Bridgewater Beta Portfolio

Today’s post looks at a recent paper from Bridgewater on how to build a Beta portfolio in an environment that looks difficult for many assets.

Contents

Difficult circumstances

The paper – called Building a Beta Portfolio in an Environment That Looks Difficult for Assets and written by David Gordon, Rutendo Chigora and Andrei Cretu – was published in May 2022.

- It looks at what to do now that the economic environment is not so favourable for beta in general and equities in particular.

Bridgewater worry about the withdrawal of liquidity (end of QE) and think markets are underpricing the amount of tightening that will be needed to control inflation.

- High inflation has a second effect – it makes holding cash unattractive.

Bridgewater caution against making big portfolio shifts based on volatile alpha opinions:

Our approach to building a total portfolio has always been to build the best beta you can, independent of any active views, and then carefully layer in a diversified set of alphas to the degree that you have them or can find them.

That’s pretty close to my own approach, so this is a good start.

The difficult conditions point to balanced (diversified) rather than concentrated beta:

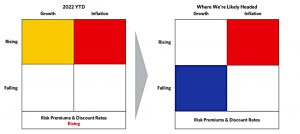

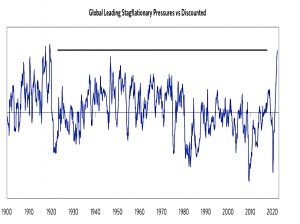

The biggest vulnerabilities of typical portfolios are to falling discounted growth and rising discounted inflation, and we see the likelihood of that combination going forward—stagflation—to be the highest it has been in 100 years.

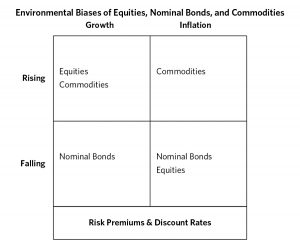

So the idea is to build a portfolio that is neutral to growth and inflation, without giving up the expected returns.

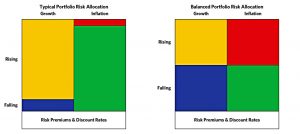

A typical portfolio has the bulk of its risk in pro-growth, falling-inflation assets, whereas a balanced portfolio spreads its risk equally across the four environments by holding assets that do well in each.

More to come

The rise in risk premiums and discount rates in early 2022 hurt all assets, but there is more to come:

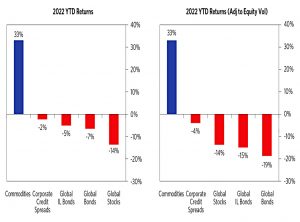

We have not yet seen the big shifts in discounted growth and inflation that are particularly bad for typical portfolios. As a result, all of the beta portfolios that we see are down by roughly similar amounts.

Equities appear to have done particularly badly, but on a risk-adjusted basis, they are in the middle of the pack.

All Weather lens

Bridgewater uses an “All-Weather” Lens to analyse macro forces during 2022: (( The name comes from one of their most famous portfolios ))

Discounted inflation rose, and risk premiums and discount rates both rose (their return impact on assets was negative). Discounted growth, while volatile over the period, actually rose on net since the beginning of the year.

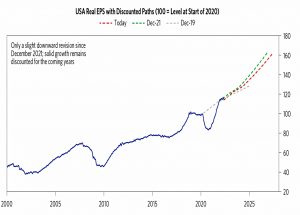

The fall in equity prices was from yields rising rather than discounted earnings falling.

Rising-growth assets overall significantly outperformed falling-growth assets. Corporate credit and equities have outperformed nominal and inflation-linked bonds on a risk-adjusted basis. Major shifts in market pricing that are particularly bad for equities and typical portfolios haven’t yet occurred.

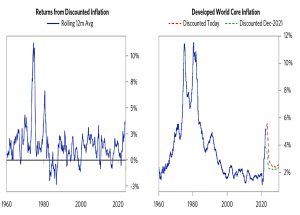

While the move in discounted inflation can look big up close, it’s actually modest by historical standards. It’s nothing like what we saw in the 1970s and what we’d expect to see when markets price in a secular shift in inflation.

Markets are still on team transitory, with inflation predicted to normalise relatively quickly.

60/40

The global 60/40 [was] hurt by the rise in discounted inflation, but this was largely offset by the rise in discounted growth across assets. Discounted inflation rose by more than discounted growth, but the sensitivity of a global 60/40 to discounted inflation is about half its sensitivity to discounted growth.

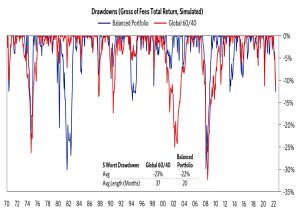

So the 60/40 and the balanced portfolio are down by similar amounts and both within the normal historical ranges.

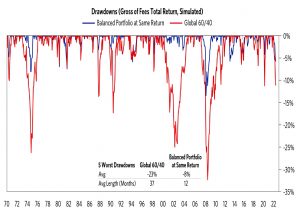

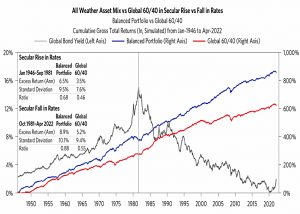

The chart above has the balanced portfolio running at the same volatility as the 60/40 (with higher expected returns).

- The chart below matches the portfolios on returns, giving the balanced portfolio lower drawdowns.

Stagflation

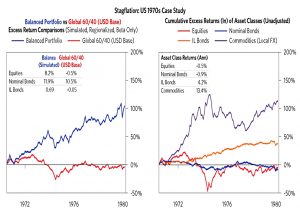

Bridgewater is worried about stagflation, but the good news is that this is the environment in which the balanced portfolio delivers the greatest benefit.

We assess the pressure for stagflation relative to market discounting to be the highest it’s been in about 100 years. We had a demand shock due to the impact

of aggressive MP3 policies on balance sheets, and that kicked off a self-reinforcing wage-price spiral.And then on top of that, we had a supply shock due to the Russia-Ukraine conflict and more recently China’s lockdown, which are creating an additional need to spend to rebuild broken supply chains. Supply is struggling to keep up with demand, resulting in weak growth and high inflation that we expect to persist.

Tightening

A key factor is how aggressively central banks (particularly the Fed) will tighten:

A tightening faster than markets are discounting would be a headwind to all assets, but how much faster matters a lot.

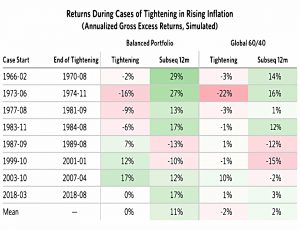

Over previous tightenings into rising inflation, the balanced portfolio is flat on average and the 60/40 is slightly negative.

- But there is a lot of variation depending on the severity of tightening.

In the year after the end of tightening—i.e., once the tightening bites and the economy starts to slow—balance significantly outperforms concentration on average, due to its exposure to assets that do well in falling growth.

Lost decades

Returns from risk premiums and discount rates tend to normalize over longer periods of time, as:

a) a spike in risk premiums implies higher expected returns going forward, and

b) all assets underperforming cash by very much for very long will ultimately spill over into the economy and create a depression, and central banks will do everything in their power to prevent this.

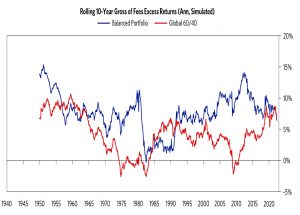

The 60/40 has several decades of underperforming cash, whereas the balanced portfolio is only briefly negative during the Volcker tightening of the 1980s.

The stagflationary 1970s are shown as a case study.

Rising rates

The balanced portfolio has more bonds than the 60/40, and some worry about it sensitivity to rising interest rates.

A balanced portfolio holds more bonds to get balance to falling growth—just as it holds more real assets (commodities, inflation-linked bonds, etc.) in order to get balance to rising inflation.

Over longer periods the drivers of interest rates tend to be the same ones that drive assets generally: shifts in growth and inflation. So, a portfolio that is balanced to growth and inflation is balanced to the primary drivers of interest rate moves over sustained periods.

The balanced portfolio outperforms during rising rates (1946 to 1981) and falling rates (1981 to 2022).

Correlations

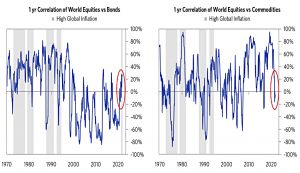

The 60/40 (( Any many other strategies, such as the leverage HFEA )) depends on an inverse correlation between stocks and bonds.

- This has worked well for several decades, but now the two assets are positively correlated.

Conversely, stocks and commodities are now diversifying to one another, after many years of high correlations.

This makes sense when we look at the macro drivers.

Equities and nominal bonds have opposite biases to growth—so when growth is the dominant driver (as it was over recent decades), they will be negatively correlated. But they have similar biases to inflation—so when inflation is the dominant driver (as it has been recently), they will be positively correlated.

Equities and commodities have similar biases to growth but opposite biases to inflation, so they will be positively correlated when growth is dominant but negatively correlated when inflation is dominant.

The point of a balanced portfolio is to balance the macro drivers.

How to invest

Bridgewater admits that this analysis doesn’t make it any easier to invest.

A typical portfolio could easily outperform a balanced one over time frames that matter, and there are real risks to holding beta in any form.

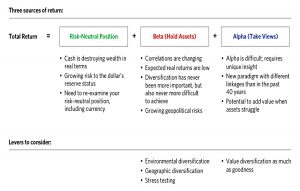

They have a three-step process:

- Risk-neutral

- Beta and

- Alpha

But there are no easy answers.

We think this is the time to revisit strategic asset allocation, and specifically how to get portfolio diversification in a world in which inflation is the dominant driver and stagflation a quite plausible outcome.

Until next time.