Macro Momentum

Today’s post looks at an AQR paper from 2017 on Macro Momentum.

Contents

Macro Momentum

The paper is called “A Half-Century of Macro Momentum” and was written by Jordan Brooks, an MD at AQR.

- It was written in August 2017, but I only came across it recently.

Global macro hedge funds are a diverse group that make up around 20% of total hedge fund assets.

- Famous names in the area include George Soros, Paul Tudor Jones, John Paulson and David Harding.

Jordan starts the paper with a quote from Harding:

We tend to make money out of surprises… Most surprises unfold gradually.

Some of the funds are event-driven and use large unhedged bets, whilst others use technical approaches like trend and carry.

Jordan’s approach follows the Harding quote:

The strategy aims to capitalize on the tendency of market participants to underreact to news by positioning on the basis of fundamental macroeconomic trends across currency, equity and fixed income markets.

Methodology

Jordan’s strategy involves four asset classes:

- global stocks

- global currencies

- global 10-year bonds

- global 3-month interest rates (ie. short-term bonds)

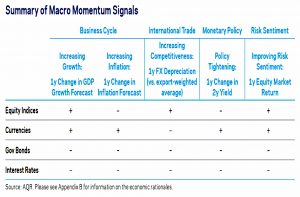

To decide whether to go long or short, he looks at four macro signals:

- the business cycle (growth and inflation)

- international trade

- monetary policy

- risk sentiment

The specific measures used are shown in the table above.

- The table shows the bullish/bearish signals for each asset (eg. increasing growth is good for stocks, but increasing inflation is bad).

Jordan forms portfolios in two ways:

- long-short, based on an asset’s signal relative to the average signal

- directional, based on the absolute signal for each asset

- directional portfolios should be market-neutral on average

The next step is to combine long-short and directional portfolios into two intermediate portfolios:

- asset class averages

- theme (signal) averages

Finally, the asset class and theme portfolios are combined to form an aggregate Macro Momentum (MM) portfolio.

Performance

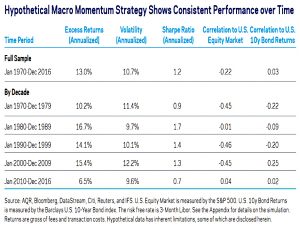

The performance of macro momentum has been consistent over the last nearly 50 years, a period that features a wide variety of financial market episodes: seven NBER-defined recessions, multiple wars, stagflation, oil price shocks, Volcker disinflation, the Global Financial Crisis, and secular increases and declines in real and nominal interest rates.

The strategy has had positive annualized excess returns and Sharpe ratios over every simulated decade, and has also achieved low to negative correlation with U.S. equity and bond markets.

Not bad.

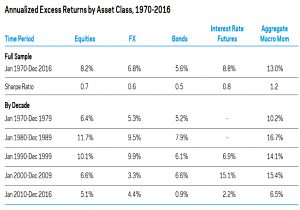

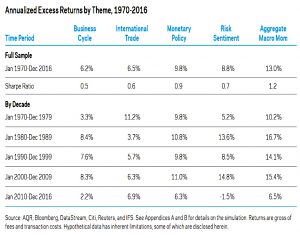

- All of the asset classes and signals (themes) have contributed and have comparable returns.

Stock crashes

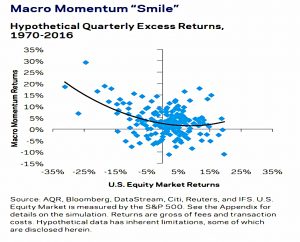

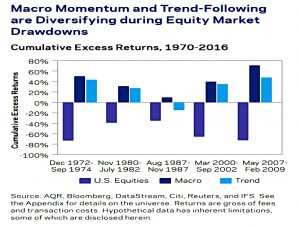

Macro momentum exhibits a pronounced ‘smile’ relative to equity market returns: it tends to have negative beta to equities in down-markets and positive beta in up-markets. In the ten worst quarters for equities since 1970 (during which equities averaged -19.9%), macro momentum returned an average of 13.7% in excess of cash.

Since equity bear markets are usually preceded by deteriorating macro signals, MM tends to get short early.

Rising yields

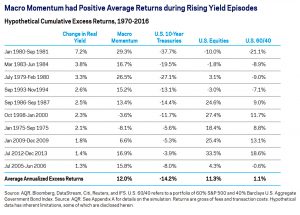

During ten rising yield episodes, MM returned 12% pa, compared to 1.1% pa for a 60/40 portfolio.

- MM was positive in 8 out of the ten episodes.

Once again, rising real yields tend to be preceded by macro signals.

Trend

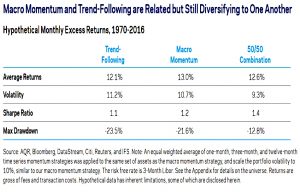

Since price trends and fundamental trends tend to align on average, one would expect trend-following returns and macro momentum returns to be positively correlated.

Jordan says that MM should respond more quickly to market turning points, however.

- And long-short relative value views within asset classes should also help.

The correlation turns out to be 0.4, which is low enough to offer diversification benefits.

- A 50/50 combination of trend and MM looks very attractive.

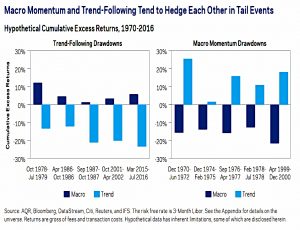

The two strategies appear to be diversifying when it matters most. Remarkably, in each of the five largest drawdowns for trendfollowing, macro momentum realized positive returns; and in each of the five largest drawdowns for macro momentum, trend-following realized positive returns.

Both trend and MM do well during stock drawdowns.

Macro momentum tends to do well in equity market drawdowns that are preceded by deteriorating macroeconomic fundamentals. Trend-following, on the other hand, tends to do well in equity market drawdowns that evolve gradually.

Most stock crashes show both characteristics.

- MM showed positive returns in four out of the five largest equity market drawdowns, whilst trend was positive in four of them.

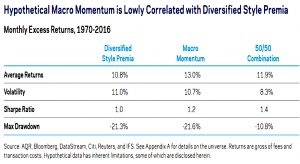

Style premia

Jordan’s style premia portfolio is a market-neutral mix of value, momentum and carry.

- This has a low correlation of 0.2 with MM.

Once again, a 50/50 combination of style premia and MM looks very attractive.

Global macro

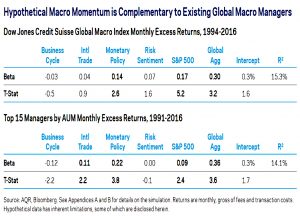

Jordan also analysed the DJCS Global Macro index of macro hedge funds, and an equal-weight portfolio of the 15 largest global macro managers in the index.

Both portfolios load significantly on stocks and bonds. This may indicate prudent tactical bets by global macro managers over the last 20+ years, but more likely reflects a passive allocation to traditional risk premia.

In contrast, MM shows a low to negative correlation with stocks and bonds.

Global macro funds load significantly on monetary policy but loadings on other macromomentum themes are mixed. Managers seem to be reacting to changes in the monetary policy outlook (“central bank watching”). Positioning on the basis of trends in business cycles, international trade, or risk sentiment, appears largely unexploited.

Jordan concludes that MM is complementary to existing global macro managers.

Conclusions

Macro momentum (MM) is a systematic approach to global macro investing that takes long positions in assets with improving fundamental trends and short positions in assets with deteriorating fundamental

trends.

- MM has delivered strong returns with low correlations across a variety of macro environments during the last 50 years.

- MM can provide diversification during equity bear markets and rising yields environments (both of which might become relevant in the coming years).

- MM is complementary to other alternatives like trend, long-short value, momentum and carry, and is not being captured completely by existing global macro funds.

- MM combines very well with trend and with a diversified style premia portfolio.

All of which makes MM worthy of further investigation.

Jordan concludes:

Given the current elevated level of equity valuations and historically low real yields on bonds, there are strong reasons to believe medium-term performance for traditional assets will not be as impressive as in the past. This strengthens the tactical case for alternative strategies in general, and macro momentum in particular.

Not much has changed in the four years since Jordan wrote the paper.

- Until next time.