Weekly Roundup, 24th February 2020

We begin today’s Weekly Roundup with what the media seems to think is the big personal finance story of the week – the launch of Vanguard’s SIPP.

Contents

Vanguard SIPP

The launch of the Vanguard SIPP is certainly long-awaited, but it’s not earth-shattering.

Josephine Cumbo’s coverage in the FT was typical:

- It’s low-cost, and low costs help in the long run.

Yes, but it’s not low cost enough.

The Vanguard pension fees are 0.15%, capped at £375 pa.

- That means all pots above £250K are charged the same amount.

But I have an AJ Bell SIPP that charges only £100 pa (for stocks, ETFs and ITs), and a Fidelity SIPP that only charges £45 pa (for ETFs and ITs).

- Even Hargreaves Lansdown only charge £200 pa.

Vanguard is more expensive than AJ Bell for pots greater than £67K.

- Using a 3% pa SWR, a pot of that size would provide just £2K pa in income.

The idea behind a pension is to save up enough money to live on in retirement.

- Let’s say you need £25K to live, of which the State Pension will provide £9K pa.

Generating the remaining £16K needs a pot of £533K.

So using the annual allowance of £40K – or the average pot size in the UK – to compare fees (as a number of articles have done) is disingenuous.

- For the sizes of pension pot that make a meaningful difference, Vanguard is nowhere near the cheapest.

And on top of that, they have a restricted range of funds (just their own).

- So they won’t be getting any of my business.

State Pension

Sticking with pensions, Maria Espadinha pointed out in FT Adviser that the UK’s State Pension is the worst in the developed world.

- That’s not the impression you would get from the mainstream media’s constant bleating about the triple lock.

We pay out 29% of average earnings, compared to 101% in the Netherlands, 94% in Portugal and 93% in Italy.

- Mexico (30%) and Poland (39%) are closest to the UK.

The OECD average payout is 63%, more than double the UK level.

Mental accounting

Back in the FT, Bobby Seagull reminded us that mental accounting is a bad idea.

- Separating money into different pots for different purposes leads to sub-optimal behaviour.

We knew that already, didn’t we?

Money is money, no matter what label you have stuck on to the jar. You could unlock some of the hidden power of your own personal finances by taking some time to puzzle over the bigger picture.

Premium Bonds

Katharine Gemmell reported that NS&I has cut the prize rate on Premium Bonds.

- But it’s still a tax-free 1.30% pa.

This is unbeatable for secure savings if you are close to being a higher-rate tax-payer, and you have already stuck £70K in a Marcus account.

Student debt

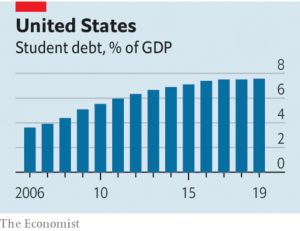

The Economist looked at how the Democratic candidates for president want to tackle America’s student debt problem.

- Sanders and Warren want to cancel it (Warren only below $50K, Sanders entirely), which would disproportionately help rich people (who are more likely to take it out).

Biden and Bloomberg want to adopt the UK system of a graduate tax above a certain income threshold (£26K / $34K in the UK).

Linking repayments to income makes it impossible to be impoverished by student debt, and frees graduates to take risks early in their careers.

The US already has debt forgiveness after 25 years, but bizarrely this forgiveness is taxable as income.

Cultural Bias

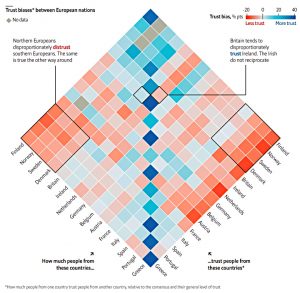

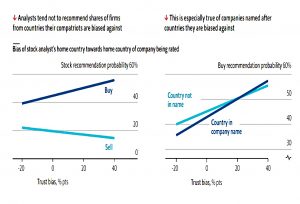

The newspaper also noted that equity analysts are less likely to recommend stocks from countries against which their own nation is biased.

- Notably for the UK, the Irish do not reciprocate our positive bias towards them.

Earnings vs cash

Buttonwood looked at the flaws in cash-based accounting.

- Many investors prefer cash to reported earnings as it is harder to manipulate via accruals, depreciation, pension contributions and allowances for bad debts.

Analysts look instead at “free cashflow”. This ignores non-cash items in the earnings statement, such as depreciation and amortisation. But it recognises capital costs, such as spending on buildings, equipment and inventories.

But there are ways to affect cashflow: deferring payments to suppliers for longer and using lease assets rather than those purchased outright.

The cash flow statement only gets you so far. As do reported earnings or the balance-sheet. You need all three to understand a company.

Tech curse

Merryn Somerset Webb noted on Twitter that the Economist cover this week might mean the end of the tech bull run.

- That said, the article wasn’t entirely positive, so perhaps the curse doesn’t apply.

Quick Links

I have five for you this week, the first two from the same people as last week:

- UK Value Investor was hunting for sustainable dividend growth

- Musings on Markets had another data update, this time on Country Risk and Currency

- The Economist looked at Business and the next recession

- Alpha Architect wrote about The Massive Performance Divergence Between Large Growth and Small Value Stocks and

- Flirting with Models looked at how to rebalance combinations of trend-following strategies.

Until next time.

First, thanks for these weekly roundups. I am so glad I am not the only one not enamored with the Vanguard Sipp: it seems rather a bad deal unless one is a Vanguard fan blinded by the name.