The Cockroach Portfolio Again

Today’s post looks at another version of the Cockroach Portfolio, this time from Mutiny Fund.

Mutiny

Mutiny is a finance website that aims to help investors with the long-term growth of their portfolios. Their motto is “Offense wins games. Defence wins championships.”

We believe that combining defensive-minded strategies such as long volatility or trend with offensive-minded strategies such as stocks or fixed income provides the best opportunity for long-term capital growth while reducing drawdowns in the interim.

Which sounds right up our street.

The website is run by Taylor Pearson and Jason Buck. Today’s article is by Taylor, who the website describes as:

An entrepreneur, investor and author of The End of Jobs. He has spent the last decade researching, consulting and speaking about how individuals and institutions can be more resilient and, if possible, antifragile.

The article is called “Nuclear Winterising Your Investments.

The Permanent Portfolio

Mutiny’s version of the Cockroach Portfolio (CP) has its genesis in the 2008 financial crisis.

In the wake of 2008, one thing in particular became clear: traditional approaches to diversification were not working. It became clear to us that we had to reimagine the way our financial models view the world in a fundamental way.

A seemingly “diversified” portfolio of U.S. stocks, international stocks, real estate, commodities, hedge funds, and corporate bonds turned out not to be so diversified.

So the guys at Mutiny looked at lots of asset allocation strategies and they came across Harry Browne’s Permanent Portfolio (PP).

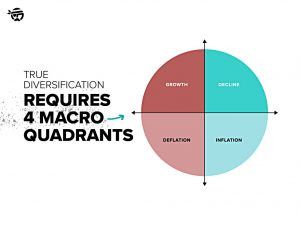

He saw that there were four possible macroeconomic environments: Growth, Recession, Inflation, and Deflation.

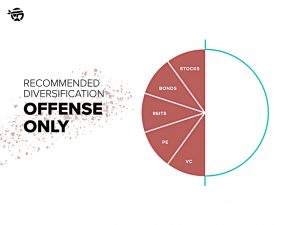

Browne’s portfolio includes offensive assets:

- 25% in Stocks which do well in Growth

- 25% in Bonds which do well in Deflation

And defensive assets:

- 25% in Cash which does well in a Recession

- 25% in Gold which does well in Inflation

What about the PP’s track record?

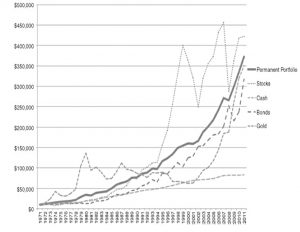

Proponents of the approach like to say that the Permanent Portfolio has produced “stock like returns with bond like risk”. From 1970 to 2012, the permanent portfolio had an annual growth rate of 8.55% with a maximum drawdown of about 18%. 93% of rolling 12-month periods deliver[ed] positive nominal returns.

An all-stock portfolio would have returned 9.61% over the same period, but the worst drawdown was 53%.

[The PP] has a fairly “smooth” curve compared to any single asset. By taking assets which do well in each of the core macro environments and rebalancing between them, you can create stability through volatility. Investors tend to focus too specifically on the risk characteristics of a single investment, as opposed to the overall portfolio.

The Cockroach Portfolio

After the 2008 crash, Mutiny looked at similar approaches to the PP, including:

- The All-Weather Portfolio from Ray Dalio at Bridgewater

- Meb Faber’s Trinity portfolio

- The Dragon Portfolio from Artemis Capital.

To fix what they saw as three holes in the PP, they developed their own version of the Cockroach Portfolio (CP):

Cockroaches aren’t cuddly, but they do two things well that we also want out

of our portfolios: they’re really hard to kill and they compound fast.

The first hole was using cash to dampen losses from a sharp sell-off leading into a recession.

Utilizing a long volatility strategy instead of just cash could better offset losses elsewhere.

Log vol strategies are not readily available to retail investors, so Mutiny had to craft a bespoke solution by speaking directly with long vol managers.

The second issue was gold:

Gold is an excellent hedge against hyperinflation but doesn’t always do well with bouts of high, but not runaway inflation (say 5-15% annually). Incorporating trend strategies on commodity, stock and bond markets would help to cover these possibilities.

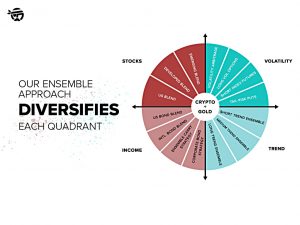

The third change was layered diversification.

Diversification across the four macro quadrants is a good starting point, but even better is diversification within each of those quadrants. By including global stocks, global bonds, four different volatility strategies and three different trend approaches, The Cockroach approach diversifies within each of the quadrants.

Taylor notes that traditional portfolio diversification is focused on offensive assets:

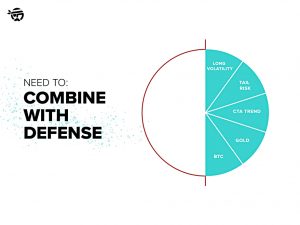

But to minimise drawdowns and improve long-term compounding, you also need defensive assets.

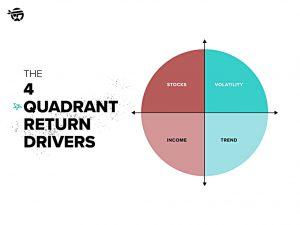

The seemingly much more complicated Mutiny CP still maps back to Browne’s four macro environments:

- Stocks do well in Growth – when GDP is increasing, corporate profits tend to increase as well.

- Income does well in Deflation – Bonds are the most common and easily accessible return driver for a deflationary environment [but] other assets which provide a yield such as Real Estate and carry trades also serve the same function.

- Volatility does well in Decline – a put option on the S&P is guaranteed

to pay out if the S&P declines.- Trend does well in Inflation – commodities are a fundamental return driver. The Trend bucket should help augment our volatility bucket in the case of a prolonged recession.

Mutiny now offers an implementation of their portfolio directly to investors (though only in the US).

Conclusions

In one sense, we haven’t covered anything new today.

- We’ve looked at the Permanent Portfolio before and also at Calderwood’s version of it (which they call the Cockroach Portfolio).

Mutiny’s version is more sophisticated but draws on other portfolios that we’ve already analysed (the All-Weather, the Trinity and the Dragon).

The short version of the story is that we need to add Trend and Long Vol to the PP.

- Trend is relatively easy to implement (via momentum strategies on stocks and levered accounts like spread bets).

- Long Vol is more difficult, though using options looks promising.

The next issue then becomes allocation.

- It seems too pat to me that the four quadrants should have equal weights.

- For a start, the underlying economic environments don’t occur with equal frequency.

In practice, those few private investors who can be bothered to move towards this kind of portfolio will start by adding trend to a base portfolio which resembles the traditional 60/40.

- They might also beef up their allocations to gold and commodities (and perhaps add a pinch of crypto these days).

Stage three would be finding a long vol solution.

It would be great if the industry offered portfolios like this, but there seems to be no retail appetite, we have a chicken and egg situation.

- There are some systematic DIY platforms appearing in the US, but the only thing I’ve seen over here that could be useful is Aikido.

We’ll take a look at that platform in a future post.

- Until next time.

Hi Mike,

Thank you for writing this, I enjoyed the article as I like to see how these types of portfolio approaches are revisited and see how they can be revamped using things like factors, other asset types ( not previously available), etc.

I just wondered if you were aware of possible retail investor replacements for long vol (maybe not as effective but possibly useful). The older style portfolios also generally use less components making them easier for small DIY portfolios.

Also, I wondered how these newer ideas mapped over for UK investors as sometimes the returns are not always as strong as for the US.

Anyway, thank you for your time in writing and I hope to see more, keep up the great work deciphering these papers.

The search box is your friend – I looked at Long Vol in May: https://the7circles.uk/long-vol/

The short version is bonds plus FX pairs (developed world vs commodity currencies). The bad news is that bonds haven’t worked well this year as interest rates have risen.

Not sure what you mean by mapping over to UK investors – you need to take a global approach to these portfolios, not a UK-centric one.