Warren Buffett’s Annual Letters – 2022

As part of our series on Warren Buffett’s Annual Letters, we look at the letter for 2022, which was released over the weekend.

Contents

Warren Buffett’s Annual Letters – 2022

We’ve previously looked at Warren Buffett’s letters that cover:

2021, 2020, 2019, 2018, 2017, 2016, 2015, 2014, 2013, 2012, 2011, 2010, 2009 and 2008.

Today we’ll examine the 2022 letter, which was published last week.

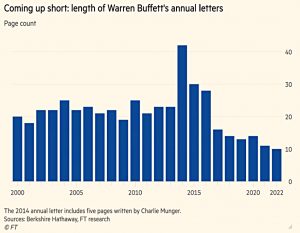

- It’s one of the shortest in a long time, at just ten pages.

Performance

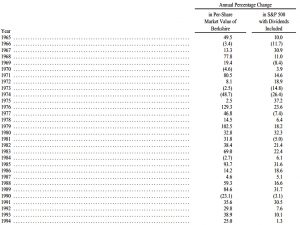

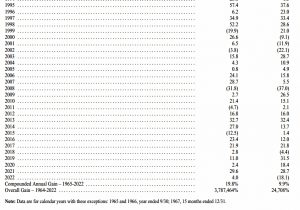

Over the 58 years to 2022, BRK has compounded its share price by 19.8% pa.

- During the same period, the S&P 500 has compounded at 9.9% pa (dividends included).

Total gains are 3.8M% for BRK and 24.7K% for the S&P – more than a hundredfold difference.

- In 2021, BRK was up 4% whilst the S&P went down 18.1%.

Ownership

As he often does, Buffett explains that BRK has both wholly-owned subsidiaries and chunks of publicly-listed firms.

One advantage of our publicly-traded segment is that – episodically – it becomes easy to buy pieces of wonderful businesses at wonderful prices. It’s crucial to understand that stocks often trade at truly foolish prices, both high and low.

Controlled businesses are a different breed. They sometimes command ridiculously higher prices than justified but are almost never available at bargain valuations.

He also claims to have been “so-so” at capital allocation:

Our satisfactory results have been the product of about a dozen truly good decisions – that would be about one every five years. The weeds wither away in significance as the flowers bloom. Over time, it takes just a few winners to work wonders.

Earnings

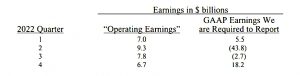

The downside of the public shares is that their fluctuations in value feed through to the Generally Accepted Accounting Principles (GAAP) earnings, making them volatile.

- Warren prefers to ignore these fluctuations and prefers a number he calls “operating earnings”.

The volatility comes through in the 2022 quarterly numbers:

As you can see, BRK made a massive (GAAP) loss for the year of $23 bn.

- On the other hand, operating earnings of $30.8bn were a record high.

The GAAP earnings are 100% misleading when viewed quarterly or even annually. Their quarter-by-quarter gyrations, regularly and mindlessly headlined by media, totally misinform investors.

But even operating earnings can be manipulated:

“Bold imaginative accounting,” as a CEO once described his deception to

me, has become one of the shames of capitalism. Reporters and analysts embrace its existence as well. Beating “expectations” is heralded as a managerial triumph.

Float

The insurance float, a key to the success of BRK, increased from $147 bn to $164 bn.

Since purchasing our first property-casualty insurer in 1967, Berkshire’s float has increased 8,000-fold through acquisitions, operations and innovations.

Buybacks

A very minor gain in per-share intrinsic value took place in 2022 through Berkshire share repurchases as well as similar moves at Apple and American Express.

Buffett has long been a fan of share buybacks:

The math isn’t complicated: When the share count goes down, your interest in our many businesses goes up. Every small bit helps if repurchases are made at value-accretive prices.

When you are told that all repurchases are harmful to shareholders or to the country, or particularly beneficial to CEOs, you are listening to either an economic illiterate or a silver-tongued demagogue.

BRK spent $8 bn on buybacks in 2002, down from a record $27 bn in 2021.

Warren’s robust defence of buybacks this year might be prompted by the “Inflation Reduction Act” which has just added a 1% tax on them.

Cash

BRK continues to hold cash and bonds:

Berkshire will always hold a boatload of cash and U.S. Treasury bills along with a wide array of businesses. We will also avoid behavior that could result in any uncomfortable cash needs at inconvenient times, including financial panics and unprecedented insurance losses.

And there is still no dividend:

And yes, our shareholders will continue to save and prosper by retaining earnings. At Berkshire, there will be no finish line.

BRK did make some investments in 2022 (in Paramount, Louisiana-Pacific and Occidental Petroleum) and cash fell from the record $147 bn in 2021 to $129 bn at the end of 2022.

- But in the final quarter, BRK sold more than $16bn worth of stocks, including Taiwan Semiconductor, US Bancorp and Bank of New York Mellon.

Inflation

Buffet warned that BRK was not an inflation hedge:

Berkshire also offers some modest protection from runaway inflation, but this attribute is far from perfect. Huge and entrenched fiscal deficits have consequences.

Taxes

Warren notes that BRK paid 1 in 1000 of all UK tax revenue dollars over the past decade.

Imagine piling up $32 billion, the total of Berkshire’s 2012-21 federal income tax payments. The stack [is] more than 21 miles in height, about three times the level at which commercial airplanes usually cruise. When it comes to federal taxes, individuals who own Berkshire can unequivocally state “I gave at the office.”

Conclusions

It’s a fairly short and quiet letter again this year.

- There was a nice section about how grateful Warren is to Charlie, and how everyone should find themselves a smart, slightly older partner.

- It quotes a lot of Charlie’s famous investing rules if you haven’t heard them before.

There was also a medium-sized deal – the $12 bn takeover of insurer Alleghany, which boosted the float.

But:

- He once again resisted the temptation to reduce BRK’s massive cash pile by paying a dividend.

- And there was no timetable for a handover to vice chairman Greg Abel, his likely successor (and a sprightly 60 years old).

Maybe things will be different next year.

- Until next time.