is more interesting than the traditional 60/40, and potentially more robust, but for a leverage-averse investor, its returns will be too low.

Most PIs would up the stock allocation (to 60%?) in order to meet their goals.

- This takes us almost back to square one.

Ironically, NewFound defends the portfolios as being easier to stick with, due to their smoother ride:

These behavior-aware portfolios will not be “optimal” in the traditional sense of achieving the highest risk adjusted returns over their investment horizon. However, their focus on managing both the destination and the journey aims to provide a smoother ride overall, a ride that can be weathered.

These portfolios balance long-term results while managing the risk of short-term underperformance to common benchmarks and the impact of uncertain parameter estimates.

I agree with all of this, but you can’t get someone to stick with something that they won’t adopt in the first place.

- Until next time.