RPC Stability Portfolio

Today’s post looks at a new stability portfolio from Risk Parity Chronicles.

Risk Parity Chronicles

Last year I wrote about Risk Parity Radio, a nice podcast about the principles of Risk Parity (RP) portfolios.

- Risk Parity Chronicles is a parallel website run by a listener to RPR, Jason. (( I couldn’t find a picture ))

Jason is in his 40s and from California, but he now lives in Japan, where he teaches at an international school (including a personal finance course).

Jason says he has three objectives for the site:

- I want to research the world of Risk Parity

- I want to test what I’ve learned

- I want to share what I have learned

To date, I’ve mainly used the site for its reviews of classic RP papers and resources.

- But Jason also has his own model portfolios, some of which go beyond the eight or so that Frank Vasquez tracks on RPR (and which Jason also tracks on RPC).

Today we’re looking at one of these portfolios which has caught my eye.

RPC Stability Portfolio

Jason has obviously been unlucky with his timing, launching his website only months before stock and bond markets started to crash.

He explains his motivation for the new portfolio:

The current disastrous period for every asset class except for commodities has made me wonder how a very conservative, very diverse portfolio would have performed over these past few months.

This is his third portfolio, and the first unlevered on.

- The RPC Income portfolio has 60% leverage, and the RPC Growth portfolio is 100% levered.

As you can see from the chart above, the RPC Stability portfolio has ten equally weighted assets.

- From a high level, it’s 30% stocks, 30% bonds, 20% commodities and 20% “other”.

Let’s look at the other in more detail:

- PFF invests in preferred shares and income shares, and I might classify that as bonds rather than stocks.

- DBMF is a trend-following managed futures ETF that mimics a CTA service – I would classify this as a True Alternative asset.

So let’s call the portfolio 30% stocks, 40% bonds and 30% Alts.

- That’s a pretty conservative allocation.

Performance

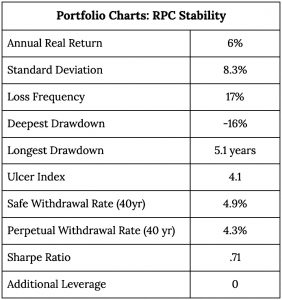

Despite the allocation, performance since the 1970s has been pretty good.

- It has a real return of 6% pa and a standard deviation of 8.3%

Jason says this is comparable to the performance of other conservative portfolios like the Golden Butterfly and the All Seasons (which are bother tracked on RPR).

It also has a nice max drawdown of just 16%, though the longest drawdown was 5 years.

The SWR is 4.9% and the perpetual withdrawal rate is 4.3%.

- These seem very high to me, though I don’t know the methodology Jason uses to calculate them.

It’s important to note that Jason had to cheat on the backtest:

The backtests on Portfolio Charts are likely slightly off, since neither managed futures nor preferred shares were available asset classes. I counted them as commodities and Large-cap value, respectively.

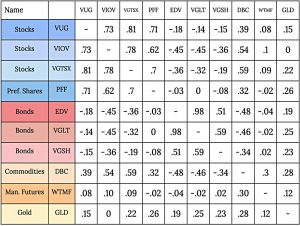

With these limitations, Jason also provides a correlation table:

Jason also compared the new portfolio to his existing pair of portfolios – and the RPR portfolios he looks at – all of which he has been tracking since July 2021:

The $1,000,000 starting figure is down to $945,210. This is a loss, yes, but would still be the highest of the eleven portfolios and about $34,000 above the RPC

Growth. Keep in mind that this figure is net of withdrawals for living expenses (a 4% withdrawal rate).

It’s a short track record, but at least the portfolio behaves as expected, just as it did when markets were performing well:

As of January 1st, 2022, when all portfolios were doing fairly well and in positive territory, the RPC Stability would have ranked eleventh at $1,003,537, or about $57,000 below the leader at that time, the RPC Growth portfolio.

7C Analysis

Jason describes the Stability portfolio as complex since it has 10 funds (equally weighted).

- Of course, I plan to make it a bit more complicated.

Let’s start with the high-level allocation.

- 30% stocks are way too low and 40% bonds are way too high (for me).

For stocks, let’s try:

- 10% UK

- 10% US

- 10% Europe

- 10% EM

- 5% APAC

- 5% Japan

That’s 50%, which is fine.

- We can also handle the growth and small cap value tilts via some factor (smart beta funds). (( I would also use mid-cap and small-cap funds across each of my equity geographies ))

Let’s allocate 10% to that, and add momentum, quality and low vol to the factors we access.

- So now we have 60% stocks.

Onto bonds. We don’t have a PFF fund in the UK, so let’s fall back to a default bond allocation:

- 5% Treasuries

- 5% Gilts

- 5% European government bonds

- 5% EM government bonds

That’s 20% for bonds, leaving 20% for Alts.

- I would cut the allocations to commodities and gold to 5% each. (( I would also fold in some other precious metals to the gold allocation ))

This means that we can stick with a 10% allocation to trend, though we’ll have to do it manually in the UK since we can’t buy DBMF.

- Now we have a very nice allocation, though it will probably need 30 funds to implement it, which means that it’s not suitable for small portfolios.

That’s it for today.

- RPC is a useful resource, and I found the stability portfolio quite thought-provoking, though it’s impossible to implement directly here in the UK.

Until next time.