Weekly Roundup, 3rd May 2022

We begin today’s Weekly Roundup with pensions.

Small pots

In Pensions Expert, Stephanie Hawthorne looked at the micro-pot problem created by auto-enrolment.

Millennials may have 14 jobs in a lifetime. Every job comes with a separate pension pot, which corresponds to a huge amount of wasted time and expenses incurred in their administration.

I had a lot more than 14 jobs during my career, but I also did my best to tidy up pensions as I moved around.

- So I “only” ended up with seven pension pots, which I have now reduced to five.

Former pensions minister Steve Webb agrees with Stephanie:

Without this cost, pension charges could be lower and member pensions higher.

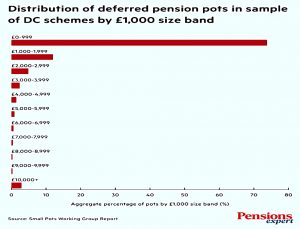

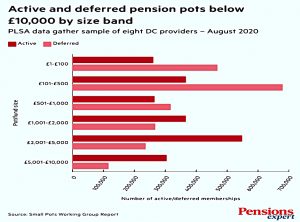

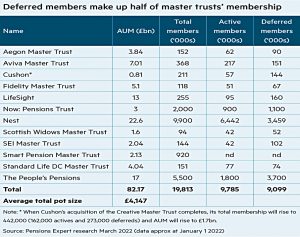

The average pot in what is known as a “master trust” is now just £4K in size.

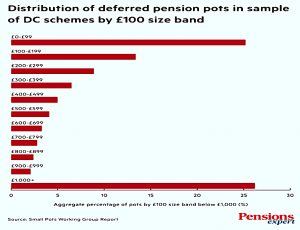

- There are 20M members, of whom 10M are deferred, and many of these have pots below £100.

The Department for Work and Pensions predicts that there will be 50M deferred pension pots by 2050.

- Already there are 11.2M deferred pots, with 74% smaller than £1K and 25% smaller than £100.

Pots below £100 are protected from being exhausted by running costs, with flat fees in particular banned.

- But that is a ludicrously low limit – A £100 pot buys an annual pension (annuity) of a few pounds per year.

The limit needs to be in the thousands, but the real solution is to make the consolidation of pots much easier.

- Education will also be needed – research from Cushon Master Trust shows that only 35% of employees are aware that they can consolidate pension pots.

Steve Webb worries about the potential impact on the concept of auto-enrolment:

The credibility of AE itself could be at stake if people end up with large numbers of pointless pots; and, in many ways, a statement season almost makes matters worse as people will be bombarded with paper in a short period of time of no great interest to them.

The industry’s small pots working party is not optimistic:

Large scale cost-effective consolidation of deferred small pension pots will only be possible if current administrative processes are modernised across the AE workplace pensions market.

This includes: the adoption of common data standards; effective matching capability; and the removal of undue friction to enable low-cost transfers with proportionate member safeguards.

There are even those in the industry who oppose a “pot follows member” system, in case a new pension provider is in some way “worse” than the old one.

Better pensions

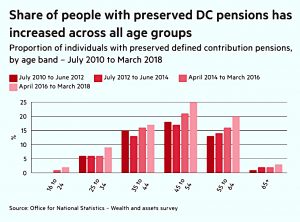

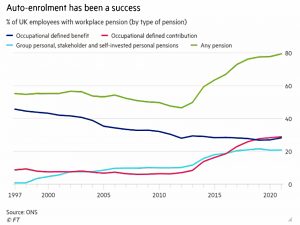

In the FT, Merryn Somerset Webb was celebrating the good news from the latest ONS data on workforce pension participation.

- There are now 22.6M people (79% of employees) enrolled.

This is up from 47% before AE and only 32% in the private sector.

- Total contributions in 2019-20 were £32.2bn (that’s £1,425 each).

Rather than bemoan the small pot problem, Merryn recalls the days (as do I) when moving jobs meant that you just got your contributions back (minus income tax).

OECD numbers show that pension savings in the UK come to around 126 per cent of GDP, making our system one of the best funded in the world.

It’s worth pointing out that this is mainly down to private and company pensions – the UK’s state pension is one of the lowest in the OECD.

- Other countries depend more on state pensions and have smaller private pots.

Merryn says she would rather have privately funded than public-funded, but I say why not both?

Success

Sarah O’Connor was also celebrating AE.

In 2012, Britain became one of the first countries to require employers to enrol almost all employees automatically into a workplace pension. Workers could opt out but by default both they and their employers would pay in.

In the decade before this intervention, the proportion of employees participating in a workplace pension had declined steadily from 57 to 47 per cent. Now the figure is almost 80 per cent.

AE has worked particularly well for low-paid sectors:

Participation rates increased from 5 per cent to 51 per cent in accommodation and food services, and from 14 to 64 per cent in admin and support services.

But the self-employed aren’t covered, and they tend not to make their own pension provision.

Selfies

In the FT, Nobel prize-winner Robert Merton called for a new type of retirement savings product.

- They are called Selfies (Standard-of-living indexed, forward-starting, income-only securities), and Merton helped to create them.

These could be an excellent currency for retirement and particularly relevant for the inflation challenges at hand. A comfortable standard of living is measured by the amount of sustainable lifetime income received, and not by the size of an accumulated “pot”.

Selfies are a form of index-linked government bond that payout for a specified period.

- The problem with linkers is that they trade at negative yields, so you lose money by buying them.

For a government to price them such that they had attractive positive yields would result in a subsidy.

- It might be simpler to bail out underfunded private schemes and boost the state pension.

Diversification

Duncan Macinnes of Ruffer looked at the illusion of diversification.

- People claim to be diversifying away from the stocks and bonds portfolio, but are they?

Where once there was a large allocation to listed equities, there is now an increased weighting to private equity and venture equity. But all equity – private, public and venture – is subject to the same underlying economic forces and vicissitudes.

True enough, though unlisted stocks come with pricing illiquidity which results in lower apparent volatility (they also generally have higher fees).

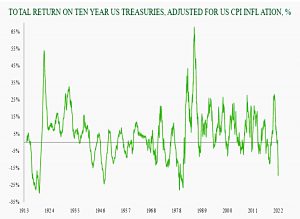

People are also “diversifying” away from bonds, which are showing the worst real returns since the 1980s.

Moving into investment grade, high yield, private credit, infrastructure and renewables, [is] in effect, swapping one type of duration risk for another. The predominant driver of returns in these assets is a sensitivity to interest rates.

And after falling for 40 years, these are now starting to rise.

- A 1% rise in the discount rate for an infrastructure asset could produce a 16% fall in the net asset value.

The rarest and most valuable assets or strategies in the investment world are going to be those which are truly zero duration and those which are truly uncorrelated.

Hamish has three suggestions:

- Real assets – inflation-linked bonds, commodities and gold

- Unconventional assets – “the less your portfolio looks like the benchmark the better” (derivative hedges, asset-backed holding and even digital currencies)

- Tactical asset allocation – passive buy and hold will provide low returns.

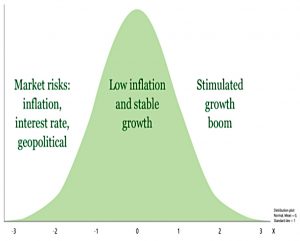

Ruffer says that returns will be found in the tails:

For bad market outcomes on the left-hand side – a monetary policy squeeze, a cost-of-living recession, the escalation of war – we have what we call our unconventional toolkit – credit protection, interest rate options, gold exposure, the yen, equity puts and we previously held bitcoin.

On the right-hand side – we think there is a chance we do get a stimulated growth boom, another roaring 20s, driven by fiscal stimulus to tackle the big social issues – climate change, societal inequalities and the containment of Chinese and Russian geopolitical ambitions. For this scenario we have exposure to energy, commodities and financials.

The bad place is the middle – banking on low and stable growth and inflation.

Tech, quality growth stocks and long duration assets like venture capital, renewables and infrastructure which look extremely vulnerable to the rising interest rates and risk premium environment.

What works

On his Adventurous Investor substack, David Stevenson looked at a report from Deutsche Bank on what has worked during eleven previous Fed rate hiking cycles.

David highlighted a number of points:

- A typical cycle is 4% of hikes over 19 months.

- The Fed is (so far) guiding us lower and faster this time.

- Eight of the eleven cycles (73%) ended in recessions, but usually only two years after the start of the cycle.

- That puts us in March 2024, with a stock market peak five months earlier (late 2023).

- The flattened yield curve suggests the recession might start in 4Q23.

- Growth slows for housing, cars, durable consumer goods and financial services.

- Other sectors have positive growth.

- This time, the Fed is hiking much later in the economic cycle (at full employment).

- This means many sectors are already inflated and prone to slowing (particularly consumer goods and housing).

- Equity returns were positive in the first year of hiking but weak in year two (especially the second half).

- Equity prices were up 91% of the time after 1 year, by an average of 7%.

- Even year two is positive on average.

- There is no consistent pattern of relative sector performance.

- Almost every sector outperformed in half the hiking cycles and

underperformed in the other half. - This suggests the initial valuations and earnings prospects mattered most (tech’s decline would be a good example this time).

- Almost every sector outperformed in half the hiking cycles and

- Multiples compressed during cycles, but Deutsche didn’t blame rate increases.

- Equities tend to bottom halfway through recessions as the market starts to price in recovery in earnings. Multiples rise then fall as the priced-in) recovery in earnings unfolds.

- This time, the trailing multiple peaked in early 2021 and was falling before the hiking cycle began.

Quick Links

I have five for you this week, the first four from The Economist:

- The Economist reported that Elon Musk is taking Twitter’s “public square” private

- And that he wants to reengineer it.

- The newspaper also said that free-speech idealism will clash with laws and reality

- And wrote about the secrets of big tech.

- Alpha Architect had new insights on betting against beta.

Until next time.