Weekly Roundup, 6th December 2021

We begin today’s Weekly Roundup with a look at demographics.

Demographics

Merryn Somerset Webb made the counterintuitive point that the world may soon have to deal with a falling population.

The UN has slightly downgraded its peak population forecast — to 10.9bn by 2100

— and is already noting that the world population is growing at a slower pace than

at any time since 1950 thanks to fast-falling fertility.

Most countries have now fallen to (or below) replacement rate, and growth is concentrated in nine countries.

Merryn also challenges the view that falling (and usually, therefore, ageing) populations are deflationary.

We are told you can see this clearly in Japan, where deflation appears to have taken an irreversible hold over the economy.

The key question is whether more old people reduces aggregate demand.

The over-80s may not be buying much in the way of new cars but their need for (often state financed) medical care, mobility and other devices and labour is huge. Maybe think of today’s labour shortages, sharp wage rises and supply driven

inflationary impulses as a taste of things to come.

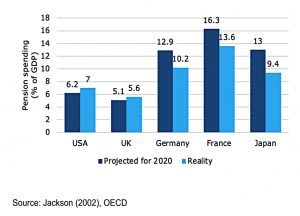

Meanwhile, Joachim Klement looked at what he calls the retirement crisis – the ability of pension systems to meet their liabilities.

In 1995, the World Bank warned that around 2030, the social security systems in the United States and other industrialised countries would be running out of money.

The central idea was that retiring boomers would deplete the system as the ratio of workers to retirees fell.

The bad news is that the projections haven’t changed since then – the US system is still forecasted to run out of money between 2030 and 2035.

Pension spending has also generally increased by more than was projected twenty years ago – but not for the countries with the greatest demographic challenges.

Countries with less sustainable pension systems have engaged in significant pension reform over the last twenty years, while countries like the UK and the United States that had less generous and thus more sustainable pension systems, to begin with, have not.

As Joachim says, demographics is not destiny – cutting benefits, increasing the retirement age and increasing contributions can all be used to manage the crisis.

Joachim’s second article looked at the natural real rate of interest (the rate which maximises employment and output without driving higher inflation), which has been falling for many decades.

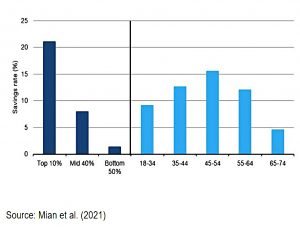

This decline in the natural real rate of interest is typically blamed on both declining trend growth and increased savings. The retirement of the baby boomer generation should lead to a lot of dissaving by pensioners, which in turn should push the natural real rate of interest higher.

Joachim doesn’t believe in the demographic explanation and links to a couple of papers to support his view.

- Instead, he blames rising inequality, and the propensity of those with higher incomes to save more.

As long as income inequality remains high, the natural real rate of interest should not rise.

As Joachim doesn’t expect inequality to reduce quickly, this is good news for stocks and bonds (though obviously less good for those on lower incomes).

Attracting DIY investors

In FT Adviser, James Coney looked at how financial advisors can attract DIY investors.

- He noted that Vanguard is now attracting more new customers than Hargreaves Lansdown (though HL still has 10 times the level of AUM in the UK).

James thinks that Vanguard’s success has lessons for IFAs:

I like Vanguard, it’s cheap and cheerful. If you’re a new investor it is very easy to understand. With the market environment that has persisted for the past 14 years it has looked remarkably easy to make money by tracking a share index.

Investors that are starting out just need a cheap platform that supports regular small contributions, and Vanguard does this (as do some of the robo advisors, though usually at a higher cost).

But James notes that even though he is now in his forties, most of his wealth is tied up in his house, and he still doesn’t have that many investable assets.

- So an IFA looks expensive to him (as it does to me).

And when he gets to pension age, having looked after his own investments for decades and gained confidence, he probably won’t feel like changing.

- Now that Vanguard is winning over young investors, how will IFAs attract them later on?

James doesn’t have any solutions.

- I agree with his diagnosis, but I can’t say that it bothers me.

Almost nobody needs an advisor, and it’s never been easier to be a DIY investor.

DeGiro fees

DeGiro has announced free trades in US stocks from 20th December 2021 (they already allowed free trades in 200 ETFs).

I opened an account with DeGiro a few years ago, when it was based in The Netherlands (it’s since been taken over by a German firm).

- I found that I didn’t use it much because of the European compensation scheme, which is limited to 90% refunds capped at €20K. (( I know that in theory investments and cash are segregated, but I still prefer to stay under the compensation limits when I open accounts with new-ish firms ))

They also don’t offer tax-sheltered accounts (ISAs and SIPPs).

This is the same situation as with Bux, which is based in The Netherlands and also offers free US trading.

- So Stake and LightYear remain my preferred solution, as they qualify for UK compensation of £85K.

But if you already have £170K invested in the US market, you could boost that to £200 using DeGiro and Bux.

ii Fees

Interactive Investor has also cut fees, in a sense.

- They have introduced a “Friends and Family” option by which an extra £5 per month on top of the £10 per month regular fee allows an investor to invite five other people to have a free account.

It’s aimed at large groups, particularly those where some of the members have small pots (ii#’s flat fee structure is less attractive to those with a small pot).

- But for a couple, this takes the annual fee down from £120 pa to £80 pa.

This sounds competitive with platforms like AJ Bell (£100 pa) but:

- The offer only includes ISAs, GIAs and JISAs – there’s no SIPP.

- ISAs are completely free with providers like X-O, iWeb and Trading 212

- Free accounts are capped at £30K, making the £60 pa in extra fees the equivalent of a 0.2% pa platform fee.

- This is also is far less than the £85K investment compensation limit on apps like Trading 212, Stake and Light Year.

- The free accounts don’t have a free monthly trade like the paid is accounts do.

For these reasons, the new ii offer doesn’t interest me.

40-year fix

Kensington Mortgages and Rothesay – neither of which I have come across before – have launched the first 40-year fixed-rate UK mortgage that I have come across.

- A 40-year fix with a 60% LTV will cost 3.34% pa.

Apparently, Habito launched a 40-year fix back in March, but I missed that one.

- A 40-year fix with Habito at a 6-0% LTV costs 4.65% pa – a lot more.

The government has previously indicated that it wants fixes longer than two or three years. John Glen, economic secretary to the Treasury, said:

Greater product choice creates more competition and more options for consumers, in this case particularly those who value certainty in their repayments over a longer period of time.

Volcano bonds

On Bloomberg, Matt Levine looked at El Salvador’s Volcano bonds.

- The country plans to issue $1 bn of bonds denominated in dollars and partially backed by bitcoin.

The crypto firms partnering with El Salvador (ELS) are Blockstream and iFinex.

- Half of the money will be used to build a “Bitcoin City” at the foot of a volcano (hence the name) and heat from the volcano will be used to power bitcoin mining.

- The other half will sit in bitcoin.

The bonds are 10-years and will mature in January 2032.

- They pay 6.5% pa interest and 50% of the projected gains on the bitcoin investment will also come back to the bondholders.

The bonds will sell in $100 units and you can pay with dollars, bitcoin or Tether (uh, oh).

Matt points out that you can synthesise a better deal from an existing ELS bond and some bitcoin.

You can buy a $500 million U.S. dollar bond issued in 2002 and maturing in April 2032, around the same time as the Volcano Bonds. 1 It has a coupon of 8.25% per year. It is listed on the Luxembourg Stock Exchange and seems to trade at about 73 or 74 cents on the dollar.

So Matt suggests using $75K to buy $100K nominal of that bond and using another $25K to go directly into BTC.

- $100K of Volcano bond equates to $25K BTC exposure since you get half of the return on the half of the bond that is invested in bitcoin.

The non-volcano bond also has a higher yield.

At maturity, in 2032, the Non-Volcano Bond pays off $100,000, and the Volcano Bond pays off $100,000. (Or they both default, I mean; they are instruments of the same government and seem to have the same seniority and mature at almost the same time.)

Because you are buying the non-volcano bond below par, at maturity you will be ahead by that $25K discount, when compared to the Volcano bond.

The Volcano bond does have one advantage:

Investments >= $100,000 will qualify investors for citizenship-by-investment applications after a five year term. So if you are looking to buy El Salvador citizenship the Volcano Bond does have that advantage.

Matt’s second point is that the way this product has been launched – via tweeted photos of ELS president Nayib Bukele standing in front of a PowerPoint presentation, wearing a baseball cap backwards, and by using the cool name of Volcano bonds – is a form of market segmentation.

This is market segmentation by combining a normal thing with (1) crypto and (2) a huge markup, and then marketing it to crypto people who want to pay the huge markup not to buy crypto (they can just buy crypto!) but to buy into a crypto adventure.

Matt thinks this may be the main financial story of 2021:

I bought that stock [bond, cryptocurrency, etc.] to be part of a cool club, not because it made financial sense.

Quick Links

I have five for you this week, the first three from Alpha Architect.

- AA wondered whether prospect theory could explain the value and momentum factors

- And looked at factors in international stocks

- And asked why investors hold ESG investments.

- The Economist wrote about Jack Dorsey leaving Twitter

- And wondered if SPACs have been cleaned up.

Until next time.