Tail Protection Fast or Slow?

Today’s post looks at a recent paper from AQR on whether you should prefer tail risk protection that works in slow drawdowns or in rapid crashes.

AQR

We’ve looked at many papers from AQR in the past.

- This one comes from the Portfolio Solutions Group and was published in 4Q22 under their “Alternative Thinking” banner.

The note is called “Should Your Portfolio Protection Work Fast or Slow?”

- AQR believes that assets which work well in longer drawdowns are more valuable than those that work in sharp crashes.

This year’s drawdown, among the more persistent in recent memory, provides a clear picture for the types of strategies that can actually deliver in a “slow burn”.

AQR prefers trend-based strategies to options-based strategies and believes that macro conditions favourable to trends are now in place and are likely to persist.

2022 vs Covid

The introductory section of the paper looks at what worked in 2022.

Options-based hedging strategies, while showing positive returns in some cases, have been disappointing in the magnitude of their contributions. Market neutral value strategies have continued their resurgence with positive returns in 2022, and global macro and trend-following strategies have posted exceptional performance.

This is in contrast to the sharp Covid crash of March 2020:

Many options based strategies produced exceptional gains, while trend-following was generally flat. Bonds also provided offsetting returns that time, as portfolio pain was really driven by equites.

The drawdown of 2022 was longer than that of 2020, and longer drawdowns are more typical in market history.

- Examples of bonds and stocks suffering together are also more common than recent history would suggest.

They are also the most damaging type of drawdowns, so protection strategies that work here are particularly valuable.

Tortoise and hare

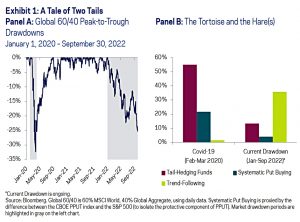

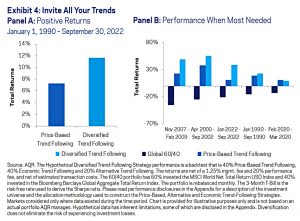

The chart shows the crashes of 2020 and 2022 (fast and slow respectively) through the lens of a 60/40 portfolio.

- The right panel compares the returns from three hedging strategies, two fast “hares” and one slow “tortoise”.

The hares are tail-hedging funds and systematic put-buying.

- The tortoise is trend following.

Tail-hedging funds—and to a lesser extent the “passive” options strategy—had strong returns during the shorter drawdown, but have been markedly less impressive during the current one.

Trend-following strategies had little to show for themselves during the Covid drawdown, but have proven clear winners in the current, longer drawdown.

21st Century

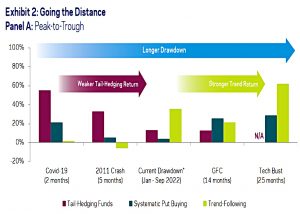

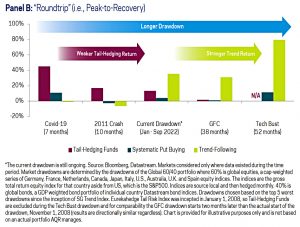

The next chart widens the study to five 60/40 drawdowns since 2000.

Options-based hedging strategies outperform in shorter drawdowns but are less impressive in longer ones. Trend-following shows roughly the opposite pattern.

This is true for both “peak-to-tough” and “round trip” (peak-to-recovery) where trend does even better.

This “round-trip advantage” makes sense economically: the price of protection from options increases amid drawdowns (e.g., via higher premiums), resulting in greater-than-typical losses in the recoveries that follow.

Average returns

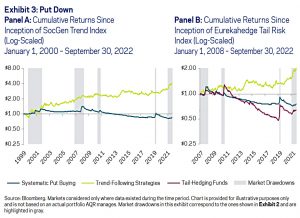

Looking at long-term returns for the hedging strategies, it’s clear that trend is superior.

In exchange for crash protection, options-based strategies suffer negative long-term average returns; whereas trend-following— beyond its tendency to deliver in longer-term drawdowns—also has positive average returns at its back.

AQR speculates that investor preference for fast hedges (despite them not working so well) is due to them assigning a premium to instantaneous protection – they are ” willing to pay handsomely not to be caught wrong-footed in a crash.

Diversified trend

AQR prefer “diversified trend” to old-school price-based trend.

They add two more versions:

- Trends in alternative assets ( non-index commodities or equity factors), and

- Economic trend-following

- This involves going long assets for which fundamental macroeconomic

trends are improving, and short assets for which fundamental macroeconomic

trends are deteriorating.

- This involves going long assets for which fundamental macroeconomic

AQR’s preferred blend is 40% price, 40% economic and 20% alternative, and it seems to work.

They can provide valuable diversification—improving the ability of the strategy to both provide positive returns on average, and, importantly, returns during market drawdowns.

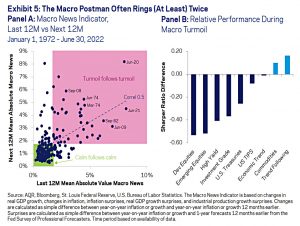

Macro factors

The final section of the report discusses whether it is now too late to buy tail protection. As AQR notes:

Papers on tail risk tend to come out after markets lose money, leaving investors with the unappealing prospect of buying insurance after it was actually needed.

Since trend works both long-term and during the dangerous slow declines, this need not be the case. As the chart above shows:

Macro uncertainty tends to be persistent, suggesting the turmoil we’ve seen so far this year is unlikely to go away any time soon.

That’s it for today.

- The paper makes a good case for preferring trend to other tail protection strategies, and indeed, for a permanent allocation to trend.

If only implementing this recommendation were as easy for UK investors as it its for those in the US.

- Until next time.