Options 10 – WealthyOption

Today’s post is the tenth in our series on options trading. We look at WealthyOption, a blogger who uses a version of ERN’s options trading system.

Contents

The story so far

The lessons from the articles so far were getting to be quite extensive, so I have moved them to their own page.

WealthyOption

I’ve called WealthyOption (WO) a blogger, but I’m not sure that is the right description.

I’m just a regular guy with a full-time IT job who trades on the side. I’ve been actively trading for 15 years or so, using options for close to 10 years.

I came across him on Reddit, where he described the simple options trading system he used.

- It sounded like ERN’s system, so I investigated further.

WO has a website and seems to offer some kind of automated version of the options system (via Whispertrades, using TD Ameritrade as a broker, I think).

- Parts of the site are member-only, so what follows has been cobbled together from the public sections and from a couple of Reddit posts.

Target audience

I consider this strategy to be suited for intermediate options traders – somebody with at least a few years of experience.

This surprises me a little – apart from a large amount of capital employed, ERN’s strategy (and therefore WO’s) strikes me as a good first step into the world of options.

The strategy

This strategy involves selling out-of-the-money (OTM) weekly SPX puts 3-5x per week and buying them back for 70% profit before entering another trade. These are short-duration, 1-4 days to expiration (DTE), naked / uncovered puts.

Note that WO closes his positions before expiry, which SpinTwig’s backtesting showed to be sub-optimal.

I always enter the next closest expiration that is 1-4 DTE. I don’t enter any 0 DTE (options expiring on the current day). I’ll enter 1 DTE if available. Otherwise, 2, then 3, then 4. 4 DTE is only used around stock market holidays.

WO started by trading put credit spreads in mid-2019.

- This went so well for 18 months that he set up his website.

After setting up this website and sharing with other traders, I was challenged in many ways, ultimately leading me to backtesting my own strategy to find faults and/or areas for improvement. It’s those backtests that convinced me to drop the spreads and move to naked puts.

Here’s the detailed trade process:

I sell SPX puts at [5,6 and 7] delta with 1-4 days-to-expiration (DTE). When I open that position, I’ll enter a limit buy to close order at 70% profit (30% of premium/credit received on entry). I enter a new trade either when my buy order fills at 70% profit or at expiration. I hold any losing trades all the way to expiration.

Here’s why he uses 6 deltas:

I have run many backtests and 6 seems to be a sweet spot for return vs drawdown. A 6 delta strike is going to be around 2-3% OTM in low IV environments and as far as 15-20% OTM in high IV environments.

You can adjust volatility by moving your short strike closer or farther from my 6 delta. The farther you move your short strike out, the lower your volatility and returns. The closer you place your short strike, the higher volatility and returns.

Instrument

WO has many reasons for sticking to SPX:

- Three expirations available every week (Monday/Wednesday/Friday)

- Highly liquid

- Cash-settled. [No underlying on assignment.]

- Low trading fees

- Beneficial tax treatment [US]

- Less “paperwork” to file for taxes [US]

Pros and cons

WO lists the pros and cons of the method. Pros first:

- Systematic with no decision-making required

- Requires little time to manage relative to other active trading strategies (20 minutes per week)

- Higher return and lower drawdown (long-term) than the S&P500

- Viable for small accounts ($10k minimum)

I think the time commitment is understated here.

- It’s small in absolute terms, but the stress of running naked puts that are renewed every two days will be hard to put out of your mind.

Now cons:

- Theoretical undefined max risk

- High trade volume (3-5 round-trip trades per week), but can be automated

- Requires high-level options trading permissions

- Volatile short-term (days to a week), underperforming when volatility (VIX) spikes

Risks

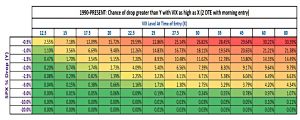

WO has a table of how likely SPX is to drop by a certain percentage over 2 days, given the VIX level.

- He has tables for morning and afternoon entry – as I’m in the UK I would trade US options in their morning, so that’s the table I’m showing.

In the event that SPX has some kind of nasty selloff, with how rapidly my trade adjusts to changing IV (by cycling in/out every 1-3 days), that short strike absolutely flies away from the current market level as selling accelerates.

Heavy selling doesn’t come out of absolutely nowhere like most would have you believe. It is always prefaced by at least some bubbling under the surface. That bubbling is enough to start pushing your short strike farther and farther away from the current price level. Before you know it, the market is puking its guts out but you’re actually making money because your short strike is 15% below the current price level!

It’s safe to say that WO is not unduly concerned by the risks of his strategy (in the same way that ERN isn’t).

When the market collapses, you’ll find that you have a large loss very quickly, but once that loss is out of the way, you’ll be on the ‘road to recovery’ long before the overall market.

Sizing

I operate under the assumption that max risk for any one play would occur if SPX fell 20% below my short strike. This isn’t 20% below my entry price, but 20% below my short strike. Any time you see “max risk” next to one of my trades or backtests for a naked position, it is based on the value I must pay to buy back my put if it expires 20% ITM.

I backtested this trade over 4 years and 1000 trades, and the deepest any of those trades expired was 1.9% ITM. This included a period with a 35% drawdown in SPX and the third worst single day loss at 12%.

So if the strike is 3000, 20% is $60K (since the contract is for 100 “shares” of SPX).

- So with a $250K portfolio (allocation to this option strategy), you could sell 4 contracts.

WO runs at 75% capacity, so he would only see three contracts.

There are also smaller contracts (SPY and /ES) for smaller portfolios.

- Note that these contracts can be assigned into the underlying.

You should close out any positions at risk of an assignment. If you do not do this and are assigned shares, then you carry those shares overnight (or over the weekend) and can’t open a new set of puts or you double your exposure.

You can avoid this entirely by using SPX or /ES that are cash-settled!

Commissions

My commissions on SPX are so low that I don’t even factor them into my P/L. I estimate that about 1.5% of my total return is spent on commissions.

Performance

The website has some performance figures, though they only date back to November 2020 (around six months at the time of writing).

- This is explained by WO’s change of strategy after 18 months of put credit spreads.

Here are the scores:

- 438 trades, 434 winners (99.1%)

- 13.7% return, compared to 17.1% from an unspecified benchmark

Below benchmark performance is obviously disappointing, but perhaps acceptable if the strategy lowers the volatility of a long-only stocks-dominated portfolio.

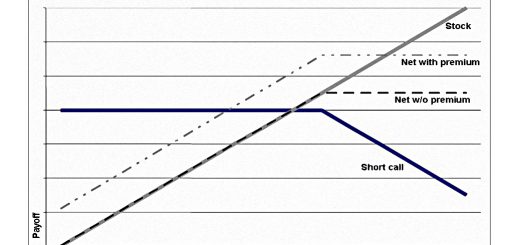

WO has a regularly updated “backtest validation” chart, showing how his live trades compare to his backtest:

Backtested over 4 years, max drawdown for this strategy was 10%. SPX over the same timeframe had a drawdown of about 35%. I’m unable to reliably backtest farther back than 2016 because SPX Monday, Wednesday, Friday weeklies didn’t actively trade back then.

I did some rudimentary backtesting on the weekly and monthly SPX options that were available in 2008, and max drawdown was still only about 11% over that timeframe.

Allocation

WO allocates a surprising 75% of his portfolio to this strategy (or rather, to its potential risk at 20% ITM expiry)

- He keeps all of his available cash/buying power in a 1-3 year Treasury fund, which adds around 1% to his annual returns.

I find that scary both in absolute terms and also in terms of how quickly WO has reached this allocation (two years of trading this system, though he has 10 years of options experience).

- My ceiling for options would be more like 20% to 25%, and I would expect to take at least five years to get there.

Perhaps I’m quite risk-averse after all.

I’m not sure we’ve learned too much today in terms of add-ons to ERN’s system, but the more bloggers I find using a variation on ERN’s approach – and willing to share some of the details of their experience – the happier I feel.

- Until next time