Weekly Roundup, 26th October 2020

We begin today’s Weekly Roundup with a look at valuations.

Contents

Everything’s expensive

In his Bloomberg newsletter, John Authers pointed out that everything is expensive and bonds don’t work as a diversifier any more.

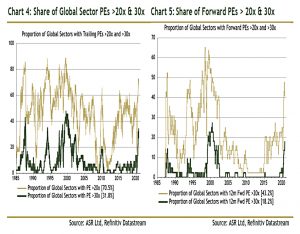

Quality and growth are more expensive than ever, and value is no cheaper than usual:

And as many sectors are expensive as at any time since the dot com bubble:

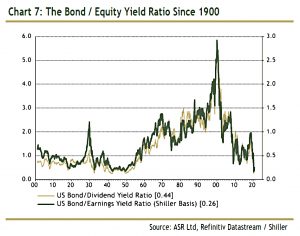

But unlike dot com, stocks are very cheap relative to bonds (in terms of earnings and dividend yields):

John thinks low yields and interest rates are to blame and quotes Andrew Lapthorne from SG:

In a world of low nominal interest rates, people become very risk averse.

If you have an opportunity of earning 5% in the bank, then you can take some risk — you can afford to lose 10%, because you have the option to go back into bonds or cash.

Without a risk-free rate, it reduces your capacity to make more losses.

Its also hard to beat inflation, especially if historic rates of inflation were to return.

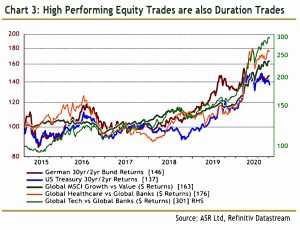

John says that all the trades that have been successful over the last five years are effectively duration trades (long of long bonds, short of short bonds):

The preference for risk avoidance leads to people buying FANGs, perceived to be low-risk and non-cyclical.

- The risk here is anti-trust, as exemplified by last weeks action against Alphabet.

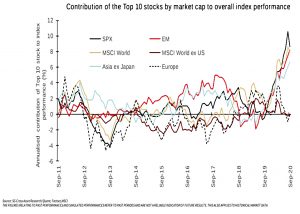

Market concentration is a problem everywhere:

John worries that continued fiscal expansion will lead to higher inflation and higher yields.

- This would reverse the duration trade and force investors to backtrack or to seek more complex solutions like pair trades and private markets.

Shock not crisis

Joachim Klement tried to decide whether the pandemic is a shock or a crisis.

In a shock, some external event derails the market for a while, but it doesn’t cause a sustained decline in economic activity or a long-lasting recession.

Meanwhile, the typical cyclical downturn is slower to unfold and often the result of a previous boom like the tech boom in the 1990s or the housing boom in the 2000s.

Comparing 2020 to a shock (the Russian and LTCM default of 1998) and a crisis (2008), it’s pretty obvious that Covid-19 is a shock, even if the recovery in the world index is more of a swoosh than a V-shape.

Stock markets are betting on a vaccine in 2021 and a return to normal in the next 12 months. I remain in the bullish camp for now and expect 2021 and 2022 to be exceptionally good years for stock markets.

I’m a little less bullish – I certainly hope there will be better news in 2021 but I’m braced for the process of vaccine discovery to take longer.

Buying a house

In a second article, Joachim asked whether a house can help you save for retirement.

He says that rising house prices have increased inequality between the middle class and the working class (because the latter don’t own houses):

The wealthy hold most of their savings and wealth in stocks and businesses. The middle class tends to hold most of their savings and wealth in their home, while the working class tends to have no savings or hold their savings predominantly in cash and other safe assets in order to access them in times of need.

Joachim is German, and I’ve seen a similar argument advanced to explain why people in the UK are richer than those in Germany, despite lower wages:

- People in the UK own their home and invest in stocks, whereas Germans rent and buy bonds.

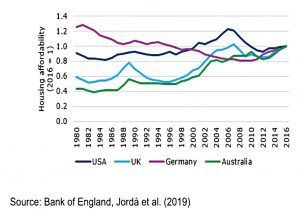

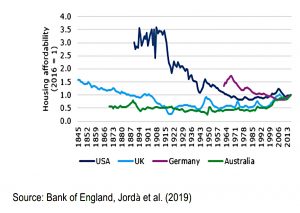

You can see the impact of this in the chart below of house prices relative to wages, where Germany is the exception:

But house prices don’t normally outpace wages, and Joachim wonders whether middle-class Millenials will be able to use their homes (assuming they can buy one in the first place) to save for retirement in the same way as previous generations.

When house prices grow less than wages, putting all of your savings into your home is suboptimal.

Diversification across assets will become more important and renting may once more become a viable alternative to owning a home.

I can’t argue with Joachim’s logo, but there are two further points in favour of owning your own home:

- It’s tax-advantaged (no CGT on the sale of your primary residence), and

- It’s a pre-payment against your future costs of shelter

- This reduces your nominal (real money) expenses in retirement, which in turn reduces your sequencing risk around your retirement age.

So unless you’re certain than house prices won’t keep up with inflation, it’s probably still a good idea to buy rather than rent.

- But don’t put all your eggs in one basket – get a decent pension sorted, too.

Auctions

The Economist reported that the 2020 Nobel prize for Economics has been awarded to Paul Milgrom and Robert Wilson, both of Stanford for their work on auction theory and design.

There are two main types of auction:

In an English auction, ascending bids are made until a winner remains; in the Dutch variety, a high opening price is set and is reduced until a bidder is found.

William Vickrey also won the Nobel in 1996 for his work on the sub-class of auction where each bidders valuation of the target object is unrelated to that of the other bidders.

- But sometimes a bidder’s valuation depends on what other people (including the seller) might think it is worth.

The first type of such an auction is one with a “common value”, held by all at the end of the auction.

- Here the winner often discovers that superior information caused other bidders to offer less – something known as the winner’s curse.

More complex are those auctions where value depends on the common value and also private valuations.

- The example provided is an oil field where each bidder much estimate the amount of oil in the ground, but will also know how cheaply they can extract it.

An English auction provides more information to bidders and so reduces the winner’s curse.

- It can also be in the seller’s interest to provide a lot of information.

Milgrom and Wilson came up with “simultaneous multiple-round auctions” (SMRAs, in which more information is released each round) in order to sell off radio spectrum.

In the FT, Tim Harford also used the award of the prize to take a look at auctions.

The basic challenge with radio-spectrum auctions is that many prizes are on offer, and bidders desire only certain combinations. A TV company might want the to use Band A, or Band B, but not both. Or the right to broadcast in the east of England, but only if they also had the right to broadcast in the west.

Hanging on

In the FT, Jason Butler looked at the character traits that affect whether people are likely to hang on to their accumulated wealth.

- He started with the story of a friend who has lifetime earnings of around £3M, but who has just borrowed a house deposit from his father, despite being in his fifties.

The friend lost most of his money punting on a start-up in his forties.

The skills one needs to generate a high income or build a business that can provide a substantial capital sum are rarely those required to preserve wealth.

The first trap to avoid is an unsustainable lifestyle, which means a withdrawal rate which is too large to be safe.

- The ideal SWR varies depending on the state of the markets and the economy at the point of your retirement, but a failsafe level is not much higher than 3% pa.

Put another way, £1M of savings will allow you £33K of risk-free spending each year.

The next issue is personality:

Some people enjoy and embrace risk, while the fear of the unknown paralyses others. Some of us are instinctive and look at the big picture, while others like to look at the detail and take our time.

Jason warns about biases, and also about having too much self-esteem:

For the person who has generated a significant amount of wealth from their own efforts, a well-developed ego can make them highly susceptible to doing stupid things with their money.

Too much risk is bad, as is too little.

- The same goes for diversification and complexity.

And we need to be certain that our success is down to skill rather than luck.

Jason ends with five tips:

- Be humble

- Don’t aim for too high a return (which will come with high risk)

- Look for the downside and how you would handle it

- Treat every pound the same (avoid “mental accounting”)

- Have a spending plan (which is less than your income)

Pension charges

Huw Evans, the director-general of the Association of British Insurers has told a Treasury Select Committee that the 0.75% pa charge cap on auto-enrolment pensions needed to be removed.

Environmental, social and governance funds are typically above the 0.75 per cent cap because they involve active management. As long as you have the charge cap then you will find it hard to shift [assets to sustainable assets].

The suggestion was supported by Steve Waygood, chief responsible investment officer at Aviva.

There’s an obvious answer to this – use ESG ETFs rather than active funds.

- 0.75% pa is more than enough for anyone to pay in their workplace pension.

Stamp duty for tenants

I learned last week that stamp duty is due on rentals as well as property purchases.

- A 1% tax is due on contracts which take rental payments above £125K.

Even worse, the rental tax has not been waived as it has for buyers (until March 2021).

- The good news is that the tax is only due on the excess over the £125K threshold.

£125K sounds like a lot, but in London, that might only take three to six years to mount up.

- At 25K rent pa on a two-year renewal, the third contract would take you to £150k in total rent, meaning £250 (1% of £25K) of tax would be due.

A fourth contract would attract an additional £500 in tax.

The key to avoiding this is to avoid “successive linked leases”.

- This appears to mean agreements between the same tenant and landlord, at the same rent.

So perhaps a peppercorn rent increase is a way around it.

Quick links

I have six for you this week, the first five from The Economist:

- The newspaper reported on NextEra, America’s most valuable energy firm

- And on the antitrust case against Google

- But also wondered whether tech might be getting more competitive.

- The Economist also looked at what Brexit will do to the City of London

- And described how Satya Nadella turned Microsoft around.

- Musings on Markets looked at Value Investing – Requiem, Rebirth or Reinvention.

Until next time.

Stamp duty for tenants – never heard of this before and I fail to see the sense in at as described above.

For example, is the plan really to punish people for staying put?

Well, it’s a transaction tax, so the only possible interpretation is that they want to see fewer transactions. But since there is a cliff edge, applying it to rents as well as purchases should lead to more rental transactions (yet less tax raised).

I think the original thinking was that only the richest would spend £125K in renting the same flat, but unfortunately this is all too easy in London nowadays.

OK.

This article seems to hint at a work-around:

https://www.theguardian.com/money/2020/oct/05/as-a-tenant-when-am-i-liable-for-stamp-duty

You mean vary the terms? That’s what I suggested in the post.

Got you.

Perhaps there is a typo above and it should say “linked” rather than “liked” above.

The worst kind – real words that Grammarly ignores.